Uptrend

TSP Pro

- Reaction score

- 74

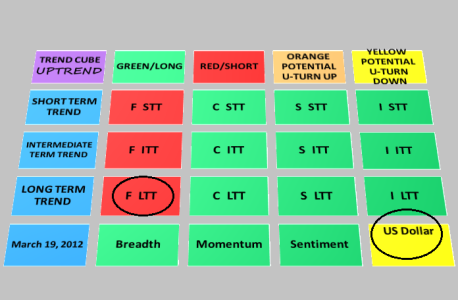

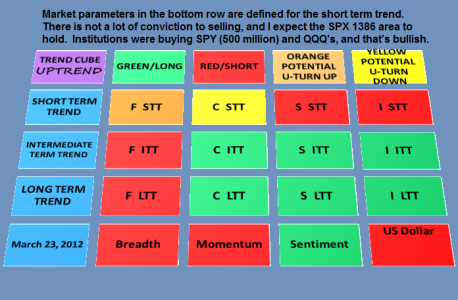

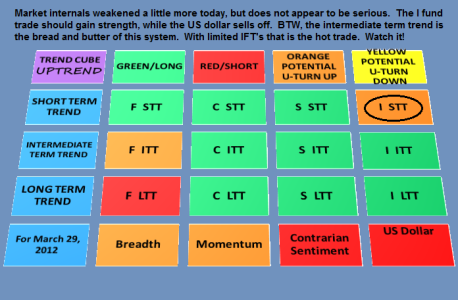

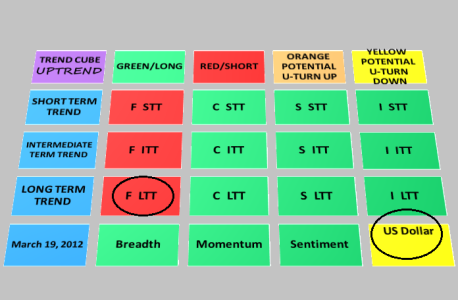

Below is the Uptrend Cube for March 19,2012. Note that bonds and the F fund is a sell, sell, sell. They are not looking good. Circles show what colors on the cube have changed from yesterday. Despite what you may think, C, S and I are still a buy (green). Notice that I started color coding the bottom row. These designations refer to the short term trend, but could also be true for the other time periods (I just don't have room to show everything and don't want to bore you). Breadth, momentum and sentiment refer to the TSP funds in green long positions only. All three must be in agreement for the trade to continue. The US dollar is topping and could decline in the short term.

BTW, more than 50 charts are used to construct this cube, and they update every day (I know it's a rectangle, but I call it a cube anyway). I believe this cube will outperform, but we shall see going forward. For most TSP trades, the intermediate term trend (ITT) should be followed, but you must take long positions on the day when when it turns from orange to green. The strong point of the intermediate term trend, is that it avoids whipsaws. We all know that can lock you out for the rest of the month if you sell and then are out of trades. So, because of our 2 IFT limitation in TSP, and depending where the trades occur, at times the short term trend would be the appripriate time period to trade. It all depends. The long term trend is for reference and could be traded, but the gain would be less that the other time periods.

BTW, more than 50 charts are used to construct this cube, and they update every day (I know it's a rectangle, but I call it a cube anyway). I believe this cube will outperform, but we shall see going forward. For most TSP trades, the intermediate term trend (ITT) should be followed, but you must take long positions on the day when when it turns from orange to green. The strong point of the intermediate term trend, is that it avoids whipsaws. We all know that can lock you out for the rest of the month if you sell and then are out of trades. So, because of our 2 IFT limitation in TSP, and depending where the trades occur, at times the short term trend would be the appripriate time period to trade. It all depends. The long term trend is for reference and could be traded, but the gain would be less that the other time periods.