Early weakness gives way to gains again. See a theme here? Yes, this market is due for some selling, but buyers keep jumping in before any real damage is done. It's possible that this could continue longer than some might think. That's not a bullish statement by me, I'm neutral and simply watching the charts.

Earnings season has started, but it's way too early to know how the market is going to trade in reaction the results as company reports start to pile up in the coming weeks. The S&P did not quite make it to the 1200 level today, and it would seem we'll get there given the underlying resilience of this market. Maybe tomorrow? The VIX actually moved 3.5% higher today, after hitting a multiyear low yesterday.

Here's today's charts:

Not much activity here. Still hovering around zero. One buy and one sell.

Both NAHL and NYHL flipped back to sells today, but that's not a problem at the moment.

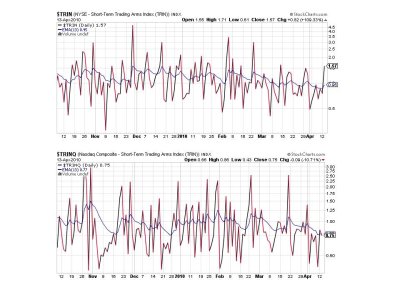

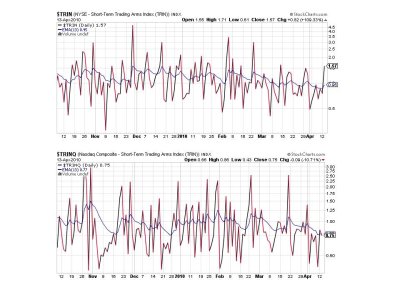

TRIN flipped to a sell while TRINQ actually turned down a bit, triggering a buy. That's a bit odd, but still not an issue.

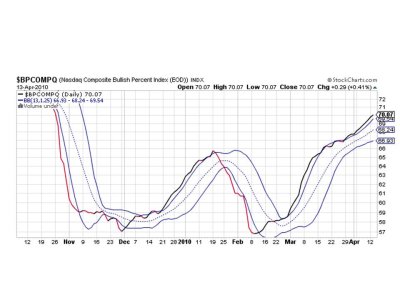

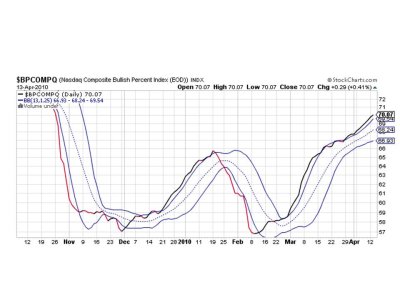

BPCOMPQ has pushed past 70 on the chart, which officially puts the Nasdaq in overbought territory. A concern? No. We've seen it linger above 70 for weeks during Aug - Oct last year. But if it turns down in noteworthy fashion I may start thinking about a defensive position. But for now, it's still bullish.

So we have 3 of 7 signals on a buy, which keeps the system on a buy. Even though some of the signals rolled over today, market action was not particularly bearish. The bears might think the market looks tired, while the bulls will point out how it keeps coming back to new highs. And the trend has been up. So for now stocks get a green light.

Hope you're trading well. See you tomorrow.

Earnings season has started, but it's way too early to know how the market is going to trade in reaction the results as company reports start to pile up in the coming weeks. The S&P did not quite make it to the 1200 level today, and it would seem we'll get there given the underlying resilience of this market. Maybe tomorrow? The VIX actually moved 3.5% higher today, after hitting a multiyear low yesterday.

Here's today's charts:

Not much activity here. Still hovering around zero. One buy and one sell.

Both NAHL and NYHL flipped back to sells today, but that's not a problem at the moment.

TRIN flipped to a sell while TRINQ actually turned down a bit, triggering a buy. That's a bit odd, but still not an issue.

BPCOMPQ has pushed past 70 on the chart, which officially puts the Nasdaq in overbought territory. A concern? No. We've seen it linger above 70 for weeks during Aug - Oct last year. But if it turns down in noteworthy fashion I may start thinking about a defensive position. But for now, it's still bullish.

So we have 3 of 7 signals on a buy, which keeps the system on a buy. Even though some of the signals rolled over today, market action was not particularly bearish. The bears might think the market looks tired, while the bulls will point out how it keeps coming back to new highs. And the trend has been up. So for now stocks get a green light.

Hope you're trading well. See you tomorrow.