This entire week seemed to be anticlimactic given September's historical run. Many traders were looking for a rally leading up to the elections, but few expected it to happen so early. Of course it's possible that September was just the lead-in of a big fourth quarter, but not many are embracing that idea.

There were numerous data points released this morning. Personal income was up 0.5%, which was higher than an anticipated 0.3%. Spending also increased at 0.4%, which was just a tad higher than expected, while core personal consumption increased 0.1%, which was in-line with estimates.

The University of Michigan consumer sentiment reading for September was up from 66.6 to 68.2%, which was above the 67.0 that was expected.

Construction spending improved from a -1.4% drop in July to post a 0.4% gain for August. Economists were looking for a 0.5% decrease.

So far, so good as the data was supportive of a recovering economy, however the ISM Manufacturing Index for September dropped to 54.4 from 56.3. That was a bit lower than estimates.

Let's look at the charts.

NAMO has been moving sideways this week, while NYMO tracked a bit higher. Both are on buys, but also sitting pretty much on their trigger points.

Both NAHL and NYHL dipped with NAHL flashing a sell while NYHL is flashing a buy. But they too are sitting very near their trigger points.

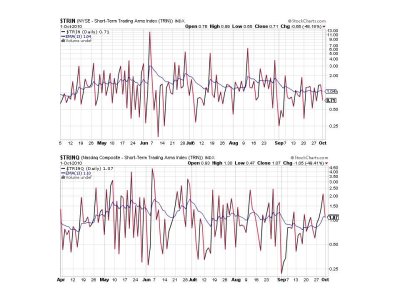

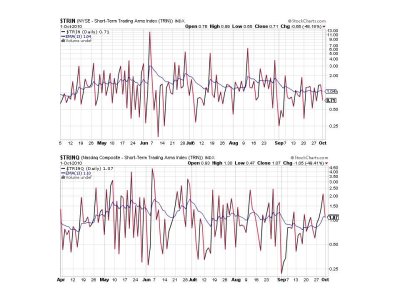

TRIN and TRINQ are now in buy territory and giving a fairly neutral reading.

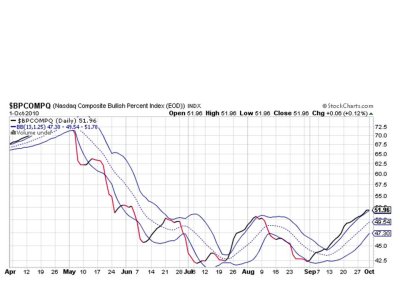

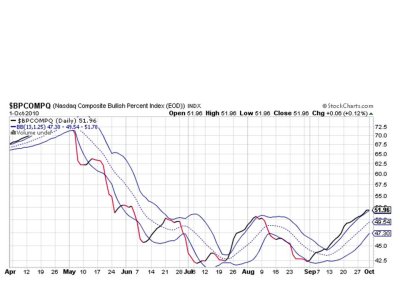

BPCOMPQ, while still flashing a buy, was flat today.

So the system remains on a buy, but now that September is officially over the question to ask is "what's next"?

Given the big September rally that turned flat the final week of the month, many traders are all but convinced that the market is about to reverse. But the sentinels are neutral in a market that's stubbornly bearish in many pockets. It's very difficult for me to envision a severe correction in such an environment. So while I am expecting some weakness next week, I think it'll be a buying opportunity unless the market begins to fall through key support levels. Of course this is assuming we'll get some selling pressure in the first place. We'll just have to watch and see how next week plays out to get the next clue.

See you this weekend when I post the tracker data.

There were numerous data points released this morning. Personal income was up 0.5%, which was higher than an anticipated 0.3%. Spending also increased at 0.4%, which was just a tad higher than expected, while core personal consumption increased 0.1%, which was in-line with estimates.

The University of Michigan consumer sentiment reading for September was up from 66.6 to 68.2%, which was above the 67.0 that was expected.

Construction spending improved from a -1.4% drop in July to post a 0.4% gain for August. Economists were looking for a 0.5% decrease.

So far, so good as the data was supportive of a recovering economy, however the ISM Manufacturing Index for September dropped to 54.4 from 56.3. That was a bit lower than estimates.

Let's look at the charts.

NAMO has been moving sideways this week, while NYMO tracked a bit higher. Both are on buys, but also sitting pretty much on their trigger points.

Both NAHL and NYHL dipped with NAHL flashing a sell while NYHL is flashing a buy. But they too are sitting very near their trigger points.

TRIN and TRINQ are now in buy territory and giving a fairly neutral reading.

BPCOMPQ, while still flashing a buy, was flat today.

So the system remains on a buy, but now that September is officially over the question to ask is "what's next"?

Given the big September rally that turned flat the final week of the month, many traders are all but convinced that the market is about to reverse. But the sentinels are neutral in a market that's stubbornly bearish in many pockets. It's very difficult for me to envision a severe correction in such an environment. So while I am expecting some weakness next week, I think it'll be a buying opportunity unless the market begins to fall through key support levels. Of course this is assuming we'll get some selling pressure in the first place. We'll just have to watch and see how next week plays out to get the next clue.

See you this weekend when I post the tracker data.