Stay tuned, more stats will be coming out this week, we'll cover the entire Dec/Jan transition.

BLS Data: The Quarterly ECI - Employment Cost Index releases on Wednesday 10-Dec-2025, the normal release was set for October.

Statistically (on the surface) 4th Qrt ECI is the most stable of the four quarters, with all 3 sessions (Pre, ECI, Post) having a 58% win ratio.

♗ Weekly Recap

● WTD Overview: Risk-on week: SPX added +0.31% with gains shared by mid-caps, small caps, and global stocks; breadth stayed wide. Flows favored ETFs and cash while mutual funds saw equity outflows as long bonds sold off and volatility eased.

Key Takeaway: Long yields and the dollar now gate the regime; calmer yields plus a soft dollar would extend the risk-on bias.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

♔ Equities

WTD Overview: SPX rose +0.31% as gains were modest but well shared across the index tiers. NDX and transports outpaced the broad index while global developed stocks and extended market funds kept pace.

Leaders & Relative Holds

● Risk Bias: Risk-on. Mid-pack and small caps helped, with NDX +1.01% and transports near +3.60% cushioning any mega-cap softness.

● Breadth: Participation widened; mid-90 and bottom-403 trailed only slightly as small caps (VXF) gained +1.06% and ex-US (ACWX) added +0.72%.

Key Takeaway: As long as transports and small caps hold above recent ranges, dips in SPX look like pullback risk, not regime change.

Key Takeaway: As long as transports and small caps hold above recent ranges, dips in SPX look like pullback risk, not regime change.

♛ Barometer

WTD Overview: Short and long Treasuries fell as IGSB, IEF, and TLT slipped between −0.47% and −2.26%. The dollar (DXY) eased −0.49%; gold (IAU) dipped while copper (CPER) jumped +3.31% and BTC lost −1.74% as VIX sank −5.75%.

Hedges & Risk Bias

● Risk Bias: Risk-on. The curve cheapened at the long end, gold softened, industrial metals firmed, and the softer dollar kept global risk supported.

● Breadth: Safety trades were mixed; cyclic proxies like copper rallied while crypto faded; participation tilted toward offense with lower volatility.

Key Takeaway: A steady or easing long end plus contained volatility would confirm this risk-on shift; another sharp yield spike would test it.

Key Takeaway: A steady or easing long end plus contained volatility would confirm this risk-on shift; another sharp yield spike would test it.

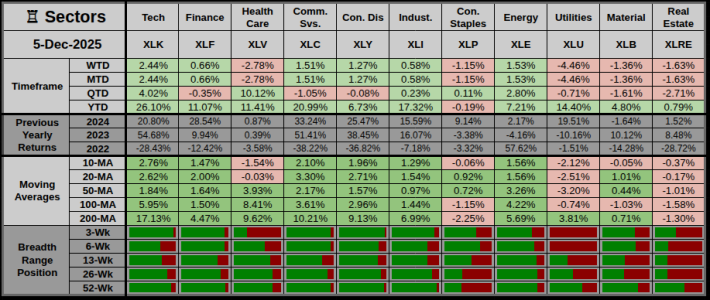

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals led as tech and communication services advanced while defensives, especially utilities and health care, lagged sharply.

Offensive Assets

● Top WTD gainers: XLK +2.44%, XLE +1.53%, XLC +1.51% — growth plus energy leadership.

● Breadth/outperformance: Cyclicals outperformed SPX; participation widened with XLY +1.27% and XLI +0.58% joining the advance.

Defensive Assets

● Standout hedge/defense: XLU −4.46% and XLV −2.78% slumped as yield sensitivity weighed on classic defensives.

● Safety tone or drag: Staples, materials, and real estate (XLP, XLB, XLRE) all slipped, signaling little demand for traditional safety outside cash.

Key Takeaway: With cyclicals leading and defensives under pressure, the tape favors offense; a decisive bid for utilities or staples would flag a turn.

Key Takeaway: With cyclicals leading and defensives under pressure, the tape favors offense; a decisive bid for utilities or staples would flag a turn.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Early: cyclicals led; trend firm; breadth early tilt, pointing to a constructive, offense-favoring phase.

● ● Alternate: Mid: mixed spread; trend mixed; breadth neutral, leaving room for rotation without a clear defensive pivot.

● ● ● Confidence: Medium — trend lens is Early, breadth lens neutral, while timeframe readings still disagree.

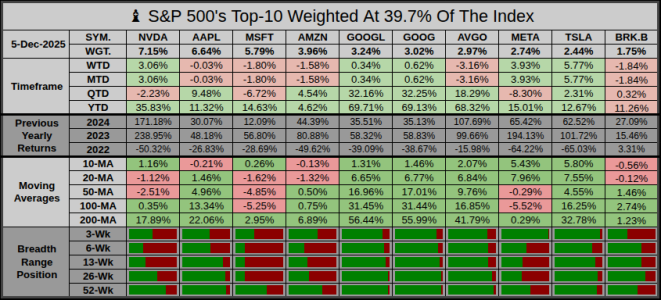

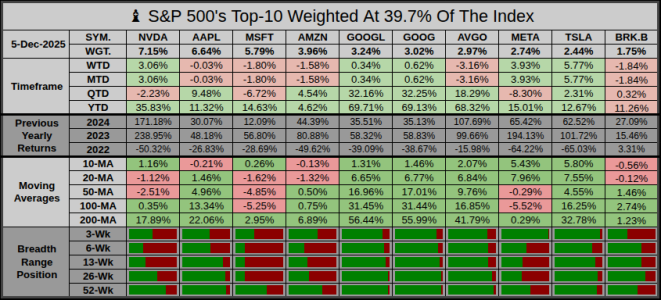

♗ S&P 500’s Weighted Top-10

Overview: Top-10 performance was mixed: some mega-caps rallied, others slipped, leaving a modest drag versus healthy breadth underneath.

Offensive Leaders

● Top movers: NVDA +3.06%, META +3.93%, TSLA +5.77% — semis and growth communication names drove upside.

● Secondary: Paired strength in GOOGL/GOOG and select growth kept the group from acting as a headwind.

Defensive Laggards

● Biggest decliners: MSFT −1.80%, AVGO −3.16%, BRK.B −1.84% eased after strong prior runs.

● Drag/reversal: The mix of strong and weak mega-caps points to rotation within leaders rather than a wholesale unwind at the top.

Key Takeaway: Leadership is still concentrated but less one-sided; rotation within the Top-10 supports a healthier tape if breadth stays firm.

Key Takeaway: Leadership is still concentrated but less one-sided; rotation within the Top-10 supports a healthier tape if breadth stays firm.

Next Week’s Projection

Next Week’s Projection

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

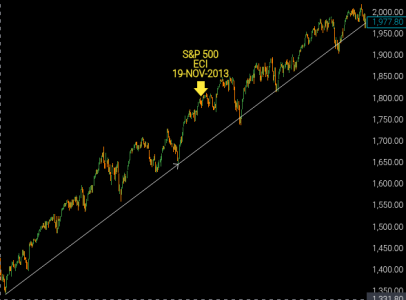

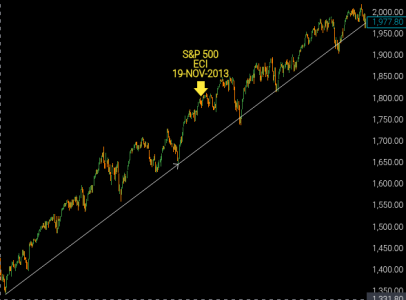

BLS Data: The Quarterly ECI - Employment Cost Index releases on Wednesday 10-Dec-2025, the normal release was set for October.

- From the 80+ I have on record this is the first delay since Oct-2013, which was pushed to 19-Nov-2013.

- The 2013 delay was due to the partial federal government shutdown

- In this particular case, there was little impact on the S&P 500.

Statistically (on the surface) 4th Qrt ECI is the most stable of the four quarters, with all 3 sessions (Pre, ECI, Post) having a 58% win ratio.

- What does make 4th Qrt ECI special, within the 3-Session-Pocket (Pre-ECI, ECI, Post-ECI) many of those sessions were large movers exceeding ±1%.”

- For Context, About 26% of all 5040 sessions (20 years) exceed ±1%

- But within this 3-Session ECI Pocket, we have more ±1% than the 26% benchmark

- ECI 1st Qrt___42% (the largest mover)

- ECI 2nd Qrt___23% (slightly muted)

- ECI 3rd Qrt___27% (on par with the benchmark)

- ECI 4th Qrt___37% (Elevated)

♗ Weekly Recap

● WTD Overview: Risk-on week: SPX added +0.31% with gains shared by mid-caps, small caps, and global stocks; breadth stayed wide. Flows favored ETFs and cash while mutual funds saw equity outflows as long bonds sold off and volatility eased.

Key Takeaway: Long yields and the dollar now gate the regime; calmer yields plus a soft dollar would extend the risk-on bias.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | −$19.65B | Near | Risk-off/de-risking | |

| Bond mutual funds | −$1.34B | Below | Mixed/neutral | |

| ETFs (net issuance) | +$30.24B | Below | Risk-on/supportive | |

| Combined MF + ETF | +$8.96B | Below | Mixed: ETF bid, MF drag | |

| Money market funds | +$86.82B to $7.65T | Above | Risk-off/de-risking (cash build) |

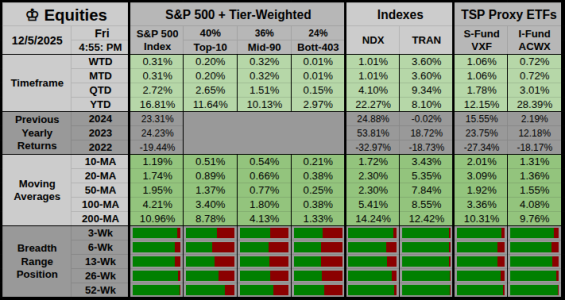

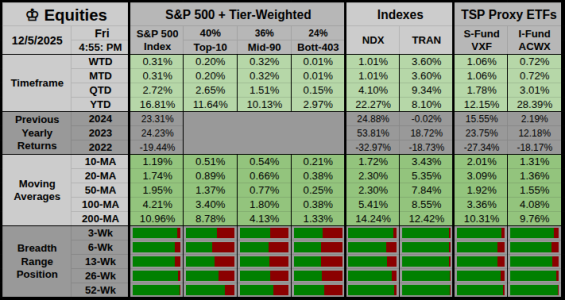

♔ Equities

WTD Overview: SPX rose +0.31% as gains were modest but well shared across the index tiers. NDX and transports outpaced the broad index while global developed stocks and extended market funds kept pace.

Leaders & Relative Holds

● Risk Bias: Risk-on. Mid-pack and small caps helped, with NDX +1.01% and transports near +3.60% cushioning any mega-cap softness.

● Breadth: Participation widened; mid-90 and bottom-403 trailed only slightly as small caps (VXF) gained +1.06% and ex-US (ACWX) added +0.72%.

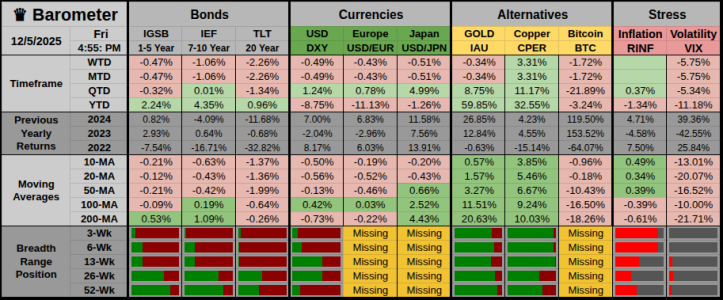

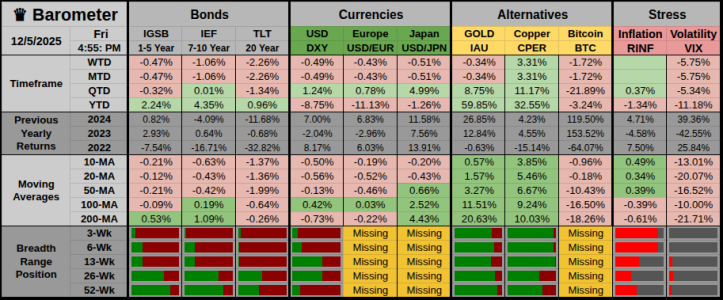

♛ Barometer

WTD Overview: Short and long Treasuries fell as IGSB, IEF, and TLT slipped between −0.47% and −2.26%. The dollar (DXY) eased −0.49%; gold (IAU) dipped while copper (CPER) jumped +3.31% and BTC lost −1.74% as VIX sank −5.75%.

Hedges & Risk Bias

● Risk Bias: Risk-on. The curve cheapened at the long end, gold softened, industrial metals firmed, and the softer dollar kept global risk supported.

● Breadth: Safety trades were mixed; cyclic proxies like copper rallied while crypto faded; participation tilted toward offense with lower volatility.

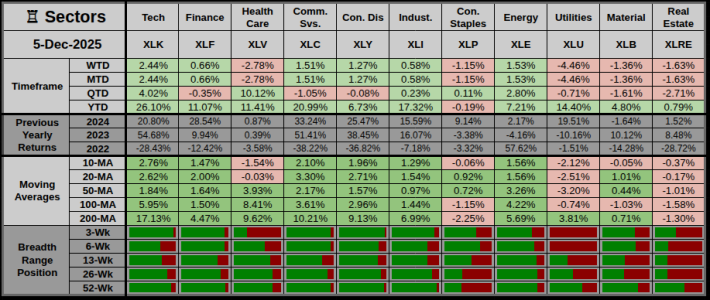

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals led as tech and communication services advanced while defensives, especially utilities and health care, lagged sharply.

Offensive Assets

● Top WTD gainers: XLK +2.44%, XLE +1.53%, XLC +1.51% — growth plus energy leadership.

● Breadth/outperformance: Cyclicals outperformed SPX; participation widened with XLY +1.27% and XLI +0.58% joining the advance.

Defensive Assets

● Standout hedge/defense: XLU −4.46% and XLV −2.78% slumped as yield sensitivity weighed on classic defensives.

● Safety tone or drag: Staples, materials, and real estate (XLP, XLB, XLRE) all slipped, signaling little demand for traditional safety outside cash.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Early: cyclicals led; trend firm; breadth early tilt, pointing to a constructive, offense-favoring phase.

● ● Alternate: Mid: mixed spread; trend mixed; breadth neutral, leaving room for rotation without a clear defensive pivot.

● ● ● Confidence: Medium — trend lens is Early, breadth lens neutral, while timeframe readings still disagree.

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 65% | If cyclicals and tech keep leading while volatility stays calm and the dollar stays soft, then indexes grind higher. | |

| Sideways | 18% | If long yields stay choppy and sector leadership rotates, then the index moves sideways in a tight, noisy range. | |

| Down | 17% | If long yields jump and defensives regain leadership, then indexes pull back as cash demand rises. |

♗ S&P 500’s Weighted Top-10

Overview: Top-10 performance was mixed: some mega-caps rallied, others slipped, leaving a modest drag versus healthy breadth underneath.

Offensive Leaders

● Top movers: NVDA +3.06%, META +3.93%, TSLA +5.77% — semis and growth communication names drove upside.

● Secondary: Paired strength in GOOGL/GOOG and select growth kept the group from acting as a headwind.

Defensive Laggards

● Biggest decliners: MSFT −1.80%, AVGO −3.16%, BRK.B −1.84% eased after strong prior runs.

● Drag/reversal: The mix of strong and weak mega-caps points to rotation within leaders rather than a wholesale unwind at the top.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 45% | If long yields stabilize, the dollar stays soft, and cyclicals lead, then SPX drifts modestly higher next week. | |

| 30% | If yields stay choppy and sector leadership rotates daily, then SPX trades sideways in a tight range next week. | |

| 25% | If long yields jump and utilities or staples catch strong bids, then SPX pulls back as cash demand rises. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Last edited: