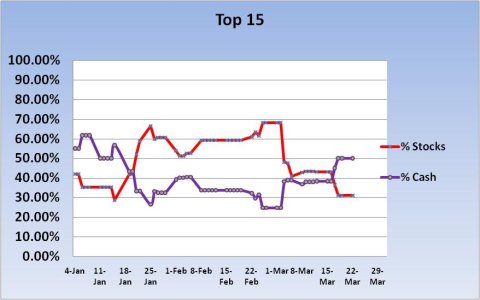

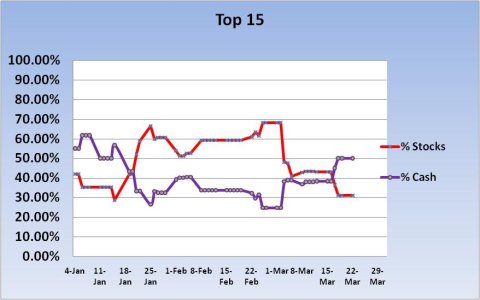

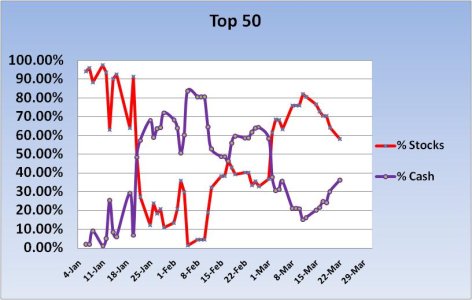

Both the Top 15 and Top 50 are holding a fair amount of cash going into another week of trading. Here's the chart:

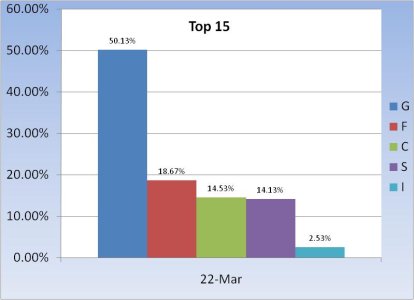

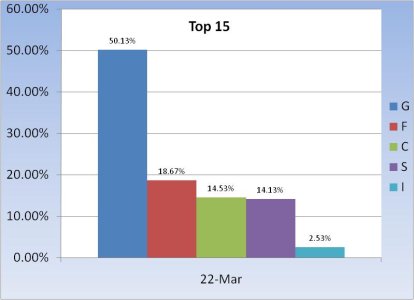

Over 50% cash and over 18% bonds is a conservative stance. Is this a winning hand after the recent runup in stocks?

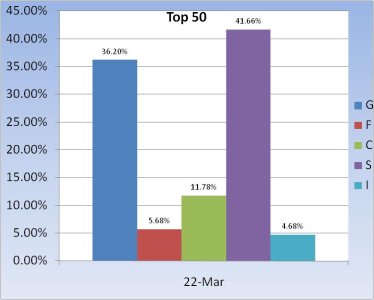

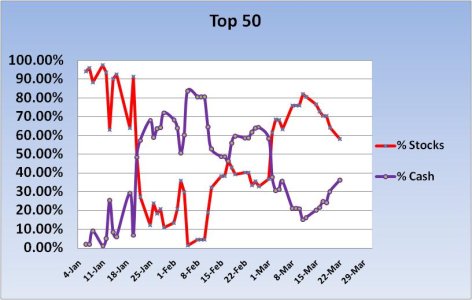

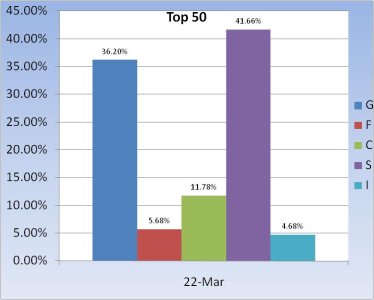

The Top 50 is holding over 36% cash and not nearly as much F fund. We can also see the S fund is significantly overweighted. This is a much more aggressive stance, but lately it's been getting more conservative by the day.

We are entering the final week and half of trading for the 1st quarter and there's plenty of tension in the air, primarily due to the healthcare reform vote. I have no idea how the market is going to react to either a yes or no vote, but since the Sentinels are on a sell it doesn't really matter. Too much pessimism though could rally this market. Some folks also think the HC debate is already baked in, but I don't know how you price an unknown. In any event this could be an interesting week. See you tomorrow.

Over 50% cash and over 18% bonds is a conservative stance. Is this a winning hand after the recent runup in stocks?

The Top 50 is holding over 36% cash and not nearly as much F fund. We can also see the S fund is significantly overweighted. This is a much more aggressive stance, but lately it's been getting more conservative by the day.

We are entering the final week and half of trading for the 1st quarter and there's plenty of tension in the air, primarily due to the healthcare reform vote. I have no idea how the market is going to react to either a yes or no vote, but since the Sentinels are on a sell it doesn't really matter. Too much pessimism though could rally this market. Some folks also think the HC debate is already baked in, but I don't know how you price an unknown. In any event this could be an interesting week. See you tomorrow.