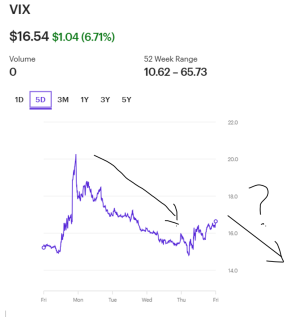

Ok, well, not an opinion this time, the market decided it IS going higher, and did so on the back of stubborn mega caps, chips, and some Bitcoin speculation. I will have my finger on the button anyways if the ripcord needs action. The true lows this year have matched low bull bear spreads but it doesn't have to go there and has reversed when VIX doesn't hold a trend. That happened in this week and also earlier around 9/11. An August 5 extreme didn't rematerialize and maybe you have Santa or, more likely, Holiday program trading to thank. Senior haircuts are actually $16 now for me. I think the markets could go big either way depending on what actually gets cooked up in terms of deals to avert loss of migrant workers and tariff imposition.aaii bull-bear spread is no-where near the low single digit early August and late November readings that preceded a bounce. This market is going lower. I know where to get a $10 haircut; I don't need a $10,000 haircut. Seeya end of next week.

Sent from my moto g 5G (2022) using Tapatalk