- Reaction score

- 2,455

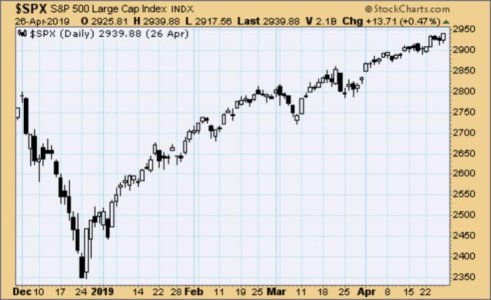

Yields up, dollar down, and the stock market is getting some relief with small caps leading on the upside.

This is rather optimistic of investors with the PPI on deck tomorrow, and the CPI and rate kike next week. I thought maybe we could get a rally off of that data but now maybe it will turn into a set up of buy the rumor, sell the news?

The indices were oversold in the short-term and due for some relief so we'll see if this has any legs, or if the bears are still in the sell the rallies mode.

The initial jobless claims were a little higher than expected so the market seems to be celebrating some weakness in the jobs market, which has become the Fed's target.

This is rather optimistic of investors with the PPI on deck tomorrow, and the CPI and rate kike next week. I thought maybe we could get a rally off of that data but now maybe it will turn into a set up of buy the rumor, sell the news?

The indices were oversold in the short-term and due for some relief so we'll see if this has any legs, or if the bears are still in the sell the rallies mode.

The initial jobless claims were a little higher than expected so the market seems to be celebrating some weakness in the jobs market, which has become the Fed's target.