Boghie

Market Veteran

- Reaction score

- 363

Shaken but not broken. I'm sure it was enough to panic a handful. Nice recovery, of course the days not over yet.

It must be a result of the joyful moment OPEC crapped on us - their allies :smile:

All the speculators hope bad news will keep interest rates low.

Sometime soon bad news is likely to be bad news and just hammer the market.

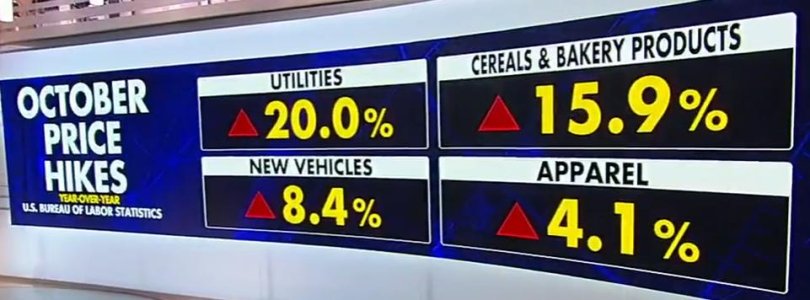

This kinda bad news is another bit of inflationary pressure. That will just keep the FED humming...