With the kind of volatility we saw today, it's obvious that executing an IFT given market conditions prior to 1200 EST may not deliver the desired results by the close. That's not anything new, but this volatility is going to make it that much more challenging to exit the market should one wish to do so.

The market opened trading on the upside, and aside from a brief sell-off early on followed through in that direction for several hours. At least until the FOMC issued its latest Policy Statement. The FOMC left the Fed Funds Rate at 0.00% to 0.25%, as was expected. And they also promised to keep rates at exceptionally low levels for an extended period at least through mid-2013. But the committee didn't address the US debt downgrade and associated stock market plunge other than to say, in essence, that the market was on its own.

And that's when the market's gains were tested. After being up more than 2.5% mid-day, the S&P 500 fell to a loss of more than 1%, while treasuries rallied yet again (the yield on the benchmark 10-year Note fell to a record low of 2.03%).

So it looked like the bear was taking over again. But the S&P 500 found support around 1100 and consequently rallied very hard into the close, easily eclipsing its earlier intra-day high to end the day with a 4.74% gain.

Breadth and volume were strong, as the NYSE saw more than 2 billion shares traded. The VIX fell 27% to end the day at 35.

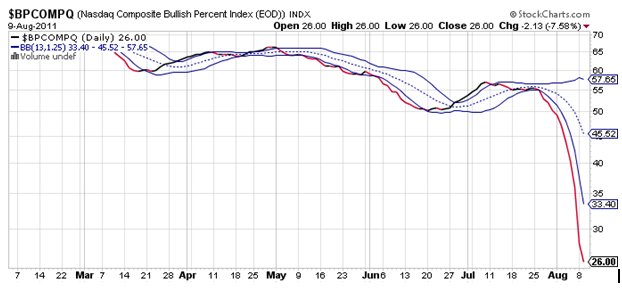

Here's the charts:

NAMO and NYMO bounced and moved back through their 6 day EMAs, which triggered a buy signal in both.

NAHL and NYHL also bounced, but remain in sell conditions.

TRIN and TRINQ both had massive spikes into buy territory, but are screaming overbought in the short term, which suggests weakness will follow soon.

BPCOMPQ tagged lower lows and remains in a sell condition.

So the signals are mixed and that keeps the Seven Sentinels in an Intermediate Term sell condition.

This is the bounce many of us have been looking for. I anticipate there's still more upside given the move off of the extreme lows in NAMO and NYMO, but TRIN and TRINQ are pointing to a very overbought condition, so stand by for more volatility too. I should also point out that a reading below 30 in the BPCOMPQ signal means an oversold market (generally in the longer term). Any remaining upside may last days or weeks, but the downside is probably not over either. I remain 100% S fund, but I'm still looking to lighten up. Today was not really a good day to do that in such a fragile market with an FOMC announcement looming in the afternoon. I opted to stay put for a bit and let the market play out some more. If the market manages to retrace 10% of its previous losses, I'll probably begin lightening up. But that won't be easy if today is any indication of market action to come.