True to recent form, today's market action was largely a function of dollar direction, and it's been an inverse relationship. The dollar gained 0.8% on the day, while the major averages suffered moderate losses. Of course that doesn't include our "I" fund as it took it on the chin as a result of the dollar rally. The "I" fund fell 1.42% as result.

Given today was OPEX, I'll not try to pin today's trading on anything specific. So let's go to the charts:

NAMO and NYMO both dropped back under their respective 6 day EMAs, which means they flipped back to a sell condition.

So too did NAHL and NYHL.

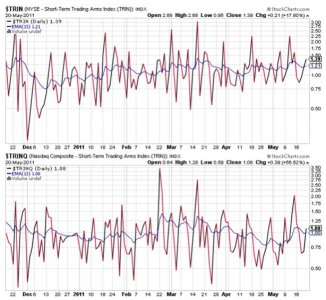

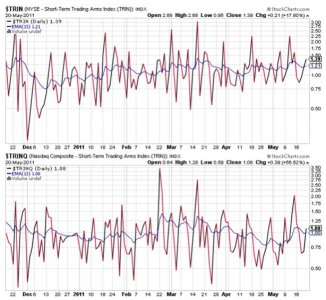

TRIN and TRINQ both flipped to sells as well today.

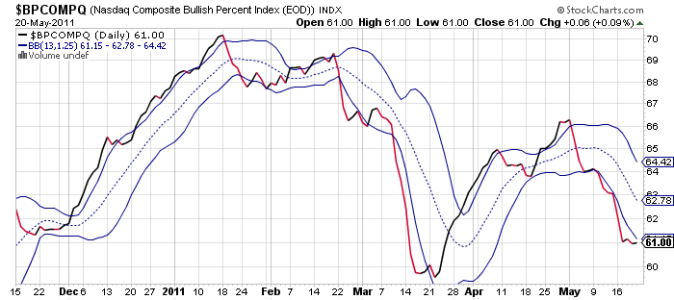

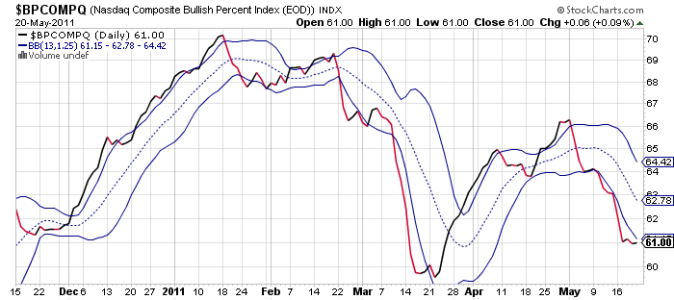

BPCOMPQ managed to tick just barely higher today, but remains in a sell condition. If it can get back above that lower bollinger band it will turn back to a buy. But that's a big "if" and even if it does get above it, there is still reason to question whether it can remain there.

If you were keeping count, you'll notice that all signals are now flashing sells, which puts the Seven Sentinels into an "unconfirmed" sell condition. That's three times we've seen an unconfirmed sell issued since its last buy signal, but the system has yet to confirm that sell condition with a fresh 28 day trading low from NYMO. And the market hasn't really gone anywhere in all that time either, so it's not really a surprise.

But I consider it a protracted warning just the same.

Check back in Sunday evening for the latest Tracker charts. I'll see you then.

Given today was OPEX, I'll not try to pin today's trading on anything specific. So let's go to the charts:

NAMO and NYMO both dropped back under their respective 6 day EMAs, which means they flipped back to a sell condition.

So too did NAHL and NYHL.

TRIN and TRINQ both flipped to sells as well today.

BPCOMPQ managed to tick just barely higher today, but remains in a sell condition. If it can get back above that lower bollinger band it will turn back to a buy. But that's a big "if" and even if it does get above it, there is still reason to question whether it can remain there.

If you were keeping count, you'll notice that all signals are now flashing sells, which puts the Seven Sentinels into an "unconfirmed" sell condition. That's three times we've seen an unconfirmed sell issued since its last buy signal, but the system has yet to confirm that sell condition with a fresh 28 day trading low from NYMO. And the market hasn't really gone anywhere in all that time either, so it's not really a surprise.

But I consider it a protracted warning just the same.

Check back in Sunday evening for the latest Tracker charts. I'll see you then.