rangerray

TSP Pro

- Reaction score

- 209

FYSA - the TSP site is very slow, I should have had enough time to put in an IFT once I logged in. After three or four page refreshes while making my way to the IFT page I was out of time.

Good to know.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

FYSA - the TSP site is very slow, I should have had enough time to put in an IFT once I logged in. After three or four page refreshes while making my way to the IFT page I was out of time.

25% C, 25% S, 50% G COB

Can't you download the prices on this old page?

https://www.tsp.gov/fund-performance/share-price-history/

Sent from my SM-G975U using Tapatalk

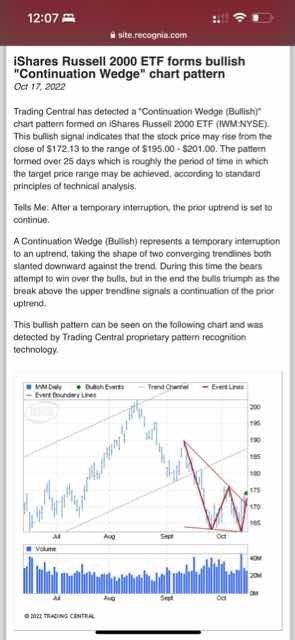

I’m with you to add more exposure. So much negative out there so just turn the media off and buckle your seatbelt. CPI data might not good enough to stop fed Nov 0.75 rate hike, but might trigger a relief rally…good luck you everyone!

Sent from my iPhone using TSP Talk Forums

Why look a gift horse in the mouth, 100% G COB (I think, there's no way to see your pending IFT in the new website. :thumbsdown: And the transfer interface is the pits!)