Even QE3 can't coax many of our TSPers out of cash and bonds as the Total Tracker shows we dropped our collective stock allocations a bit more. The Top 50 however, did increase their stock exposure. Here's the charts:

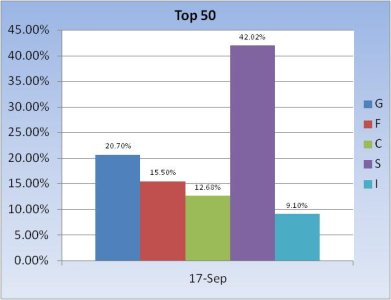

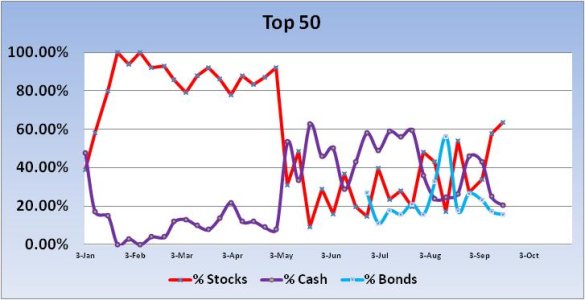

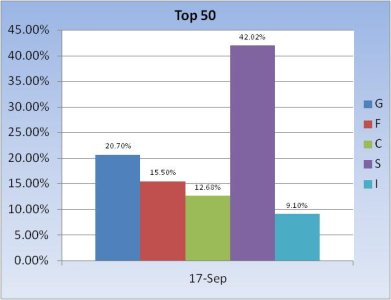

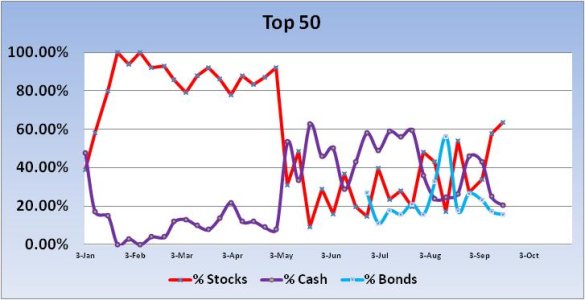

The Top 50 increased their stock exposure going into the new week from 57.96% to a total of 63.8%. That's a total increase week over week of 5.84%. Last week, the Top 50 had a big shift in bullishness and the market rewarded those who took that risk with some very nice gains.

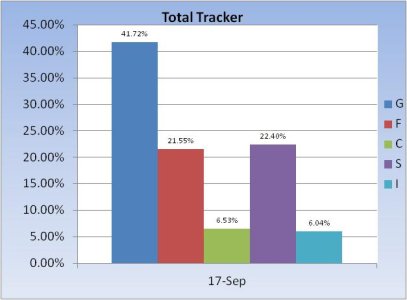

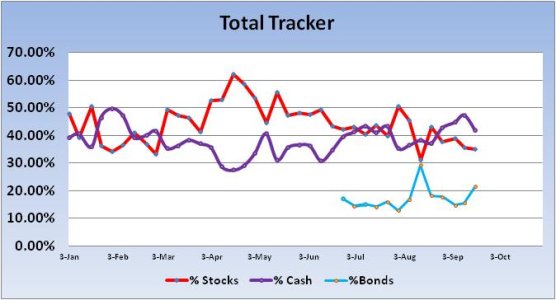

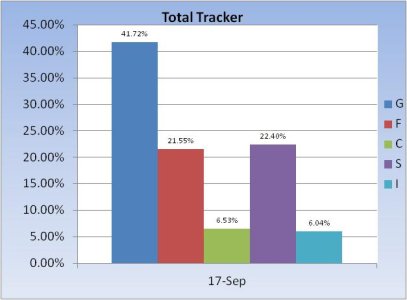

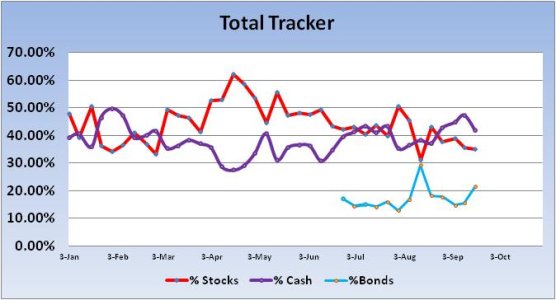

The Total Tracker showed we dropped our total stock exposure by a modest 0.65%. That's not much, but total stock exposure for this group is only 34.96%, and you can't pull back what's already been pulled back.

Our sentiment survey remained on a buy once again and we have QE3 at work as well, which would seem to significantly favor the bulls. But I would not be surprised to see some selling pressure sometime this week to keep the bulls honest and keep the bears in the game.

The Top 50 increased their stock exposure going into the new week from 57.96% to a total of 63.8%. That's a total increase week over week of 5.84%. Last week, the Top 50 had a big shift in bullishness and the market rewarded those who took that risk with some very nice gains.

The Total Tracker showed we dropped our total stock exposure by a modest 0.65%. That's not much, but total stock exposure for this group is only 34.96%, and you can't pull back what's already been pulled back.

Our sentiment survey remained on a buy once again and we have QE3 at work as well, which would seem to significantly favor the bulls. But I would not be surprised to see some selling pressure sometime this week to keep the bulls honest and keep the bears in the game.