The one thing that I've been fairly sure about the last couple of weeks (with respect to the market) is volatility. We've once again walked up to the brink of rolling over this market, only to shoot back higher again on breadth and volume. It really feels like a trap is being set, but I'm not sure whether it's a bull or bear trap. I suspect the latter, but that's been a losing bet for months.

I suppose the biggest development of the day was the report that Gaddafi accepted a peace plan as put forth by Venezuela's Chavez. Given who we're talking about here, I don't see this as more than a brief news item. But oil still reacted to it by dipping below $100 per barrel early on, and then rallying back to finish the day with a modes 0.3% loss $101.91 per barrel.

And for some reason market data became a focal point again. Stock prices took off on an initial jobless claim number of 368,000, which was moderately lower than the estimated 400,000 that was expected. The "rumor" is that since this claims total was less than 400,000 for the third time in four weeks and yesterday's ADP Employment Change was better than expected, tomorrow's February nonfarm payrolls report should look great. Sell the news? That's my expectation, but it probably won't be that simple.

Nonfarm payrolls for January was up 36,000, which fell far short of expectations.

The February ISM Services Index also helped the bullish cause, but posting a 59.7, which is its best reading since 2005.

Overall, the market posted impressive gains and the Seven Sentinels improved as a result.

Here's today's charts:

Back into positive territory for NAMO and NYMO. Both are flashing buys.

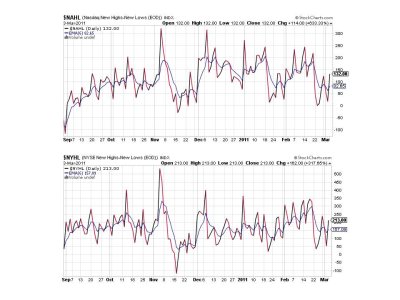

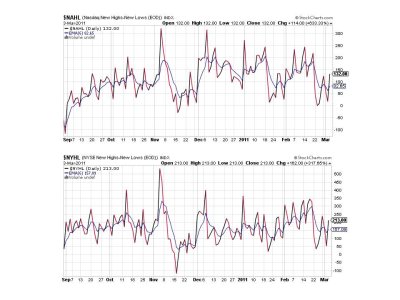

NAHL and NYHL are also flashing buys.

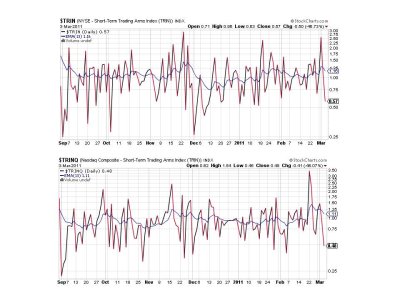

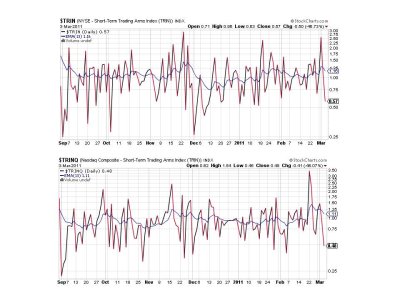

TRIN and TRINQ spiked lower and are now both on buys. They are overdone however, and suggest short term weakness may be near.

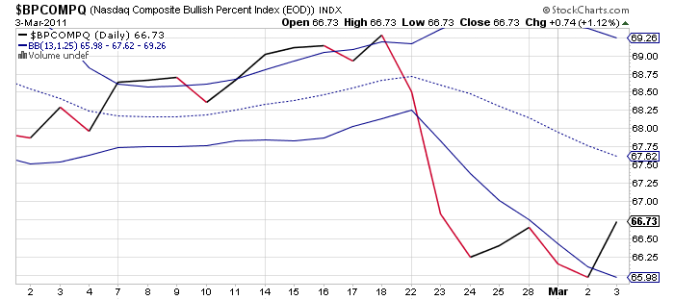

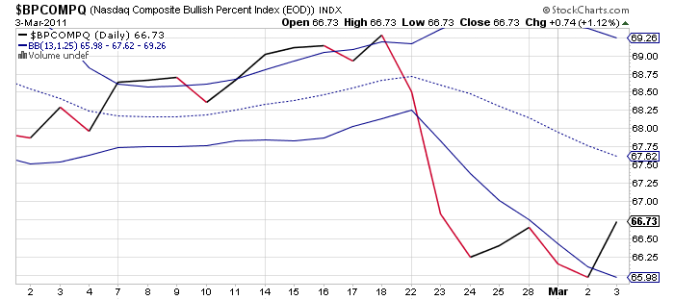

BPCOMPQ flipped back to a buy on today's action.

So all signals are flashing buys, which keeps the system on a buy.

I would not get too comfortable with today's bullish action however. That doesn't mean we can't move on to new highs, but this volatility has not been a hallmark of the bull run we've seen since last September. And the events playing out overseas will probably continue to roil the markets. In less volatile days the Seven Sentinels could sniff out a looming decline, but this volatility is not going to allow the Seven Sentinels to get out of the way fast enough should a fast, hard decline come. And that's almost certainly the way it'll happen. I think that the fact we didn't rally on the 1st of March may have been a warning.

I suppose the biggest development of the day was the report that Gaddafi accepted a peace plan as put forth by Venezuela's Chavez. Given who we're talking about here, I don't see this as more than a brief news item. But oil still reacted to it by dipping below $100 per barrel early on, and then rallying back to finish the day with a modes 0.3% loss $101.91 per barrel.

And for some reason market data became a focal point again. Stock prices took off on an initial jobless claim number of 368,000, which was moderately lower than the estimated 400,000 that was expected. The "rumor" is that since this claims total was less than 400,000 for the third time in four weeks and yesterday's ADP Employment Change was better than expected, tomorrow's February nonfarm payrolls report should look great. Sell the news? That's my expectation, but it probably won't be that simple.

Nonfarm payrolls for January was up 36,000, which fell far short of expectations.

The February ISM Services Index also helped the bullish cause, but posting a 59.7, which is its best reading since 2005.

Overall, the market posted impressive gains and the Seven Sentinels improved as a result.

Here's today's charts:

Back into positive territory for NAMO and NYMO. Both are flashing buys.

NAHL and NYHL are also flashing buys.

TRIN and TRINQ spiked lower and are now both on buys. They are overdone however, and suggest short term weakness may be near.

BPCOMPQ flipped back to a buy on today's action.

So all signals are flashing buys, which keeps the system on a buy.

I would not get too comfortable with today's bullish action however. That doesn't mean we can't move on to new highs, but this volatility has not been a hallmark of the bull run we've seen since last September. And the events playing out overseas will probably continue to roil the markets. In less volatile days the Seven Sentinels could sniff out a looming decline, but this volatility is not going to allow the Seven Sentinels to get out of the way fast enough should a fast, hard decline come. And that's almost certainly the way it'll happen. I think that the fact we didn't rally on the 1st of March may have been a warning.