The bulls are back in charge after this past weeks action, but can it hold? I see higher prices ahead based on the Seven Sentinels and what I'm seeing in the tracker leads me to believe the charts are correct. Let's take a look:

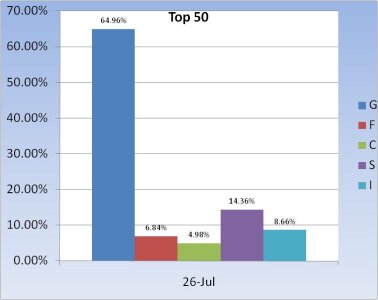

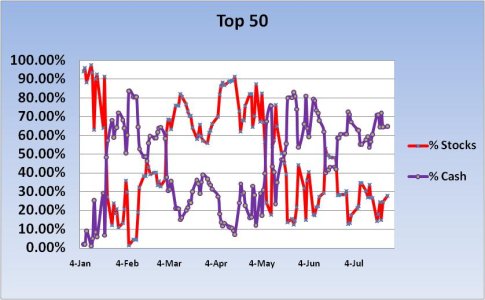

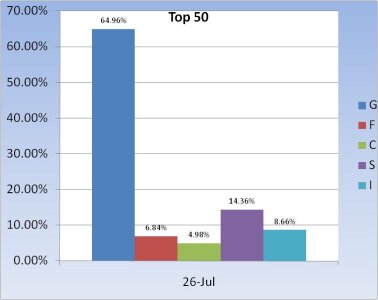

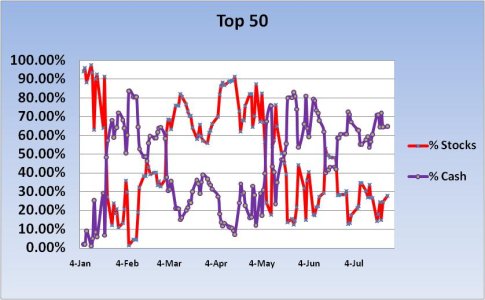

The Top 50 are still very bearish, or at least cautious and probably not buying into a new bull run. Their collective stock allocation has been very conservative and we're quite a ways off the lows. Most of those Top 50 missed those gains and their reluctance to get invested tells me bearish outlooks are still common.

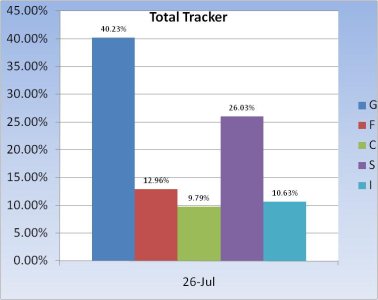

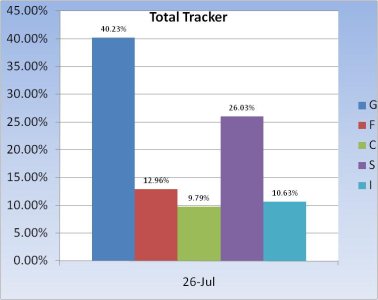

It's been subtle, but make no mistake the total tracker (which is 395 folks!) is trending bearish. Collectively we aren't buying the bull case and stock allocations continue to drop while cash levels rise.

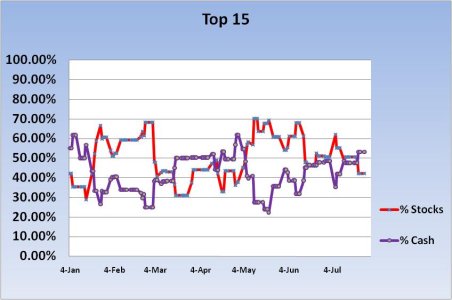

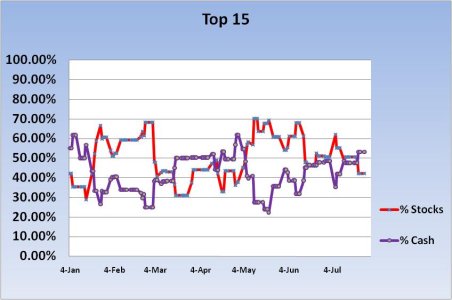

The Top 15 are a much more difficult group to read and quite frankly I don't get much out of this chart. They aren't as bearish a group as the Top 50, but they're on the conservative side nonetheless.

Sentiment on this board based on what folks are doing is bearish and if we are beginning a new up-leg this is fuel for the bulls.

My main source of information will always remain what the SS charts are telling me, but I really like what I see in these tracker charts too.

The Top 50 are still very bearish, or at least cautious and probably not buying into a new bull run. Their collective stock allocation has been very conservative and we're quite a ways off the lows. Most of those Top 50 missed those gains and their reluctance to get invested tells me bearish outlooks are still common.

It's been subtle, but make no mistake the total tracker (which is 395 folks!) is trending bearish. Collectively we aren't buying the bull case and stock allocations continue to drop while cash levels rise.

The Top 15 are a much more difficult group to read and quite frankly I don't get much out of this chart. They aren't as bearish a group as the Top 50, but they're on the conservative side nonetheless.

Sentiment on this board based on what folks are doing is bearish and if we are beginning a new up-leg this is fuel for the bulls.

My main source of information will always remain what the SS charts are telling me, but I really like what I see in these tracker charts too.