Not to mention a volume spike higher into the close for the S&P. More of the same on tap for tomorrow?

Once again it seems the Seven Sentinel's buy signal was gold. A couple days ago I said the charts looked like they were setting up for a big move higher. Here's my closing statement from Monday's blog:

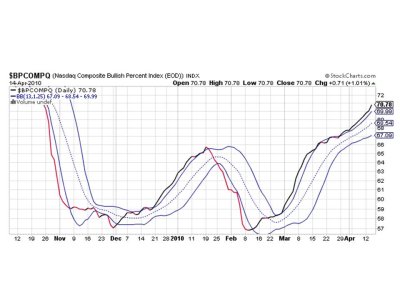

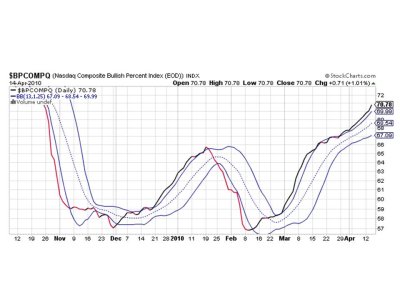

"With NAMO and NYMO in neutral territory and BPCOMPQ still rising, it's hard to get bearish and in fact we seem to be setting up for another big push higher. But I'll let the market decide if that's the case or not."

Well, the decision was made and the market agreed with me.

We did have some market data released this morning that included March advance retail sales, which increased 1.6% (higher than forecast), excluding autos March retail sales rose 0.6% (slightly higher than expected). As if those retail sales weren't enough fuel for this bull market, prior month retail numbers were revised higher than previously reported too. The March Consumer Price Index increased 0.1%, which was expected, and CPI excluding food and energy was reported flat (better than expected).

And earnings seem to be scoring points too, if INTC and JPM are any indication of things to come.

Let's take a look at the charts:

Nice move higher today with the possibility of significant follow-through.

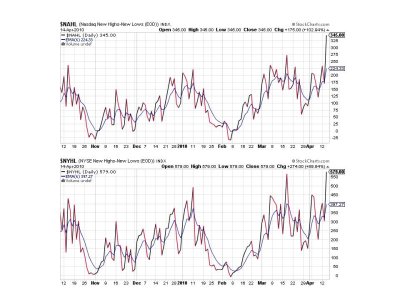

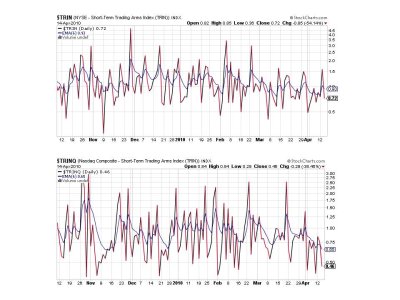

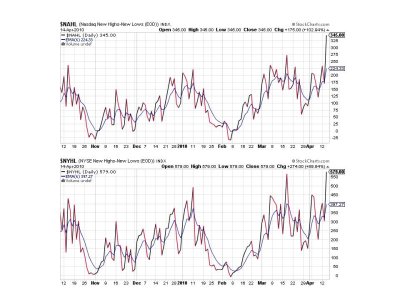

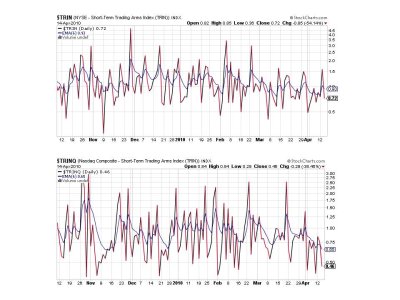

Do I need to explain these two?

Back to a buy on both of these too.

Higher still.

If you weren't keeping count, that's 7 of 7 signals on a buy. It doesn't change the system's buy status, but it sure looks bullish.

The only problem I see is the potential for capitulation by the bears in a possible parabolic move higher. Especially in the face of good earnings reports. But you'll hear no top calling from me with the charts looking this bullish.

See you tomorrow.

Once again it seems the Seven Sentinel's buy signal was gold. A couple days ago I said the charts looked like they were setting up for a big move higher. Here's my closing statement from Monday's blog:

"With NAMO and NYMO in neutral territory and BPCOMPQ still rising, it's hard to get bearish and in fact we seem to be setting up for another big push higher. But I'll let the market decide if that's the case or not."

Well, the decision was made and the market agreed with me.

We did have some market data released this morning that included March advance retail sales, which increased 1.6% (higher than forecast), excluding autos March retail sales rose 0.6% (slightly higher than expected). As if those retail sales weren't enough fuel for this bull market, prior month retail numbers were revised higher than previously reported too. The March Consumer Price Index increased 0.1%, which was expected, and CPI excluding food and energy was reported flat (better than expected).

And earnings seem to be scoring points too, if INTC and JPM are any indication of things to come.

Let's take a look at the charts:

Nice move higher today with the possibility of significant follow-through.

Do I need to explain these two?

Back to a buy on both of these too.

Higher still.

If you weren't keeping count, that's 7 of 7 signals on a buy. It doesn't change the system's buy status, but it sure looks bullish.

The only problem I see is the potential for capitulation by the bears in a possible parabolic move higher. Especially in the face of good earnings reports. But you'll hear no top calling from me with the charts looking this bullish.

See you tomorrow.