Okay, I've got a little bit of time to update you on the status of the Seven Sentinels before the new trading week begins. Here's the charts:

NAMO and NYMO are still on sells, but are just under the neutral level and very close to their buy trigger points.

NAHL and NYHL are also flashing sells, but very close to their trigger points as well.

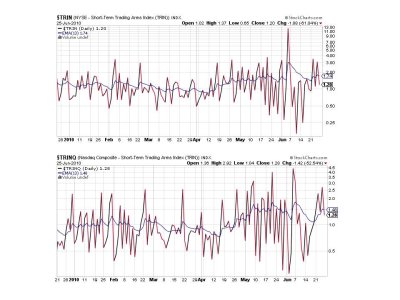

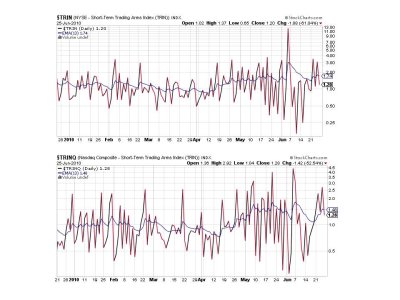

Both TRIN and TRINQ flipped to a buy on Friday.

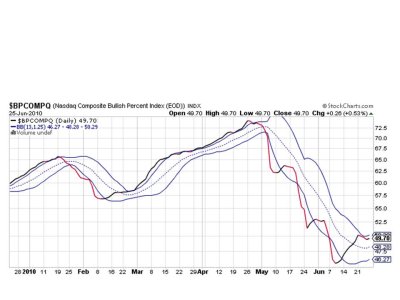

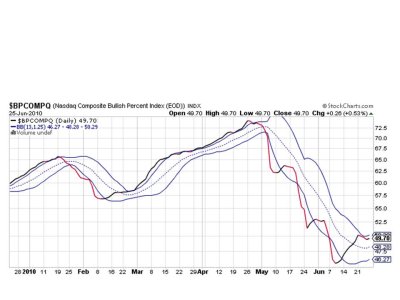

BPCOMPQ remains on buy.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy. It's interesting, and perhaps bullish, that the four signals flashing sells are very close to flipping to buys in spite of the recent selling pressure. If they do flip over to buys they have room to run from current levels.

Our TSP sentiment survey is decidedly bearish for this week (bullish) and leads me to believe the current bout of weakness is nearing its end. Friday's action saw the broader market (S fund) do much better than the S&P 500. That's what you want to see in a bull market. Small issues leading larger ones. It's just one trading day, but it comes at a time when the sentinels appear poised to run higher again and the MB is bearish.

NAMO and NYMO are still on sells, but are just under the neutral level and very close to their buy trigger points.

NAHL and NYHL are also flashing sells, but very close to their trigger points as well.

Both TRIN and TRINQ flipped to a buy on Friday.

BPCOMPQ remains on buy.

So we have 3 of 7 signals flashing buys, which keeps the system on a buy. It's interesting, and perhaps bullish, that the four signals flashing sells are very close to flipping to buys in spite of the recent selling pressure. If they do flip over to buys they have room to run from current levels.

Our TSP sentiment survey is decidedly bearish for this week (bullish) and leads me to believe the current bout of weakness is nearing its end. Friday's action saw the broader market (S fund) do much better than the S&P 500. That's what you want to see in a bull market. Small issues leading larger ones. It's just one trading day, but it comes at a time when the sentinels appear poised to run higher again and the MB is bearish.