The Top 15 and 50 charts have been updated.

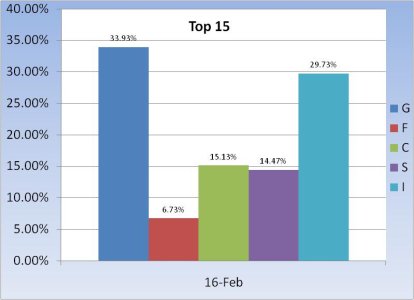

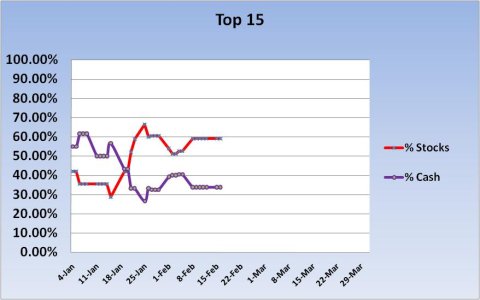

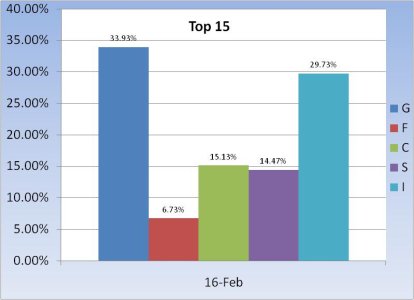

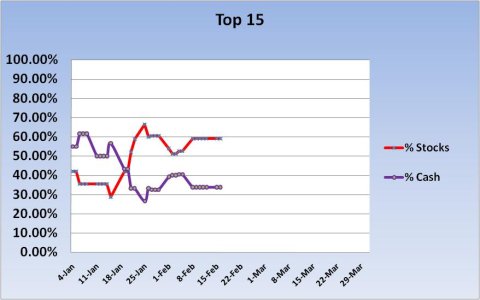

The Top 15 have not changed in over a week. Since about 40% of their collective capital is in cash/bonds I view them as moderately aggressive right now. Considering how poorly the I fund has performed so far this year this group has maintained significant exposure to it, twice as much as either the C or S. This is in contrast to the Top 50.

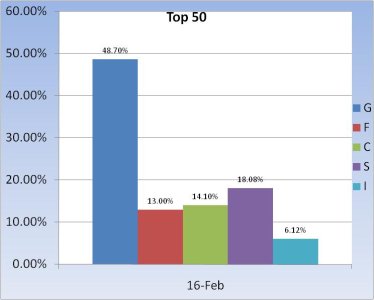

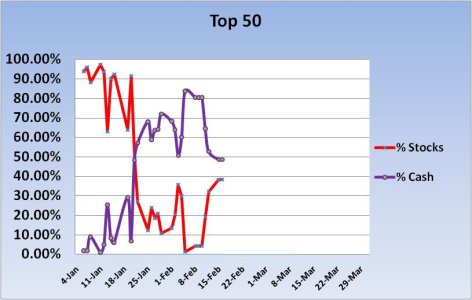

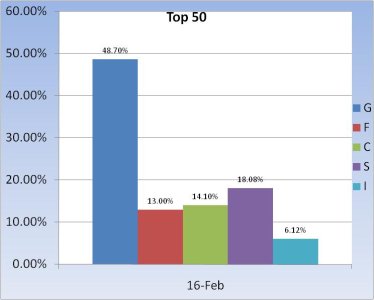

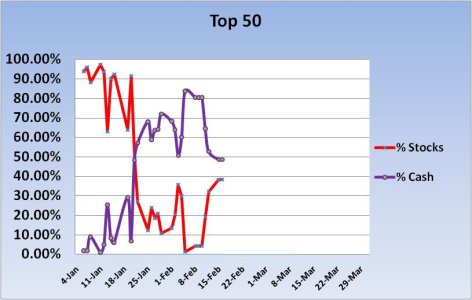

The Top 50 have seen a marked increase in stock exposure the past week, but still much lower than the Top 15 at < 40% overall. Not much I fund exposure here and more emphasis on the S fund. F Fund has found some favor as well.

The Top 15 have not changed in over a week. Since about 40% of their collective capital is in cash/bonds I view them as moderately aggressive right now. Considering how poorly the I fund has performed so far this year this group has maintained significant exposure to it, twice as much as either the C or S. This is in contrast to the Top 50.

The Top 50 have seen a marked increase in stock exposure the past week, but still much lower than the Top 15 at < 40% overall. Not much I fund exposure here and more emphasis on the S fund. F Fund has found some favor as well.