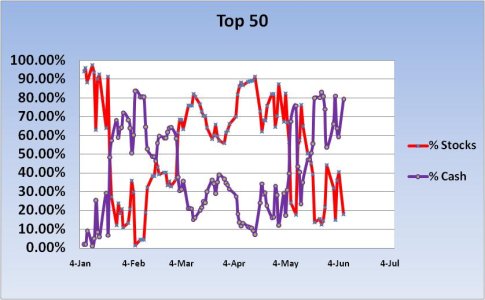

The Top 50 chart continues to reflect the wild swings in the market this past week. Is this the week we break out of the range we're currently in? Here's how the folks on the tracker are positioned going into the new week.

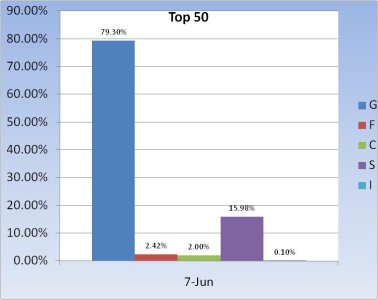

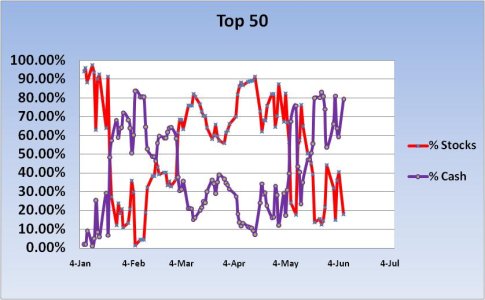

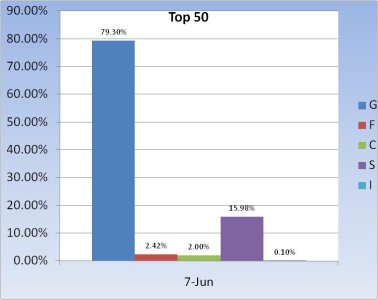

Not surprisingly after Friday's bull roast, not a lot of stocks are being held by the Top 50. But stock allocation has been swinging about 20% every time the market moves either up or down.

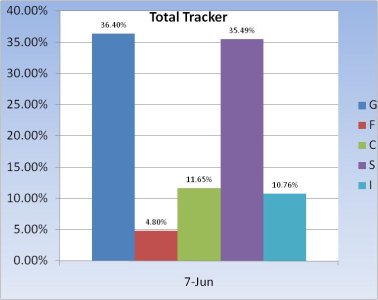

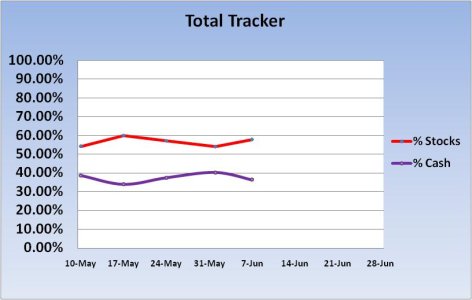

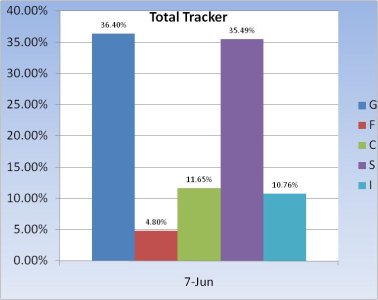

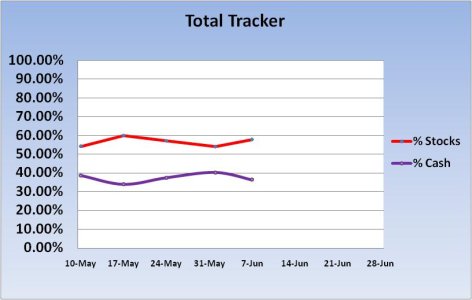

The total tracker reveals some measure of dip buying this past week. But not as much as I'd have thought. Seems bulls and bears alike are mostly paralyzed in their current allocations.

The Top 15 looks much like the Total Tracker.

Sentiment wise, our survey is still bullish overall, and did not differ much from the previous week. Early this morning, Trader's Talk daily sentiment survey was overly bullish, but participation was light. It picked up quite a bit during the course of the day and now it's relatively neutral with good participation. I would guess we'll open weak tomorrow, but reverse into positive territory intraday.

Not surprisingly after Friday's bull roast, not a lot of stocks are being held by the Top 50. But stock allocation has been swinging about 20% every time the market moves either up or down.

The total tracker reveals some measure of dip buying this past week. But not as much as I'd have thought. Seems bulls and bears alike are mostly paralyzed in their current allocations.

The Top 15 looks much like the Total Tracker.

Sentiment wise, our survey is still bullish overall, and did not differ much from the previous week. Early this morning, Trader's Talk daily sentiment survey was overly bullish, but participation was light. It picked up quite a bit during the course of the day and now it's relatively neutral with good participation. I would guess we'll open weak tomorrow, but reverse into positive territory intraday.