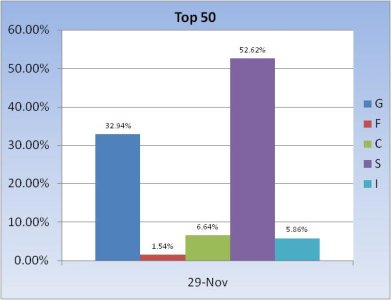

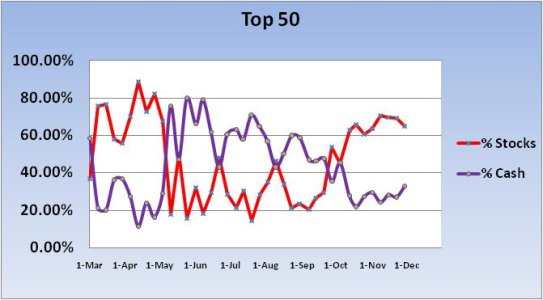

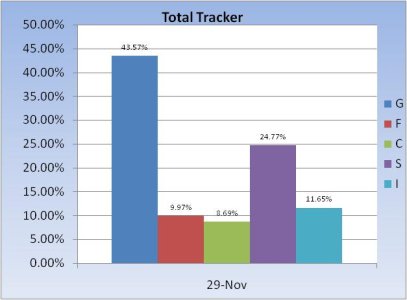

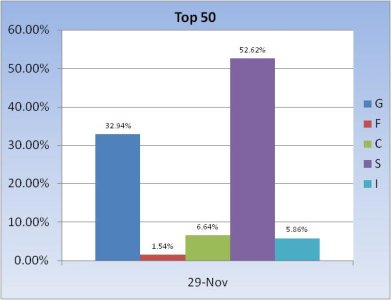

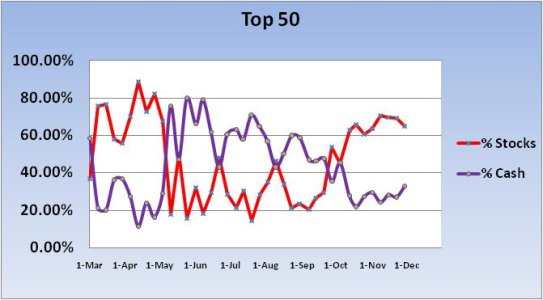

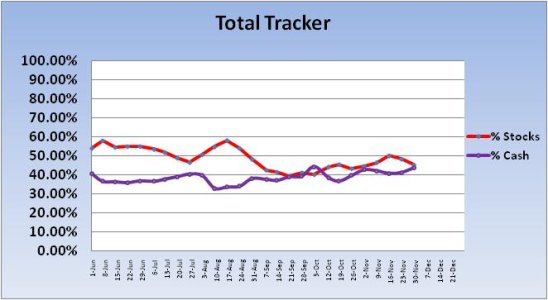

As most of you are already aware, our sentiment survey flipped back to a buy for this week. And both the Top 50 and Total Tracker show cash levels rising. I tend to be bullish on this kind of sentiment, and when this sentiment survey issued a sell a few weeks back, it did so in advance of the Sentinel's sell signal, so it was a leading indicator in that case. Will this be the same result?

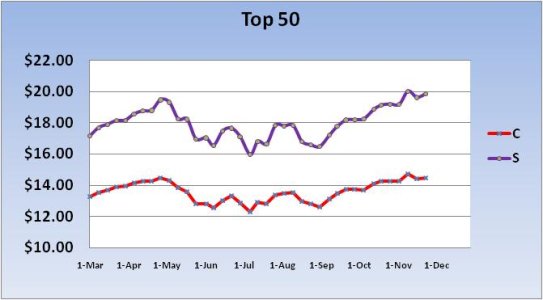

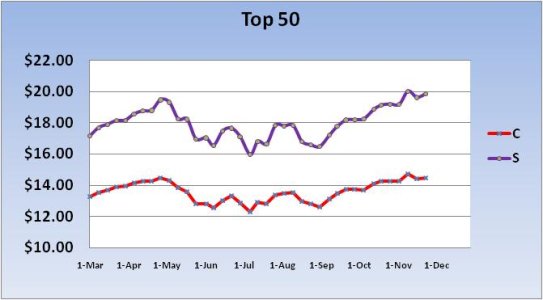

I added another chart for comparison purposes showing price action for the C and S funds.

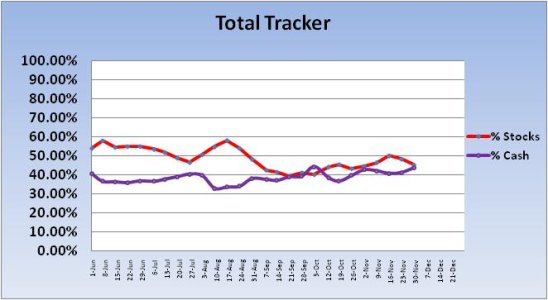

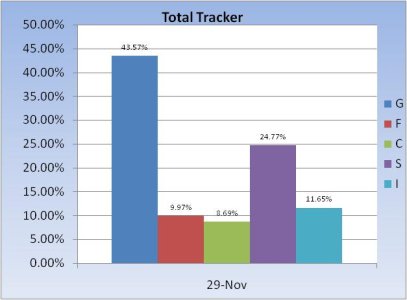

Just like the Top 50, stock allocations dipped for this week.

Overall I do suspect a bounce is at hand, but I also suspect it won't last and that volatility will keep us guessing whether we've seen a bottom or not. There's a lot going on on the global stage and most of it is worrisome. That tends to be fuel for higher prices or at least acts as support for the market in any event. But it does require one to take some risk. I am really interested in how the Asian markets trade tonight as well as how our futures shape up for tomorrow's open. Never a dull moment in this market.

I added another chart for comparison purposes showing price action for the C and S funds.

Just like the Top 50, stock allocations dipped for this week.

Overall I do suspect a bounce is at hand, but I also suspect it won't last and that volatility will keep us guessing whether we've seen a bottom or not. There's a lot going on on the global stage and most of it is worrisome. That tends to be fuel for higher prices or at least acts as support for the market in any event. But it does require one to take some risk. I am really interested in how the Asian markets trade tonight as well as how our futures shape up for tomorrow's open. Never a dull moment in this market.