There's a lot of anticipation in the air for this coming week. Election results, FOMC rate hike announcement, QE2 decision, to name some of the bigger events. But we also have the usual data points on tap such as payrolls. Earnings season seems to have been lost amid the din and it's been pretty good overall. But earnings are only a small part of a much bigger picture. The global economy hasn't changed much and currency manipulation appears to be the name of the game for many countries around the globe. So that's the context I'm applying to this week's trading activity.

But as the title of this particular blog states, sentiment is a part of the picture too. Over the past few weeks we've seen our own sentiment survey slowly become more bullish by the week. And as bullishness rises, market risk rises. We have a continued buy signal for our own sentiment survey this week and true to the current trend it's more bullish this week than last week. But while it may not be over-the-top bullish, it's just one survey of many. The others count too, and one in particular is much more bullish than ours. AAII is a strong sell for next week, at over 70% bulls. Is it enough to flip the intermediate term trend to a sell? Other survey's are not as bullish.

I believe we may be taken on a wild ride next week as all these market elements I've mentioned collide. I'd not be surprised with a shot higher in the Tuesday/Wednesday time frame, but after that I'm not so sure what to expect as the end of the week provides continuing claims, payroll, and unemployment reports.

Here's how we're positioned going into the new week:

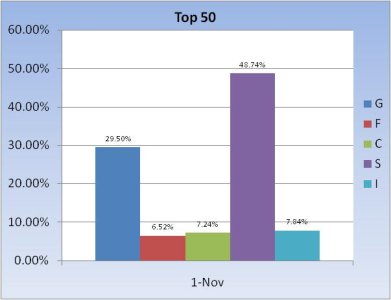

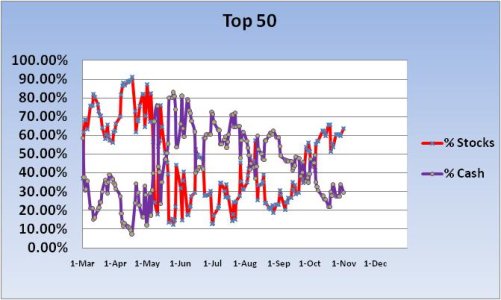

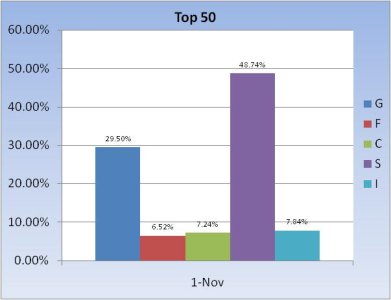

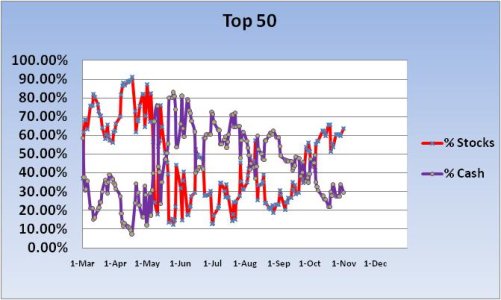

As the market has moved sideways and up (depending on the market sector) our Top 50 has drifted towards a higher stock allocation. The S fund once again is the overwhelming choice among our three stock funds. Bonds are seeing only a modest allocation, while cash levels are just below 30%. This is a bullish picture here.

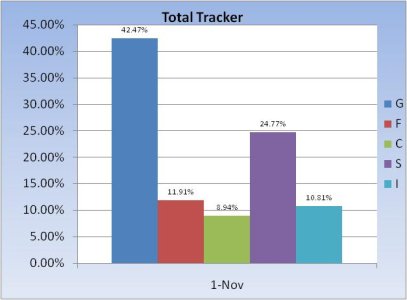

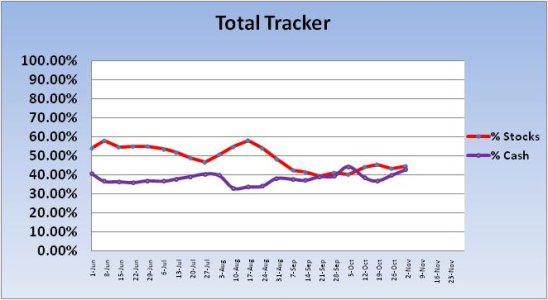

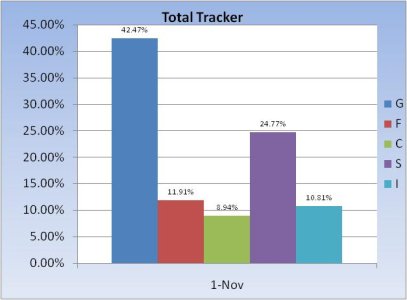

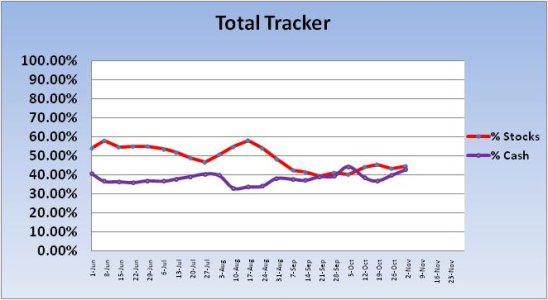

The Total Tracker shows a more evenly distributed allocation as the S fund has an allocation that's about half the Top 50, while all others funds are higher. Total cash and stock allocation rose last week, but as a group we really haven't jumped on this rally since it began in early September. That's interesting given the weekly sentiment survey's steady increase in bullishness.

The Seven Sentinels remain on a buy, but have been flirting with a sell signal for days. Something has give and this coming week offers plenty of catalysts to move the market.

But as the title of this particular blog states, sentiment is a part of the picture too. Over the past few weeks we've seen our own sentiment survey slowly become more bullish by the week. And as bullishness rises, market risk rises. We have a continued buy signal for our own sentiment survey this week and true to the current trend it's more bullish this week than last week. But while it may not be over-the-top bullish, it's just one survey of many. The others count too, and one in particular is much more bullish than ours. AAII is a strong sell for next week, at over 70% bulls. Is it enough to flip the intermediate term trend to a sell? Other survey's are not as bullish.

I believe we may be taken on a wild ride next week as all these market elements I've mentioned collide. I'd not be surprised with a shot higher in the Tuesday/Wednesday time frame, but after that I'm not so sure what to expect as the end of the week provides continuing claims, payroll, and unemployment reports.

Here's how we're positioned going into the new week:

As the market has moved sideways and up (depending on the market sector) our Top 50 has drifted towards a higher stock allocation. The S fund once again is the overwhelming choice among our three stock funds. Bonds are seeing only a modest allocation, while cash levels are just below 30%. This is a bullish picture here.

The Total Tracker shows a more evenly distributed allocation as the S fund has an allocation that's about half the Top 50, while all others funds are higher. Total cash and stock allocation rose last week, but as a group we really haven't jumped on this rally since it began in early September. That's interesting given the weekly sentiment survey's steady increase in bullishness.

The Seven Sentinels remain on a buy, but have been flirting with a sell signal for days. Something has give and this coming week offers plenty of catalysts to move the market.