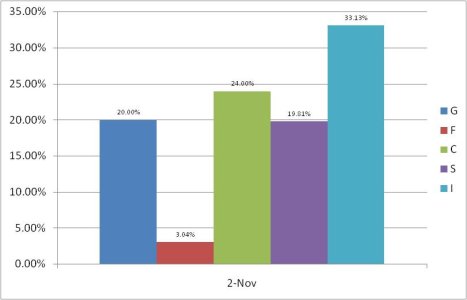

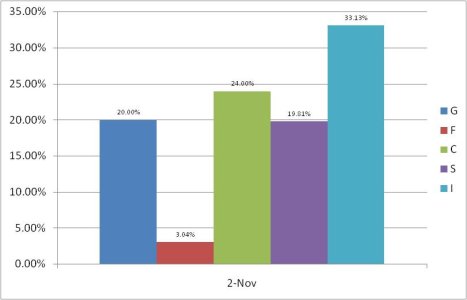

Early on today, it looked as thought the market might make another big reversal. But it was not to be, as the market took a dive around noon, dropping into the red for awhile before reversing once more and ending the day on a moderately positive note. The S fund didn't fare nearly as well as either C or I, and that happens to be the fund that is losing allocation share among our top 25%.

So the volatility continues. Here's the charts:

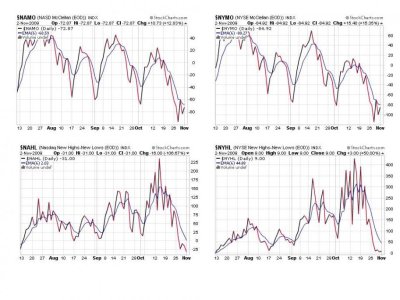

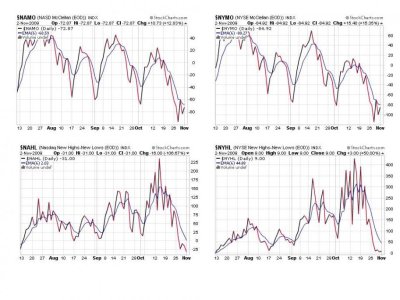

These four signals remain on a sell, but the 6 day ema is dropping quickly, so a hard market reversal could easily trigger buy signals with all four of them.

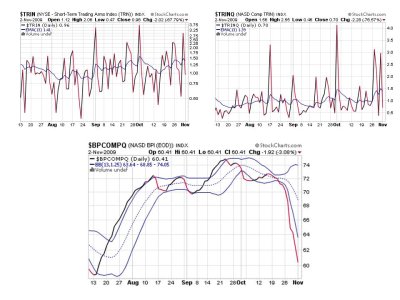

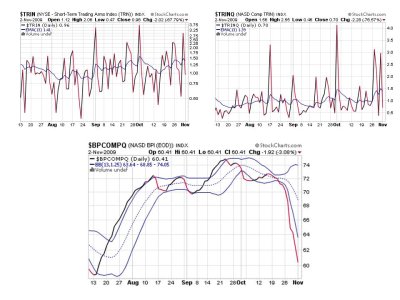

TRIN and TRINQ are flashing buys after today's action, but BPCOMPQ continues to drop. This signal implies that the trend is still down.

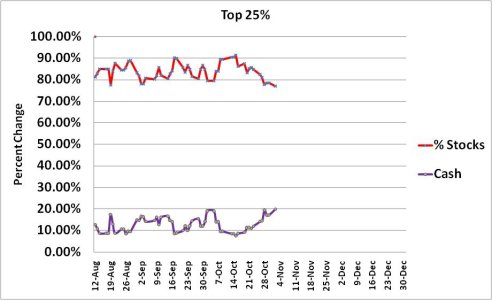

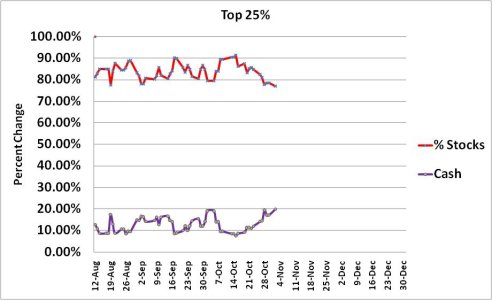

Our top 25% are now at their most bearish since I began tracking their allocation. Total stock holdings are about 76%, with a cash level of 20%. Will this trend continue?

So the seven sentinels remain on a sell and volatility continues to rock the market. This is a very challenging market for TSPers, unless you're a buy and hold type. See you tomorrow.

So the volatility continues. Here's the charts:

These four signals remain on a sell, but the 6 day ema is dropping quickly, so a hard market reversal could easily trigger buy signals with all four of them.

TRIN and TRINQ are flashing buys after today's action, but BPCOMPQ continues to drop. This signal implies that the trend is still down.

Our top 25% are now at their most bearish since I began tracking their allocation. Total stock holdings are about 76%, with a cash level of 20%. Will this trend continue?

So the seven sentinels remain on a sell and volatility continues to rock the market. This is a very challenging market for TSPers, unless you're a buy and hold type. See you tomorrow.