-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

alevin's account talk

- Thread starter alevin

- Start date

alevin

Market Veteran

- Reaction score

- 97

Holy Crap! So did we hit point # 25 today?

Hi whipsaw, no we haven't hit 25 as yet. what we have done tho, near-miss is hit that second kissback from the underside. the 25 marker is directly overtop of that big rally point a couple rallies down the slope of hope. have to wait and see if the near-miss is good enough or if we have another day of upswing indecision before another good drop. or who knows, maybe the powers that be will find a way to boost back over the kissback trendline a little longer. hard to say until the next move comes.

alevin

Market Veteran

- Reaction score

- 97

Yawn. Dusting off the furniture. Had a good nap. Tall grass outside. Nights are cool, streams icing over. Hmm. Time coming when I'll have a chance to improve on my record of the past few years. Not yet, not yet.

Hussman Funds - Weekly Market Comment: Air-Pockets, Free-Falls, and Crashes - October 13, 2014

and for good measure.... permabeardoomster.blogspot.com

I'd add deflationland link, but his count is off, he thought last week would close a little higher before dropping bigtime. Permabear was much more on target last week.

I don't know why the underline is happening with my commentary however. any ideas, anyone?

Hussman Funds - Weekly Market Comment: Air-Pockets, Free-Falls, and Crashes - October 13, 2014

and for good measure.... permabeardoomster.blogspot.com

I'd add deflationland link, but his count is off, he thought last week would close a little higher before dropping bigtime. Permabear was much more on target last week.

I don't know why the underline is happening with my commentary however. any ideas, anyone?

Frixxxx

Moderator

- Reaction score

- 131

When you put in the permabear website, it started treating it like a link.I could edit it, but didn't know where it started.

alevin

Market Veteran

- Reaction score

- 97

Will hope that won't keep happening. It did that with a couple of the music posts I made last night also. Just got back from 2 great weeks away from the dayjob, not sure that had to do anything to do with weird linking action, but perhaps I'm out of practice with posting. will have to work on that. onward.

konakathy

Market Veteran

- Reaction score

- 41

Will hope that won't keep happening. It did that with a couple of the music posts I made last night also. Just got back from 2 great weeks away from the dayjob, not sure that had to do anything to do with weird linking action, but perhaps I'm out of practice with posting. will have to work on that. onward.

Hey al - where did you go on vacation? Good luck with getting back in sync with real life and the dayjob. It's always been rough for me....I always want to be on vacation.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

I have noticed that sometimes when I post a link first on the page and go advanced the next text I type edits the link and will not let me out of that mode. It doesn't happen all of the time but the link still works but with underlined comments.

alevin

Market Veteran

- Reaction score

- 97

Hey al - where did you go on vacation? Good luck with getting back in sync with real life and the dayjob. It's always been rough for me....I always want to be on vacation.

Hmm, I had a good friend named Al, retired several years ago, haven't heard from in awhile. feminine version would be allie or giggles, or something like that. masculine version doesn't really fit.

alevin

Market Veteran

- Reaction score

- 97

Still working on post-retirement ideas, further exploration warranted and planned in a couple different directions.

OK, so I recently said I was going to lay off the political threads and refocus more on tsp management chatter. And I made a move the other day that burro noticed.

Why on earth would I do what I did? strongest season of year, going in for first of month, 2 reasons. 3d reason-I thought I was seeing a candlestick trend continuation pattern, but didn't doublecheck my pattern recognition book to confirm before I pulled the trigger. I may well have gone in at the tippy top, now that I've doublechecked my pattern reference book which says the pattern was similar but not quite what I thought I was seeing. If the trade goes against me, I have one IFT to get out on this month to stop the bleeding, and one IFT to go back in once the bleeding stops. We shall see what we shall see.

yes I get that I was a little slow to get moving on that this year, things been in a whirlwind at work, little time to focus on getting IFT made in timely manner up til now.

OK, so I recently said I was going to lay off the political threads and refocus more on tsp management chatter. And I made a move the other day that burro noticed.

Why on earth would I do what I did? strongest season of year, going in for first of month, 2 reasons. 3d reason-I thought I was seeing a candlestick trend continuation pattern, but didn't doublecheck my pattern recognition book to confirm before I pulled the trigger. I may well have gone in at the tippy top, now that I've doublechecked my pattern reference book which says the pattern was similar but not quite what I thought I was seeing. If the trade goes against me, I have one IFT to get out on this month to stop the bleeding, and one IFT to go back in once the bleeding stops. We shall see what we shall see.

yes I get that I was a little slow to get moving on that this year, things been in a whirlwind at work, little time to focus on getting IFT made in timely manner up til now.

alevin

Market Veteran

- Reaction score

- 97

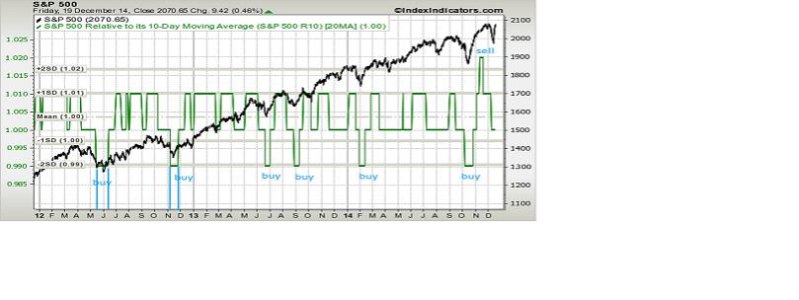

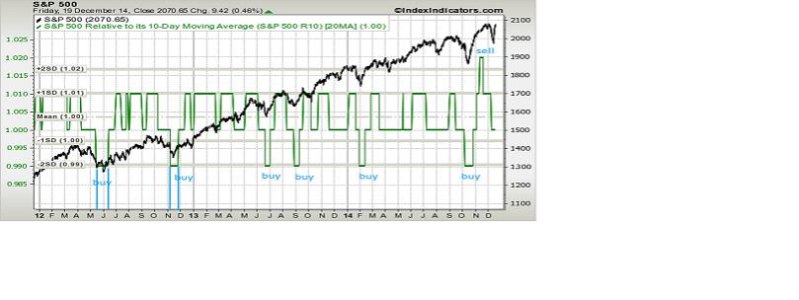

OK then, finally found a chart that I can work with for buying and adding. selling on a frequent basis may be another matter, but this is good start for me, for my preferred style of watch and wait for good opening that will last me awhile where I don't need to watch as close since I don't make decisions quickly or always have time to make changes quickly.

Am sure this strategy won't get me to top of tracker, but looks like it could move me well above where I've been for awhile on a consistent year over year basis. this looks to become my core strategy, small positions may move around the edges to experiment with signals for selling. wish I could get chart that would let me apply similar strategy and charting to other tsp index substitutes, but this particular source only works with primary indices djia, spx, nasdaq, currently no buy signal after the recent highly identifiable sell signal.

Am sure this strategy won't get me to top of tracker, but looks like it could move me well above where I've been for awhile on a consistent year over year basis. this looks to become my core strategy, small positions may move around the edges to experiment with signals for selling. wish I could get chart that would let me apply similar strategy and charting to other tsp index substitutes, but this particular source only works with primary indices djia, spx, nasdaq, currently no buy signal after the recent highly identifiable sell signal.

Boghie

Market Veteran

- Reaction score

- 378

Alevin,

I like it. You will probably want to look at 2007 through 2009 and see if it found the market top/bottom and if it churned during that timeframe. I was going to ask the source, but everything was in the chart - even the smoothing thang you did. Nice, very nice. I'm a slow mover to so this would work for me.

I like it. You will probably want to look at 2007 through 2009 and see if it found the market top/bottom and if it churned during that timeframe. I was going to ask the source, but everything was in the chart - even the smoothing thang you did. Nice, very nice. I'm a slow mover to so this would work for me.

Boghie

Market Veteran

- Reaction score

- 378

Alevin,

Since we are friends and everything - keep this little investing tip a secret...

The CEOs of all those S&P500 companies really only make money when their companies grow and make profit. Unlike we gubmint types who don't really have any incentive (other than good work habits) to make things more efficient, to grow markets, and to make a profit. Thus, there is a bias for equity markets to increase.

If that is true - and it kinda seems that way - it would be best to have a decent chunk in the market almost all the time and play on the margins.

But, be very quiet. There are those on this site who may take advantage of that knowledge. What is that behind the rock, could it be a birch tree???

Merry Christmas and/or Happy Holidays...

Since we are friends and everything - keep this little investing tip a secret...

The CEOs of all those S&P500 companies really only make money when their companies grow and make profit. Unlike we gubmint types who don't really have any incentive (other than good work habits) to make things more efficient, to grow markets, and to make a profit. Thus, there is a bias for equity markets to increase.

If that is true - and it kinda seems that way - it would be best to have a decent chunk in the market almost all the time and play on the margins.

But, be very quiet. There are those on this site who may take advantage of that knowledge. What is that behind the rock, could it be a birch tree???

Merry Christmas and/or Happy Holidays...

alevin

Market Veteran

- Reaction score

- 97

Refining my new system. been watching the chart day to day pattern-no signal changes thus far since the last chart post. been trying to figure out if there's a way to fit F into the system in addition to C. I've barely had a toe in the market YTD, and slightly below zero at this point. C looking to get uglier before it gets better, considering $ still going up.

making a test play here, moving out of 5% C to preserve capital, stem further losses, upping F % from current 10% to 40% (60%G). EOD. made decision yesterday afternoon for funds shift effective EOD today. I make decisions at work when there's a quiet moment to look and think, and make account changes through work puter. sometimes that's in the afternoon, effective for the next day.

I can't access tsptalk tracker menu from work to register changes I make in the afternoon time so have to record the change in autotracker from home-before or after I make the change from work. the changes I make for real account go into effect in real account the same day they would go into effect in tracker.

according to b's system, the fact that I'm moving 5% out of C is a heads up to all you dip-buyers out there. might be time to get wet.

making a test play here, moving out of 5% C to preserve capital, stem further losses, upping F % from current 10% to 40% (60%G). EOD. made decision yesterday afternoon for funds shift effective EOD today. I make decisions at work when there's a quiet moment to look and think, and make account changes through work puter. sometimes that's in the afternoon, effective for the next day.

I can't access tsptalk tracker menu from work to register changes I make in the afternoon time so have to record the change in autotracker from home-before or after I make the change from work. the changes I make for real account go into effect in real account the same day they would go into effect in tracker.

according to b's system, the fact that I'm moving 5% out of C is a heads up to all you dip-buyers out there. might be time to get wet.

burrocrat

TSP Talk Royalty

- Reaction score

- 162

according to b's system, the fact that I'm moving 5% out of C is a heads up to all you dip-buyers out there. might be time to get wet.

actually alevin, i think you switched from holder to trader a few weeks ago. you may be dead on with this move. the scale and timing is relative to each, but that is a change. it is going to play hell with the ark system.

i am afraid of this market right now, and i hardly ever say that. this market has teeth and it is just whetting its appetite i think. later allie gator. good bail.

maui21ice

TSP Strategist

- Reaction score

- 5

That's my thinking too right now burrocrat. On here I'm 100% F, but in real life I'm 100% G out of fear of any of the funds losing money except that one. If I knew which way it was going to go, I'd pick, but I can't say with any certainty right now.

I see a move toward the S fund though possibly 23rd-ish of January for some end of month gains carried over to the new month.

I see a move toward the S fund though possibly 23rd-ish of January for some end of month gains carried over to the new month.

Last edited:

Boghie

Market Veteran

- Reaction score

- 378

Alevin,

Don't think too much. You have a system that seems to show buys (when it is below 1.00), sits (when it is at 1.00), and sells when it is over 1.00. You bailed because the dollar is getting marginally stronger? Who cares. That is a very marginal element.

You have to have something in the market to get returns above 'G Fund' interest rates. Yeah, you have some risk - but... Lets say you have a 60/0/25/10/5 allocation and we have another 'Great Recession'. If you rode that position from the top to the bottom your temporary losses (unless you locked them in by selling) would be -14% from the top. That is the worse you could get. That allocation centers on an annual return of 6% (including 3% inflation). Your risk is 5%. That means that 67% of the time your annual return would be between 1% and 11% in a 3% inflation rate period. 33% of the time it would be better or worse. 95% of the time it would be betwee -4% and 16%. Again, the biggest draw down of the last 80 years would have left you -14% (that is, 4 risk factors).

I recommend a baseline allocation that gives you a decent return at minimal risk and then play the edges with your system. Bailing out on market noise costs you today and normal market returns and results in 2% or less returns.

Don't think too much. You have a system that seems to show buys (when it is below 1.00), sits (when it is at 1.00), and sells when it is over 1.00. You bailed because the dollar is getting marginally stronger? Who cares. That is a very marginal element.

You have to have something in the market to get returns above 'G Fund' interest rates. Yeah, you have some risk - but... Lets say you have a 60/0/25/10/5 allocation and we have another 'Great Recession'. If you rode that position from the top to the bottom your temporary losses (unless you locked them in by selling) would be -14% from the top. That is the worse you could get. That allocation centers on an annual return of 6% (including 3% inflation). Your risk is 5%. That means that 67% of the time your annual return would be between 1% and 11% in a 3% inflation rate period. 33% of the time it would be better or worse. 95% of the time it would be betwee -4% and 16%. Again, the biggest draw down of the last 80 years would have left you -14% (that is, 4 risk factors).

I recommend a baseline allocation that gives you a decent return at minimal risk and then play the edges with your system. Bailing out on market noise costs you today and normal market returns and results in 2% or less returns.

alevin

Market Veteran

- Reaction score

- 97

Alevin,

Don't think too much. You have a system that seems to show buys (when it is below 1.00), sits (when it is at 1.00), and sells when it is over 1.00. You bailed because the dollar is getting marginally stronger? Who cares. That is a very marginal element.

You have to have something in the market to get returns above 'G Fund' interest rates. Yeah, you have some risk - but... Lets say you have a 60/0/25/10/5 allocation and we have another 'Great Recession'. If you rode that position from the top to the bottom your temporary losses (unless you locked them in by selling) would be -14% from the top. That is the worse you could get. That allocation centers on an annual return of 6% (including 3% inflation). Your risk is 5%. That means that 67% of the time your annual return would be between 1% and 11% in a 3% inflation rate period. 33% of the time it would be better or worse. 95% of the time it would be betwee -4% and 16%. Again, the biggest draw down of the last 80 years would have left you -14% (that is, 4 risk factors).

I recommend a baseline allocation that gives you a decent return at minimal risk and then play the edges with your system. Bailing out on market noise costs you today and normal market returns and results in 2% or less returns.

Boghie, the move to F was an experiment. obviously I went the wrong way with the experiment. my timing sucks as per usual. right now the system I'm working with is showing a pattern that hasn't showed up in the past 3 years, which is as far back as the site lets me go. so I can't tell if I should be buying on the latest dip recovery or not. I got antsy, figured not a big loss if going to F was the wrong move. unfortunately the antsyiness prompted me to lose out on substantial gain. the chart is confusing me right now, so I experimented-oh well, I'll keep watching the indicator pattern to see what it does next and when in relation to market moves. It has a 1-day-lag in the pattern change so far as I can tell right now.

But hey, I just found a really really cool site to help me figure out allocations in outside brokerage accounts, split between taxable and non-taxable accounts. way cool. asks all kinds of questions: age, takehome $, current total investment value available (not including tsp), my probable investment behavior on a 10% drop. mulls over all that, and spits out my investment risk profile and appropriate ETF allocations. on a scale of 1-10, I fall firmly in the risk level 4 ranks. they have roughly 6-8 ETF pots to allocate funds between. which makes figuring tsp $ into the mix (based on similarity to certain ETFs) not that simple so I didn't try that out yet. but I think their recommended allocations will get me in the ballpark you're talking about for the outside accounts. especially if I consolidate them in one brokerage. which they aren't right now.

I still haven't concentrated enough on how to do the risk reward system you use, so your discussion above looks to be very helpful for the tsp account and timeframes for retirement. I can't afford a big drop right before retiring, which may come in 2 years with 30 years in (or a handful of years later if I can stand it and they can still afford me-I top out in grade later this year, max high 3 will come 3 years after that, right as I hit 62).

https://www.wealthfront.com/questions

alevin

Market Veteran

- Reaction score

- 97

believe me Birch, trying to simplify life per MindyLou's sage counsel.

I know you don't do bonds. and they are not without risk. wish I'd known about interest rates and bond prices way back 30 years ago when I had an insurance settlement. could be sitting comfortable up there in the window with MindyLou now if had known then what I do now about that. oh well. fundamentals vs market behavior-2 different things, starting to come back together finally on the energy side of things, other aspects of market will be affected-eventually. once bond vigilantes come back from the dead-someday, I might get a second chance to get in on the ground floor. til then...overpriced stocks, overpriced bonds. what's a girl to do but get up and dance while the band's still playing. :blink:

or go buy some stinky energy stocks with the cash she's been sitting on in the outside accounts, eh? not yet, but coming attraction.

I know you don't do bonds. and they are not without risk. wish I'd known about interest rates and bond prices way back 30 years ago when I had an insurance settlement. could be sitting comfortable up there in the window with MindyLou now if had known then what I do now about that. oh well. fundamentals vs market behavior-2 different things, starting to come back together finally on the energy side of things, other aspects of market will be affected-eventually. once bond vigilantes come back from the dead-someday, I might get a second chance to get in on the ground floor. til then...overpriced stocks, overpriced bonds. what's a girl to do but get up and dance while the band's still playing. :blink:

or go buy some stinky energy stocks with the cash she's been sitting on in the outside accounts, eh? not yet, but coming attraction.

Similar threads

- Replies

- 0

- Views

- 132

- Replies

- 0

- Views

- 117

- Replies

- 0

- Views

- 86