The DOW Jones crossed 12,000 today, but could not hold that level by the close, although it did manage to close with modest gains. The S&P got close to the magic 1300 level, but just missed crossing it. It ended the day with moderate gains, while the Wilshire 4500 made up for lost ground with a gain of 1.32% on the day.

The big event of the day was this afternoon's FOMC rate announcement, but it turned out to the be a relative non-event.

Earlier in the day, December new home sales posted a 17.5% increase at 329,000 units, which is a bit above the 300,000 that was estimated.

Treasuries sold off in spite of a successful $35 billion 5 year note auction, while the dollar ended the day relatively flat.

It continues to appear that downside risk has all but left the market. It has become a theme of this bull run that every time technicals show serious cracks in the foundation the market manages to come roaring back. But maybe it just appears that way. Now that the SOTU and FOMC announcement are out of the way, what will the market focus on?

The Seven Sentinels certainly improved today, but it wasn't enough to flip it to a buy status. Here's the charts:

NAMO is now just a bit below the neutral line while NYMO has crossed back into positive territory. Both are flashing buys.

Both NAHL and NYHL are also flashing buys.

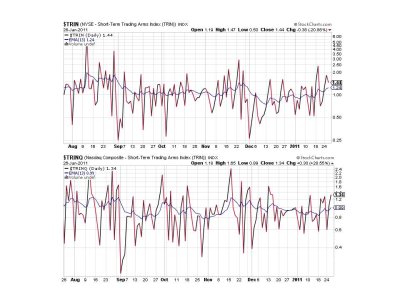

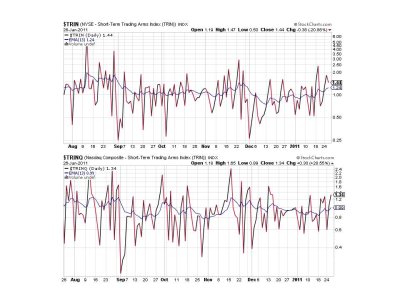

TRIN and TRINQ are on sells.

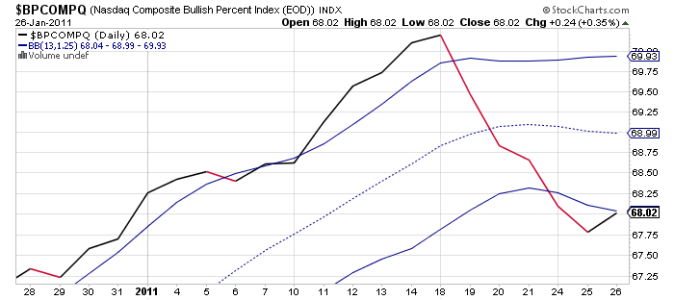

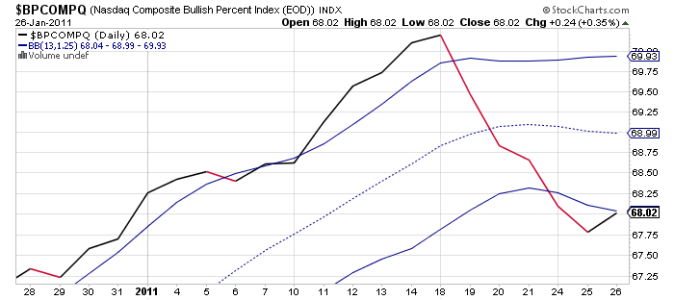

BPCOMPQ turned back up today and just barely missed triggering a buy signal. It remains on a sell.

So 4 of 7 signals remain in a sell condition, which keeps the system on a sell.

While I continue to be somewhat amazed at the continued strength of this market, I have never felt overly bearish as this strength demands respect. But as long as the sentinels remain on a sell, I'll respect that too. Perhaps now that those two big events are behind us, market character will change. It's getting hard to believe we'll ever see a serious correction again, but then that's how we're suppose to feel when one finally develops. It's not a question of "if", but "when".

The big event of the day was this afternoon's FOMC rate announcement, but it turned out to the be a relative non-event.

Earlier in the day, December new home sales posted a 17.5% increase at 329,000 units, which is a bit above the 300,000 that was estimated.

Treasuries sold off in spite of a successful $35 billion 5 year note auction, while the dollar ended the day relatively flat.

It continues to appear that downside risk has all but left the market. It has become a theme of this bull run that every time technicals show serious cracks in the foundation the market manages to come roaring back. But maybe it just appears that way. Now that the SOTU and FOMC announcement are out of the way, what will the market focus on?

The Seven Sentinels certainly improved today, but it wasn't enough to flip it to a buy status. Here's the charts:

NAMO is now just a bit below the neutral line while NYMO has crossed back into positive territory. Both are flashing buys.

Both NAHL and NYHL are also flashing buys.

TRIN and TRINQ are on sells.

BPCOMPQ turned back up today and just barely missed triggering a buy signal. It remains on a sell.

So 4 of 7 signals remain in a sell condition, which keeps the system on a sell.

While I continue to be somewhat amazed at the continued strength of this market, I have never felt overly bearish as this strength demands respect. But as long as the sentinels remain on a sell, I'll respect that too. Perhaps now that those two big events are behind us, market character will change. It's getting hard to believe we'll ever see a serious correction again, but then that's how we're suppose to feel when one finally develops. It's not a question of "if", but "when".