Can you tell it was Monday?

The market closed with moderate gains today, and it was on the lowest NYSE volume total of the entire year. But August is known for light volume so I wouldn't make too much of it.

While there were no real catalysts to move the market today, tomorrow has the potential to give it a reason to move. The FOMC rate announcement is released tomorrow afternoon. It is currently pegged at 0.25% and the consensus overwhelmingly expects it to remain there. Of course the highlight of the annoucement is contained in the wording of the policy statement, which will undergo its usual disection.

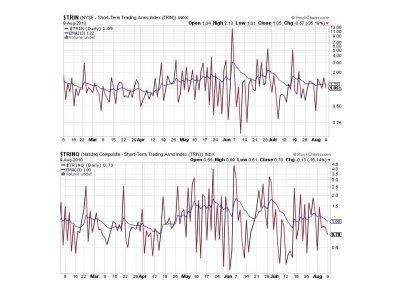

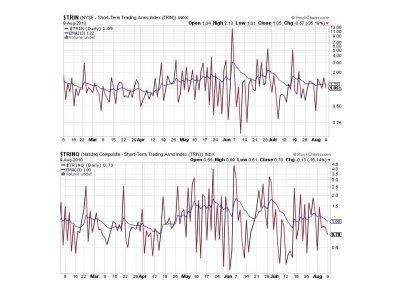

Here's today's charts:

We're hugging the neutral line here, and remain on sells.

NAHL and NYHL managed to flip back to buys today.

Same with TRIN and TRINQ. Two more buys.

BPCOMPQ ebbed higher today, but remains on a sell. Notice how this signal remained near the upper bollinger band last March/April timeframe, so I'm not concerned about this sell signal at this time. As a whole the SS looks somewhat neutral, but the trend is still up.

See you tomorrow.

The market closed with moderate gains today, and it was on the lowest NYSE volume total of the entire year. But August is known for light volume so I wouldn't make too much of it.

While there were no real catalysts to move the market today, tomorrow has the potential to give it a reason to move. The FOMC rate announcement is released tomorrow afternoon. It is currently pegged at 0.25% and the consensus overwhelmingly expects it to remain there. Of course the highlight of the annoucement is contained in the wording of the policy statement, which will undergo its usual disection.

Here's today's charts:

We're hugging the neutral line here, and remain on sells.

NAHL and NYHL managed to flip back to buys today.

Same with TRIN and TRINQ. Two more buys.

BPCOMPQ ebbed higher today, but remains on a sell. Notice how this signal remained near the upper bollinger band last March/April timeframe, so I'm not concerned about this sell signal at this time. As a whole the SS looks somewhat neutral, but the trend is still up.

See you tomorrow.