First, I'd like to reiterate what I've mentioned in the past couple of blogs, and that is that the last SS buy signal was not valid. It was triggered by high volatility. What was unusual (and telling) about that buy signal was that we didn't continue to rally like we did so many times in the past year. That's not a good sign. But at this point if you're in stocks, a change in strategy is called for. With our 2 IFT limit and a very spooked market with so many unknowns, ones options may not be desirable, but as with any strategy nothing is guaranteed either, so a plan "B" should always be ready to deploy.

I have chosen (so far) to hold my current position at this point to at least see how the market reacts to the S&P's 200 dma. So far, it's held, but it did get tested today. But I can't say I'm bullish about holding that level. The market may try to scare more money to the sidelines before the big money (crooks) load up again. Unless the global market really is in trouble and the crooks themselves are scrambling.

The euro tacked on more than 1.5% against the dollar today, but as we saw it didn't spark a rally. Although the market did close well off its lows. The problem with that euro rally is there was not fundamentals behind it. There's no reason to believe it will stick.

So the S&P managed to close over 1115 today, but if it drops and closes below 1102 (the 200 dma) then we may have more trouble coming.

Here's the charts:

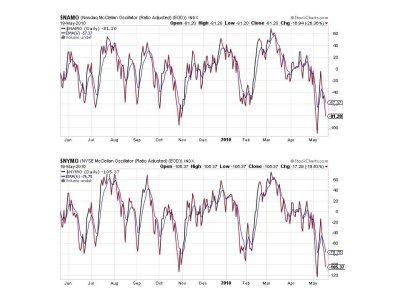

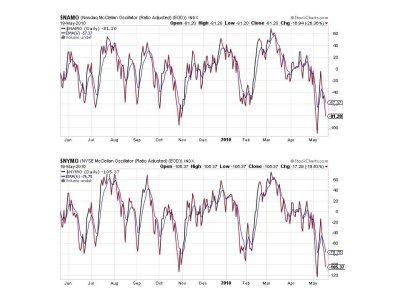

I posted a one year view this evening for comparison purposes. As we can see NAMO and NYMO are tagging lows not seen since last November and then not for many more months before that.

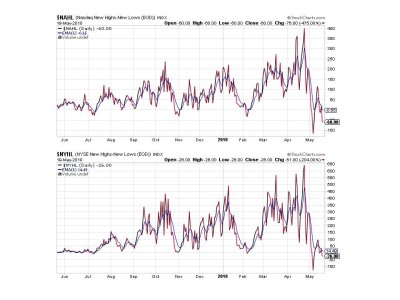

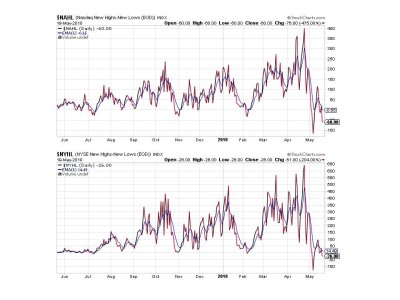

During this current down trend, NAHL and NYHL are tagging lows not seen in more than a year.

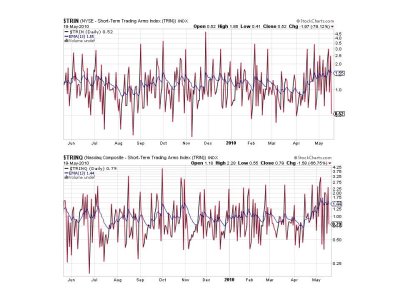

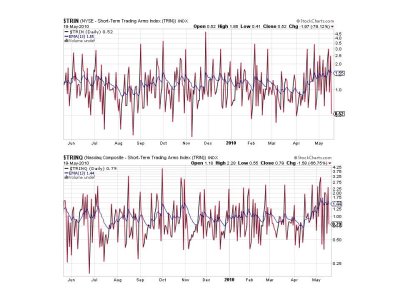

TRIN and TRINQ flipped back to buys with today's selling pressure.

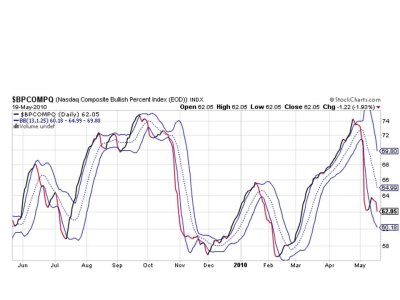

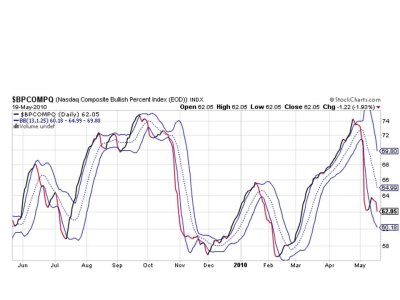

Somehow, BPCOMPQ is remaining on a buy. I find this a bit odd that it's been able to hold up as well as it has. It remains on a buy for now.

So we have 4 of 7 signals flashing sells, and I am negating my previous buy call so the system is considered on a sell.

I would also like to point out that the new parameters being used by the developer of this system never flipped back to a buy because NYMO never closed above its 28 day high. So following the newer parameters would have kept me out of this downdraft. However, it should also be recognized that the last sell signal that the system called came at least 3 trading days before the new parameters gave a sell. That means if I had followed the new parameters at that time I would have incurred about a 4% loss instead of a 1.8% gain. So simply following the new parameters is not necessarily going to give superior results.

I expect more trouble down the road, but how much trouble I cannot say. The SS will have to guide me there. But I am thinking the S&P will close below its 200 dma before this correction is over.

Good luck in your trades and see you tomorrow.

I have chosen (so far) to hold my current position at this point to at least see how the market reacts to the S&P's 200 dma. So far, it's held, but it did get tested today. But I can't say I'm bullish about holding that level. The market may try to scare more money to the sidelines before the big money (crooks) load up again. Unless the global market really is in trouble and the crooks themselves are scrambling.

The euro tacked on more than 1.5% against the dollar today, but as we saw it didn't spark a rally. Although the market did close well off its lows. The problem with that euro rally is there was not fundamentals behind it. There's no reason to believe it will stick.

So the S&P managed to close over 1115 today, but if it drops and closes below 1102 (the 200 dma) then we may have more trouble coming.

Here's the charts:

I posted a one year view this evening for comparison purposes. As we can see NAMO and NYMO are tagging lows not seen since last November and then not for many more months before that.

During this current down trend, NAHL and NYHL are tagging lows not seen in more than a year.

TRIN and TRINQ flipped back to buys with today's selling pressure.

Somehow, BPCOMPQ is remaining on a buy. I find this a bit odd that it's been able to hold up as well as it has. It remains on a buy for now.

So we have 4 of 7 signals flashing sells, and I am negating my previous buy call so the system is considered on a sell.

I would also like to point out that the new parameters being used by the developer of this system never flipped back to a buy because NYMO never closed above its 28 day high. So following the newer parameters would have kept me out of this downdraft. However, it should also be recognized that the last sell signal that the system called came at least 3 trading days before the new parameters gave a sell. That means if I had followed the new parameters at that time I would have incurred about a 4% loss instead of a 1.8% gain. So simply following the new parameters is not necessarily going to give superior results.

I expect more trouble down the road, but how much trouble I cannot say. The SS will have to guide me there. But I am thinking the S&P will close below its 200 dma before this correction is over.

Good luck in your trades and see you tomorrow.