-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

userque's Account talk

- Thread starter userque

- Start date

userque

TSP Legend

- Reaction score

- 36

That's cool. I'm interested. Thanks!

OK, we've reached sufficient interest

I'll give weekly updates on the NN's progress until it starts hunting "good." In a best-case scenario, it'll be hunting "good" by next week. If not, I'll post my most recent findings and prognosis starting next week.

If and until they let us IFT near the closing bell, this is the best alternative, imo.

Thanks.

userque

TSP Legend

- Reaction score

- 36

Entering intraday, etc. data manually is boring, tedious, and for the birds; but we do what we gotta do. I'm pacing myself (to coincide with my NN's S-Fund exit time-frame window). I expect to have the "Deadline-NN" operational by or about the 20th of this month.

userque

TSP Legend

- Reaction score

- 36

100% S by cob 6-3-14 (shudda been today)

Found a free source of intraday data going back to 9-9-2011. It required MUCH massaging and cleaning and it was for the Nasdaq Composite. Finally created a model. Tested the model. Unfortunately, the model was less accurate than my current end-of-day data models. Perhaps this means there is more noise/randomness on the intraday level, OR that more samples are needed OR that their is not enough of a correlation between the IXIC and DWCPF. Project scrapped for now.

Found a free source of intraday data going back to 9-9-2011. It required MUCH massaging and cleaning and it was for the Nasdaq Composite. Finally created a model. Tested the model. Unfortunately, the model was less accurate than my current end-of-day data models. Perhaps this means there is more noise/randomness on the intraday level, OR that more samples are needed OR that their is not enough of a correlation between the IXIC and DWCPF. Project scrapped for now.

userque

TSP Legend

- Reaction score

- 36

For the record:

Over the next several days (weeks?), I will attempt to codify a variable Zig Zag indicator for use (after optimization) as a predictive model and then, realistically back-test/compare it to my current best model (born in the latter part of May and very successful in realistic back-testing, and, doing well since going online).

My current model also uses a non-lagging smoothing custom approach; however, this Zig Zag indicator, albeit much more difficult to program, seems to be even smoother--also with no lag (unlike moving averages, etc.).

The smoothest is a straight line of best fit since the markets began trading until today. The choppiest is tick data. The sweet spot lies somewhere in between, I believe. An optimal trading time frame; with an optimal resolution or scope.

ZigZag - ChartSchool - StockCharts.com

Over the next several days (weeks?), I will attempt to codify a variable Zig Zag indicator for use (after optimization) as a predictive model and then, realistically back-test/compare it to my current best model (born in the latter part of May and very successful in realistic back-testing, and, doing well since going online).

My current model also uses a non-lagging smoothing custom approach; however, this Zig Zag indicator, albeit much more difficult to program, seems to be even smoother--also with no lag (unlike moving averages, etc.).

The smoothest is a straight line of best fit since the markets began trading until today. The choppiest is tick data. The sweet spot lies somewhere in between, I believe. An optimal trading time frame; with an optimal resolution or scope.

ZigZag - ChartSchool - StockCharts.com

userque

TSP Legend

- Reaction score

- 36

For the record:

Over the next several days (weeks?), I will attempt to codify a variable Zig Zag indicator for use (after optimization) as a predictive model and then, realistically back-test/compare it to my current best model (born in the latter part of May and very successful in realistic back-testing, and, doing well since going online).

My current model also uses a non-lagging smoothing custom approach; however, this Zig Zag indicator, albeit much more difficult to program, seems to be even smoother--also with no lag (unlike moving averages, etc.).

The smoothest is a straight line of best fit since the markets began trading until today. The choppiest is tick data. The sweet spot lies somewhere in between, I believe. An optimal trading time frame; with an optimal resolution or scope.

ZigZag - ChartSchool - StockCharts.com

Ha, codifying the zig zag was not the monster I'd read it would be. Finished that and finished back-testing it also. It didn't do well. On to the RSI.

The RSI is the only other indicator that I (currently) believe has a chance to beat my best model so far. It will be optimized based upon the number of days to use; trigger levels (for example, greater than 70%, but less than 90% for a short entry signal); and the same for an exit signal (less than 55%, exit to cash, for example. Or stay in until an opposite entry signal occurs. Or exit to cash after a variable, but set in advance number of days.)

Codifying the RSI is easy, but back-testing it will be the most time-consuming as there are many parameters with many possibilities each.

userque

TSP Legend

- Reaction score

- 36

Ha, codifying the zig zag was not the monster I'd read it would be. Finished that and finished back-testing it also. It didn't do well. On to the RSI.

The RSI is the only other indicator that I (currently) believe has a chance to beat my best model so far. It will be optimized based upon the number of days to use; trigger levels (for example, greater than 70%, but less than 90% for a short entry signal); and the same for an exit signal (less than 55%, exit to cash, for example. Or stay in until an opposite entry signal occurs. Or exit to cash after a variable, but set in advance number of days.)

Codifying the RSI is easy, but back-testing it will be the most time-consuming as there are many parameters with many possibilities each.

Nope. RSI didn't fair well over a long time span.

Curiosities satisfied.

userque

TSP Legend

- Reaction score

- 36

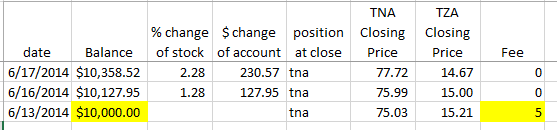

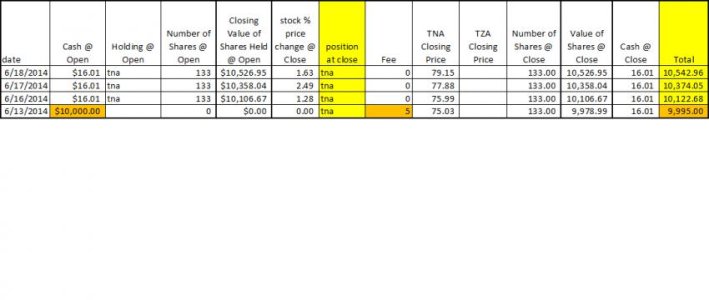

This past weekend, I made major progress by slightly increasing the 'resolution' of my pattern matching algorithms. Realistic back-testing using a simulated trading account spreadsheet including fees turned $1,000 into $2,496.44 from start of year until 6-16-14 by trading 3X W4500 (to estimate trading TNA and TZA. Actual TNA/TZA trades would likely yield greater gains.).

Increasing the resolution even further yielded worse results. Hopefully, I'm at a global best value and not just a local one.

I also had an epiphany regarding my TSP trading system. That, along with the above upgrade, made the TSP system up over 20% since start of year until 6-16-14. This doesn't include the likely F and G fund gains (and losses?) it would have encountered by flowing into the F and G funds when it predicts a downturn in the S fund. (It only includes [long, of course] trades into and out-of the S-Fund.)

For comparison to the Challenge, if I were using this latest system since the start of the Challenge, it would have turned the $10,000 into $16,183.95 so far.

I've thrown a lot of math at the problem of 'how best to trade the markets:' Artificial Neural Networks, Straight Statistics, Excel 2013 Solver using GRG and Evolutionary Algorithms, etc.

I can't think of any other (likely fruitful) trading concepts to test nor any other ways to test them.

I may start posting TNA/TZA trades here for a bit as an illustration and/or 'evidence of concept' as some can't/don't appreciate the legitimacy of proper back-testing. Other than that, and for now,

It is finished.

Increasing the resolution even further yielded worse results. Hopefully, I'm at a global best value and not just a local one.

I also had an epiphany regarding my TSP trading system. That, along with the above upgrade, made the TSP system up over 20% since start of year until 6-16-14. This doesn't include the likely F and G fund gains (and losses?) it would have encountered by flowing into the F and G funds when it predicts a downturn in the S fund. (It only includes [long, of course] trades into and out-of the S-Fund.)

For comparison to the Challenge, if I were using this latest system since the start of the Challenge, it would have turned the $10,000 into $16,183.95 so far.

I've thrown a lot of math at the problem of 'how best to trade the markets:' Artificial Neural Networks, Straight Statistics, Excel 2013 Solver using GRG and Evolutionary Algorithms, etc.

I can't think of any other (likely fruitful) trading concepts to test nor any other ways to test them.

I may start posting TNA/TZA trades here for a bit as an illustration and/or 'evidence of concept' as some can't/don't appreciate the legitimacy of proper back-testing. Other than that, and for now,

It is finished.

userque

TSP Legend

- Reaction score

- 36

Made a simple spreadsheet to track my TNA/TZA trades here. Though my system has been long since or about the start of June, I'm only starting the tracking since 6-13-14...leaving a lot of cash on the table. I will post it each trading day after or about the closing bell.

None of my posts are to be considered investment advice or the like. They are educational and informational only.

None of my posts are to be considered investment advice or the like. They are educational and informational only.

Last edited:

userque

TSP Legend

- Reaction score

- 36

Still Long TNA, working on new chart/tally design. May post the old or new design late tonight with the current figures.

PS

Made major improvements to the system. It can now trade from multiple strategies; determining which one to use for a given trade, based upon recent market action, and also based upon the gains that that strategy would have historically provided when compared to the other strategies it's been taught. (As a result, it can now choose to take a cash position.) All parameters for the system and its strategies are brute-force optimized by the compute to create rules/strategies I would have never considered on my own.

I've also given it an 'exceptions' capability. It doesn't use moving averages, but a simple example would be if one trades when the MA's cross: an 'exception' might be "go long when these MA's cross, EXCEPT when ..." The 'exception' ability allows for extreme flexibility and adaptability as the system decides it's own exceptions based upon the thousands of realistic back-tests it does internally while brute-forcing for optimal parameters.

Another example: trading with the 9 and 12 day moving averages. If I programmed my system to trade with this indicator, it would first figure out which parameters work best. Maybe 9 and 12 aren't the best for the instrument being traded. I could also give it another strategy, RSI, for example, with its parameter: days. It would crunch numbers for both of them, optimizing the parameters and deciding when to follow the RSI or rather to follow the SMA's, also while logging any exceptions to the general rules it's figuring out.

The minor drawback is that I have to somewhat manually do a one-time processing of the historical raw data that it uses when back-testing. Prior to now, that was never a priority as I've never had a system, before a few days ago, that used back data in this manner. So I'll now make doing that a priority. I'm back dated to only October 2013 so far...it has more learning to do.

Finally, I'll be making a separate version, slightly tweaked to optimize within the two-trades-per-month restrictions of the TSP.

Que

PS

Made major improvements to the system. It can now trade from multiple strategies; determining which one to use for a given trade, based upon recent market action, and also based upon the gains that that strategy would have historically provided when compared to the other strategies it's been taught. (As a result, it can now choose to take a cash position.) All parameters for the system and its strategies are brute-force optimized by the compute to create rules/strategies I would have never considered on my own.

I've also given it an 'exceptions' capability. It doesn't use moving averages, but a simple example would be if one trades when the MA's cross: an 'exception' might be "go long when these MA's cross, EXCEPT when ..." The 'exception' ability allows for extreme flexibility and adaptability as the system decides it's own exceptions based upon the thousands of realistic back-tests it does internally while brute-forcing for optimal parameters.

Another example: trading with the 9 and 12 day moving averages. If I programmed my system to trade with this indicator, it would first figure out which parameters work best. Maybe 9 and 12 aren't the best for the instrument being traded. I could also give it another strategy, RSI, for example, with its parameter: days. It would crunch numbers for both of them, optimizing the parameters and deciding when to follow the RSI or rather to follow the SMA's, also while logging any exceptions to the general rules it's figuring out.

The minor drawback is that I have to somewhat manually do a one-time processing of the historical raw data that it uses when back-testing. Prior to now, that was never a priority as I've never had a system, before a few days ago, that used back data in this manner. So I'll now make doing that a priority. I'm back dated to only October 2013 so far...it has more learning to do.

Finally, I'll be making a separate version, slightly tweaked to optimize within the two-trades-per-month restrictions of the TSP.

Que

userque

TSP Legend

- Reaction score

- 36

yeah, but can it do the dishes? the last dishwasher i had quit on me.

ha, no, but it can help you buy a new one.

userque

TSP Legend

- Reaction score

- 36

Discovered a few bugs with the Solver. But this one bug was/is scary. Solver seemed to lose the optimal solution it had worked so long and hard to find. This is the bug that caused me to go to CASH here and in the S-Fund Challenge. A few minutes after the close Friday, I discovered a work-around that, thus far, has worked each time. It does take a couple of minutes to do though.

This brings up a good point. When I used to day-trade, I would sometimes put an 'exit/closing' order in for the next trading session just in case something went wrong (passed out, arrested, power outage, phone lines down, computer crash, etc.) and I was unable to place the 'real' order. If I were 'ok' by the next session close, I would simple cancel that order and place the real order, if any. A fail safe.

Some hackers also have a setup where their computers will thoroughly wipe the hard drive (EMP?) and memory if they don't hear from them within a certain time frame. A fail safe.

Did you know, you can also set your Google account to implode if it doesn't hear from you after a certain length of time? (You can also set it to notify someone as well.) A fail safe?.

Well, after letting the Solver implementation (for both S-Fund Challenge and the TSP) of my NN's run for hours+, the 'returns' are much much greater than I've posted previously. But I'll let the tracker and Challenges have the final say on that. (There are fundamental differences in how traditional NN software tackles a problem vs. how Solver does it. It's interesting, but techie. Solver requires much more pre-processing, but its results can be more 'on point' as it can perform calculations within each iteration. Tradition NN's don't. But with Solver, you have to know a lot more about your problem and what you are looking to find than you do with tradition NN's. IOW: which one to use?...depends.)

****************

When it was just me, I was going to post extremely detailed transaction information for my TNA/TZA trades. Now that EbbCharts has joined in, this will be impractical (TMI per screenshot). Instead, I expect to use a setup similar to that used in the S-Fund Challenge. We will be either fully: cash, long TNA, or short TNA, for simplicity. But I am toying with the idea of posting my trades on a TNA stock chart as well.

UPDATE:

Forgot to mention. I wanted to clarify about something I mentioned prior, just to be clear(er?). This Solver NN uses pattern matching of historical data back to 2004. However, it optimizes its trading decisions (long, short, cash) using data, thus far, back to 9-2013. This is the data I'm back updating at a (planned) rate of 10 trading days per day. Takes about 15 minutes or so to do. I could do more, but it's so tedious.

This brings up a good point. When I used to day-trade, I would sometimes put an 'exit/closing' order in for the next trading session just in case something went wrong (passed out, arrested, power outage, phone lines down, computer crash, etc.) and I was unable to place the 'real' order. If I were 'ok' by the next session close, I would simple cancel that order and place the real order, if any. A fail safe.

Some hackers also have a setup where their computers will thoroughly wipe the hard drive (EMP?) and memory if they don't hear from them within a certain time frame. A fail safe.

Did you know, you can also set your Google account to implode if it doesn't hear from you after a certain length of time? (You can also set it to notify someone as well.) A fail safe?.

Well, after letting the Solver implementation (for both S-Fund Challenge and the TSP) of my NN's run for hours+, the 'returns' are much much greater than I've posted previously. But I'll let the tracker and Challenges have the final say on that. (There are fundamental differences in how traditional NN software tackles a problem vs. how Solver does it. It's interesting, but techie. Solver requires much more pre-processing, but its results can be more 'on point' as it can perform calculations within each iteration. Tradition NN's don't. But with Solver, you have to know a lot more about your problem and what you are looking to find than you do with tradition NN's. IOW: which one to use?...depends.)

****************

When it was just me, I was going to post extremely detailed transaction information for my TNA/TZA trades. Now that EbbCharts has joined in, this will be impractical (TMI per screenshot). Instead, I expect to use a setup similar to that used in the S-Fund Challenge. We will be either fully: cash, long TNA, or short TNA, for simplicity. But I am toying with the idea of posting my trades on a TNA stock chart as well.

UPDATE:

Forgot to mention. I wanted to clarify about something I mentioned prior, just to be clear(er?). This Solver NN uses pattern matching of historical data back to 2004. However, it optimizes its trading decisions (long, short, cash) using data, thus far, back to 9-2013. This is the data I'm back updating at a (planned) rate of 10 trading days per day. Takes about 15 minutes or so to do. I could do more, but it's so tedious.

Last edited:

userque

TSP Legend

- Reaction score

- 36

yeah, but can the solver do dishes? the last two-legged solver i employed quit when i offered to pay it to do the dishes. apparently the work was beneath her.

unfortunately no, but again, it can help you buy a new dishwasher, two-legged or otherwise.

Similar threads

- Replies

- 0

- Views

- 102

- Replies

- 0

- Views

- 98