You may not have noticed, but there was good news in the market today. March factory orders were up 1.3%, which was much higher than expected, and March pending home sales rose 5.3%, a bit more than 5.0% consensus.

But the market didn't seem to take notice today, and why should it? The Euro debt crises appears to be escalating and today saw the Greece Athex Composite fall 6.7%, Spain's IBEX fell 5.4%, and Portugal's General Index dropped 3.8%.

The dollar took off once again as the global market drove up the Dollar Index 1.3%; the most so far this year.

You might remember that yesterday I said I thought Monday's rally might be a dead cat bounce. It appears it was just that and after today's rush to the exits the S&P closed just above its 50 day moving average. Friday's Seven Sentinels sell signal appears to be on the money at this point.

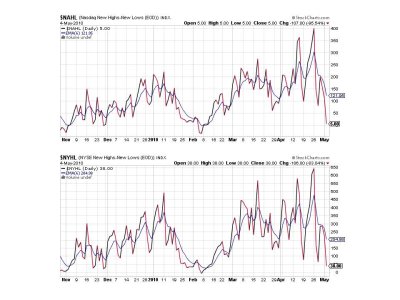

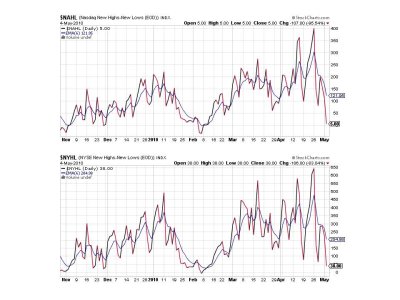

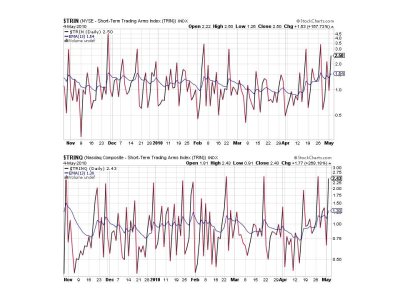

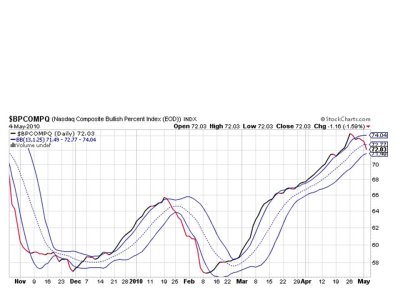

Here's the charts:

Back to a sell here.

Big time sell here too.

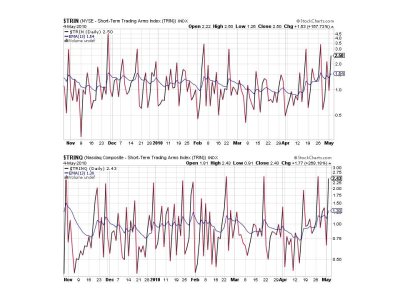

Two more sells.

Now were getting vertical again, but in the opposite direction.

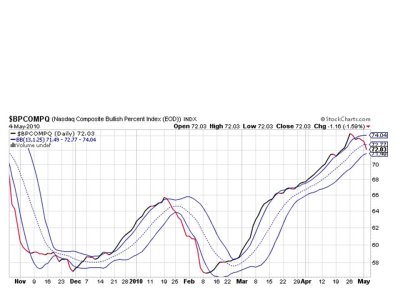

All seven sentinels are flashing sells again, but that doesn't change the system, which remains on a sell.

Please keep in the mind that the 2009 - 2010 bull lasted a long time, and I'm not writing its obit here. But sooner or later these sell signals are going to be as lasting as the buy signals were, so when we get a sell signal be mindful that dip buying without a SS buy signal is playing against the trend. And with only 2 IFTs per month it can be very costly to jump into a volatile market given our trading restrictions. Plus it's very early in the month.

One more thing. Our sentiment survey has been kicking some butt this year, and in case you were not aware it is on a sell this week.

Currently 100% G and liking the lily pad just fine. Good luck and see you tomorrow.

But the market didn't seem to take notice today, and why should it? The Euro debt crises appears to be escalating and today saw the Greece Athex Composite fall 6.7%, Spain's IBEX fell 5.4%, and Portugal's General Index dropped 3.8%.

The dollar took off once again as the global market drove up the Dollar Index 1.3%; the most so far this year.

You might remember that yesterday I said I thought Monday's rally might be a dead cat bounce. It appears it was just that and after today's rush to the exits the S&P closed just above its 50 day moving average. Friday's Seven Sentinels sell signal appears to be on the money at this point.

Here's the charts:

Back to a sell here.

Big time sell here too.

Two more sells.

Now were getting vertical again, but in the opposite direction.

All seven sentinels are flashing sells again, but that doesn't change the system, which remains on a sell.

Please keep in the mind that the 2009 - 2010 bull lasted a long time, and I'm not writing its obit here. But sooner or later these sell signals are going to be as lasting as the buy signals were, so when we get a sell signal be mindful that dip buying without a SS buy signal is playing against the trend. And with only 2 IFTs per month it can be very costly to jump into a volatile market given our trading restrictions. Plus it's very early in the month.

One more thing. Our sentiment survey has been kicking some butt this year, and in case you were not aware it is on a sell this week.

Currently 100% G and liking the lily pad just fine. Good luck and see you tomorrow.