To say the major averages closed mixed today would not adequately describe the fact that the DOW closed down -0.29%, the NAZ up +1.37%, and the S&P up 0.2%. That's quite a spread. Of course it was Options Expiration, which also explains the high volume we saw today.

After gapping higher, stocks were quickly hit with selling pressure for about an hour, hit their lows at mid-morning and fought back to the unchanged mark where they chopped around for the rest of the day. Except for the NAZ of course.

Fed Chairman Bernanke had an early meeting today in which he indicated that further quantitative easing is likely. Oddly, the dollar ended up closing with a 0.6% in volatile trade in spite of those comments.

Among today's data releases, September retail sales were up 0.6%, which was a bit higher than estimates. The October New York Empire Manufacturing Index posted a 15.73, which was much higher than estimates. The University of Michigan preliminary Consumer Sentiment reading for October was 67.9, a tad lower than estimates. And business inventories for August were up 0.6%, which was modestly higher than estimates.

But the data didn't seem to move the market much today, which was the same non-reaction we saw yesterday.

I noticed our sentiment survey did indeed creep up a bit more in bullishness, which does not make me particularly comfortable, although it is still technically on a buy.

Here's today's charts:

NAMO and NYMO both flipped to sells today and continue to track in sideways fashion.

NAHL managed to remain on a buy, while NYHL flipped to a sell. Notice however, that the 6 day EMA is tracking on an upward bent and has been for the better part of 2 months.

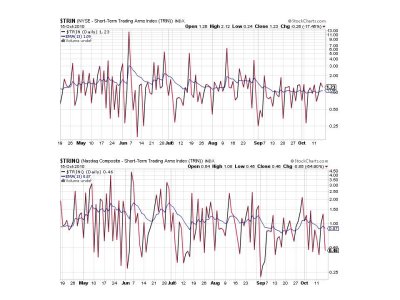

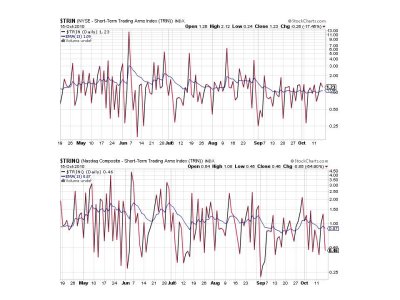

TRIN remained on a modest sell, while TRINQ dove into buy territory. That wasn't surprising given the Nasdaq's outsized gains today.

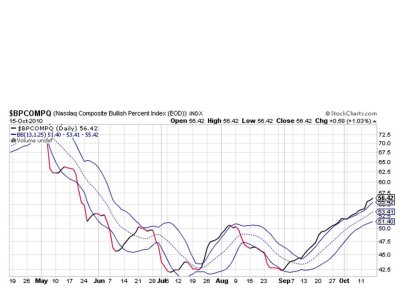

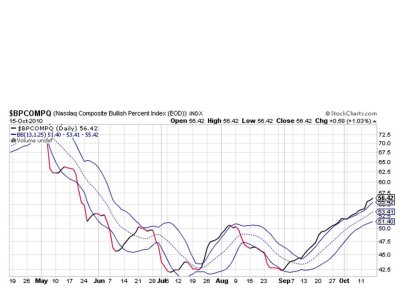

No change for BPCOMPQ. It's continuing to tracker ever higher and remains on buy.

So we 3 of 7 signals flashing buys, which keeps the system on a buy.

The charts continue to suggest the intermediate term trend is up, but sentiment does appear to be getting more bullish, but it has been a very slow conversion. While weakness may come now that OPEX is over, I don't think it will be enough to change the trend unless sentiment gets too bullish. I don't see that happening just yet. See you this weekend when I post the tracker charts.

After gapping higher, stocks were quickly hit with selling pressure for about an hour, hit their lows at mid-morning and fought back to the unchanged mark where they chopped around for the rest of the day. Except for the NAZ of course.

Fed Chairman Bernanke had an early meeting today in which he indicated that further quantitative easing is likely. Oddly, the dollar ended up closing with a 0.6% in volatile trade in spite of those comments.

Among today's data releases, September retail sales were up 0.6%, which was a bit higher than estimates. The October New York Empire Manufacturing Index posted a 15.73, which was much higher than estimates. The University of Michigan preliminary Consumer Sentiment reading for October was 67.9, a tad lower than estimates. And business inventories for August were up 0.6%, which was modestly higher than estimates.

But the data didn't seem to move the market much today, which was the same non-reaction we saw yesterday.

I noticed our sentiment survey did indeed creep up a bit more in bullishness, which does not make me particularly comfortable, although it is still technically on a buy.

Here's today's charts:

NAMO and NYMO both flipped to sells today and continue to track in sideways fashion.

NAHL managed to remain on a buy, while NYHL flipped to a sell. Notice however, that the 6 day EMA is tracking on an upward bent and has been for the better part of 2 months.

TRIN remained on a modest sell, while TRINQ dove into buy territory. That wasn't surprising given the Nasdaq's outsized gains today.

No change for BPCOMPQ. It's continuing to tracker ever higher and remains on buy.

So we 3 of 7 signals flashing buys, which keeps the system on a buy.

The charts continue to suggest the intermediate term trend is up, but sentiment does appear to be getting more bullish, but it has been a very slow conversion. While weakness may come now that OPEX is over, I don't think it will be enough to change the trend unless sentiment gets too bullish. I don't see that happening just yet. See you this weekend when I post the tracker charts.