It seems it's been going on for weeks now. The same news keeps driving this market to extremes. "Stock prices plunge amid European debt fears", "Stock prices rally on European Optimism".

Same story, different day, swap the headline.

And with no economic data to pour over the market chose to focus on Europe. Today, an expectation that EU officials are getting closer to a coordinated effort to prop up banks and address debt issues put the market in an optimistic mood. The rally started over and Europe and set the tone for trade in our domestic market.

There was also a report that an official from Germany stated that there is no intention to increase the eurozone emergency funding plan. That statement let to some selling pressure in afternoon trade, but later CNBC reported that eurozone officials are planning for an European investment bank already in existence to use special purpose vehicles to issue bonds that would help finance the purchase of debt. Apparently, that was the market's cue to launch into a short covering rally.

And after hitting new highs just two trading days ago, Treasuries have been hit with some stiff selling pressure, which has caused the yield on the benchmark 10-year Note to rise from 1.7% last Thursday to 1.90% today.

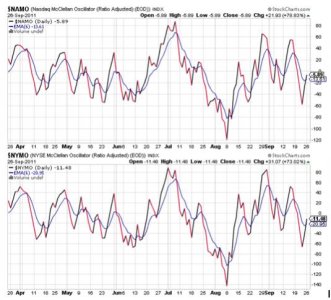

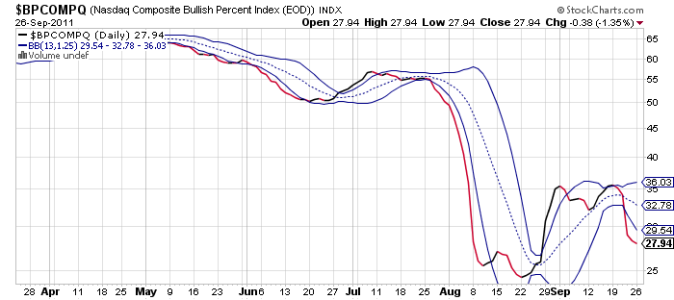

Here's today's charts:

NAMO and NYMO are back in buy conditions.

NAHL and NYHL are also on buys

TRIN spiked much lower today and is highly suggestive of an overbought condition. Unfortunately, TRINQ isn't reflecting that some condition, although it is also on a buy. Tough to say whether we'll see another reversal here. We'll probably get more back and forth action like today.

BPCOMPQ isn't confirming this upside action so far and remains on a sell.

So all signals are on buys except BPCOMPQ, which keeps the system in a sell condition.

It certainly appears that this market has once again walked up to the precipice only to reverse to the upside in a big way. Our sentiment survey certainly supports this kind of action, but sentiment isn't universally bearish the way we are. In any event, we're back in the trading range again and possibly have more upside coming before another turn back down. Trading these moves requires more faith than technical analysis, and I have little faith at the moment. I remain 94% F fund, which is hurting me the past couple of trading days, but that 6% stock exposure is helping take a little bit of the sting out of those losses.

I had been looking to increase my stock exposure this week too, but if we continue to rally I may be looking for a selling point instead to close out my September IFTs.