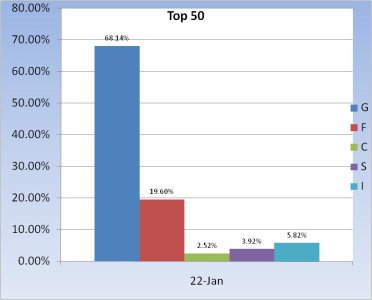

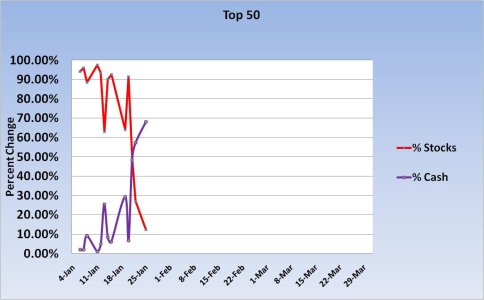

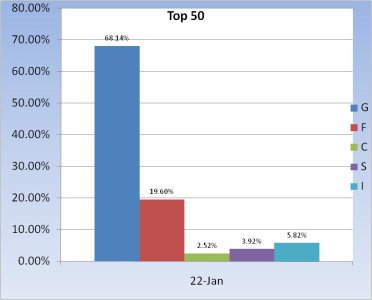

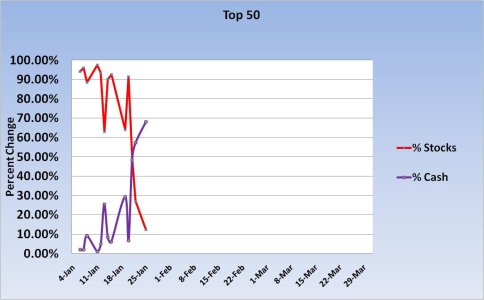

Here's our Top 50 charts. Big, big change. The lily padders have moved in.

What a difference a day makes. Or two.

Our top 15 by comparison has cash levels dropping and stock levels rising. The difference between the Top 50 and Top 15 is that the Top 50 are always at the top, so whatever is working, buy and hold or active trading, Stocks or Cash, it will always rise to the top.

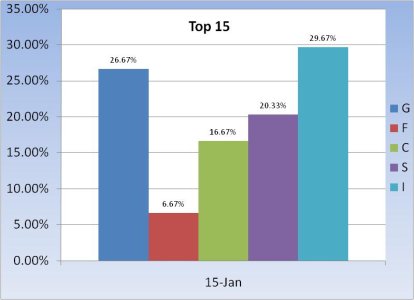

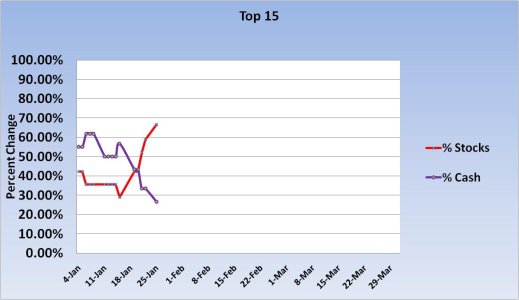

Our Top 15 on the other hand, is a selected list of performers who collectively outperformed other TSP tracker folks over the 2008 and 2009 period. They are scattered up and down the tracker list. But they are market timers and not buy and holders. The idea here was to see how they collectively react to market conditions. They had been largely in cash at the beginning of the month, but this past week have been taking more risk and buying weakness. Of course, that's the idea behind market timing.

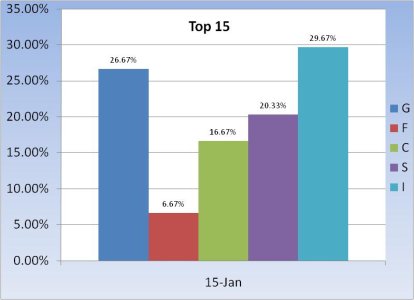

We can also see here that they tend to like the I fund over C and S, which IMO is a risky trade right now, but then that's what I wanted to see with this group. No fear to make trades.

For reference, today I calculated the Top 15 YTD returns to see where they would fall out on the tracker and to see how they are collectively performing. Currently, the Top 15 have a YTD return of -1.19, which would put them about 155 on the tracker. That's about the half way point.

That's it for the weekend. See you Monday.

What a difference a day makes. Or two.

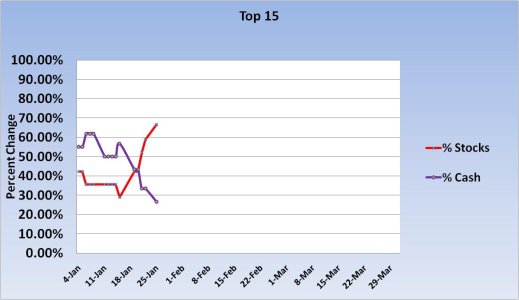

Our top 15 by comparison has cash levels dropping and stock levels rising. The difference between the Top 50 and Top 15 is that the Top 50 are always at the top, so whatever is working, buy and hold or active trading, Stocks or Cash, it will always rise to the top.

Our Top 15 on the other hand, is a selected list of performers who collectively outperformed other TSP tracker folks over the 2008 and 2009 period. They are scattered up and down the tracker list. But they are market timers and not buy and holders. The idea here was to see how they collectively react to market conditions. They had been largely in cash at the beginning of the month, but this past week have been taking more risk and buying weakness. Of course, that's the idea behind market timing.

We can also see here that they tend to like the I fund over C and S, which IMO is a risky trade right now, but then that's what I wanted to see with this group. No fear to make trades.

For reference, today I calculated the Top 15 YTD returns to see where they would fall out on the tracker and to see how they are collectively performing. Currently, the Top 15 have a YTD return of -1.19, which would put them about 155 on the tracker. That's about the half way point.

That's it for the weekend. See you Monday.