Yes, it's a little early to declare today's action anything more than overbought selling interest, but today's slide was the worst one day performance for the major averages in 5 months and that could temper bullish perspectives in the very short term.

Some analysts are pointing to Egypt as one of the primary reasons for the sell-off, and that probably has some measure of merit, but we're due for a correction too and this could just be an excuse to take profits.

It could also be argued that the markets inability to hold key technicals levels for two straight days sparked the selling interest. Whatever caused the slide volume was high, so that will get trader's attention as we move forward.

Early on this morning, the fourth quarter GDP report was released and it showed in increase of 3.2%. This was generally on par with expectations.

Once the selling began, traders had little interest in an improved January Consumer Sentiment Survey. It showed a reading of 74.2, which was better than expected.

The high volatility today caused the biggest spike in the VIX since May, which helped treasuries tack on moderate gains while pushing the dollar up 0.5%.

So yesterday the Seven Sentinels issued an unconfirmed buy signal, which means they all flipped to buys, but NYMO failed to achieve a 28 day trading high. Today's action makes that unofficial buy highly suspect so I'm not inclined to expect any confirmation now. My guess is we eventually continue lower based on the "official" status of the Seven Sentinels, which is a sell condition.

Here's today's chart:

Back to sells for NAMO and NYMO.

Same for NAHL and NYHL.

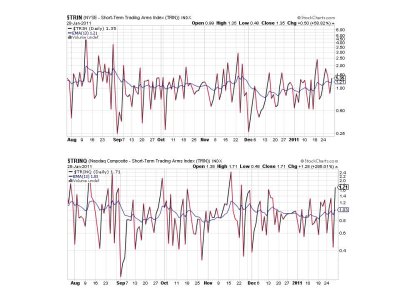

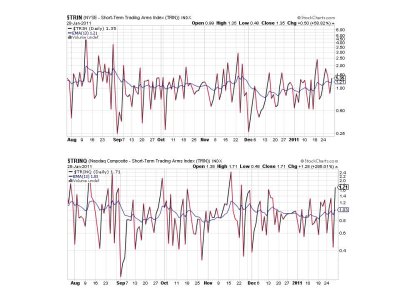

Two sells for TRIN and TRINQ.

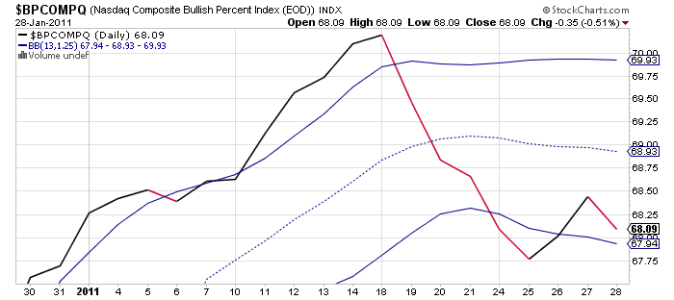

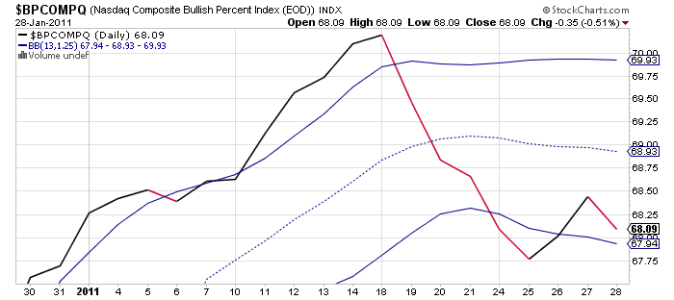

BPCOMPQ turned lower today, but remained on a buy.

I have been loath to get too bearish in such a strong market, but today's selling pressure was probably related to the weakness we saw the week before last. In between that week and today we had the President's SOTU address along with the FOMC announcement, both of which predictably buoyed this market. This indicates that we may very well be in the beginning stages of an intermediate term decline, but that doesn't mean we are no longer in a bull market. The longer term trend is still up, but lower prices may be coming and that's what I'm looking for with this sell signal.

See you this weekend when I post the tracker charts.

Some analysts are pointing to Egypt as one of the primary reasons for the sell-off, and that probably has some measure of merit, but we're due for a correction too and this could just be an excuse to take profits.

It could also be argued that the markets inability to hold key technicals levels for two straight days sparked the selling interest. Whatever caused the slide volume was high, so that will get trader's attention as we move forward.

Early on this morning, the fourth quarter GDP report was released and it showed in increase of 3.2%. This was generally on par with expectations.

Once the selling began, traders had little interest in an improved January Consumer Sentiment Survey. It showed a reading of 74.2, which was better than expected.

The high volatility today caused the biggest spike in the VIX since May, which helped treasuries tack on moderate gains while pushing the dollar up 0.5%.

So yesterday the Seven Sentinels issued an unconfirmed buy signal, which means they all flipped to buys, but NYMO failed to achieve a 28 day trading high. Today's action makes that unofficial buy highly suspect so I'm not inclined to expect any confirmation now. My guess is we eventually continue lower based on the "official" status of the Seven Sentinels, which is a sell condition.

Here's today's chart:

Back to sells for NAMO and NYMO.

Same for NAHL and NYHL.

Two sells for TRIN and TRINQ.

BPCOMPQ turned lower today, but remained on a buy.

I have been loath to get too bearish in such a strong market, but today's selling pressure was probably related to the weakness we saw the week before last. In between that week and today we had the President's SOTU address along with the FOMC announcement, both of which predictably buoyed this market. This indicates that we may very well be in the beginning stages of an intermediate term decline, but that doesn't mean we are no longer in a bull market. The longer term trend is still up, but lower prices may be coming and that's what I'm looking for with this sell signal.

See you this weekend when I post the tracker charts.