In spite of all those impressive rallies (mixed in with those impressive declines) the broader market still logged its eighth weekly loss in ten weeks. The trend definitely seems to be down, and there sure has been a lot of opportunities for swing traders. Not so much for TSPers though.

Yesterday I was leaning bearish for today's trading action, but my confidence in making a hard call like that was tempered as a result of yesterday's end of day rally. It appeared the bulls might be staging another swift reversal to the upside, but instead the market gapped lower and remained deeply in the red the entire day.

We did get some market data early in the day. The August Chicago PMI came in at 60.4, which handily beat estimates of 54.0. The consumer sentiment reading from the University of Michigan improved to 59.4 from the preliminary reading of 57.8. Both those data points were positive.

However, there was some less than optimistic numbers too. Personal income fell 0.1% while spending rose by 0.2%.

All in all, the stock market logged its poorest quarter since the fourth quarter of 2008 when it fell 23%. This quarter saw a loss of 14%.

Here's today's charts:

NAMO and NYMO remain on sells and appear poised to move lower. I've been noting the lower highs and lower lows at the peaks and this certainly is consistent with the overall movement of stock prices.

NAHL and NYHL are also flashing sells. If Monday is anything like Friday, these two signals will almost certainly drop harder.

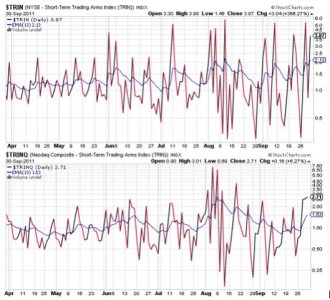

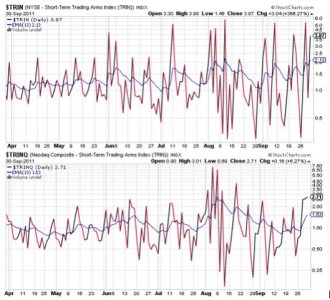

TRIN spiked back to the upside, flipping to a sell in the process, while TRINQ remained about where it's been for the last couple of days. Both are showing a moderately oversold market, which may indicate some buying pressure soon. But I'm not so sure that means another multi-day rally is near.

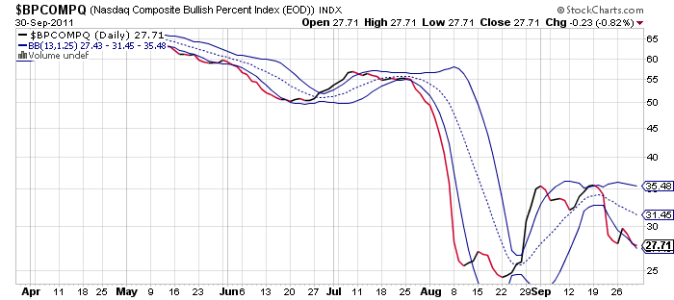

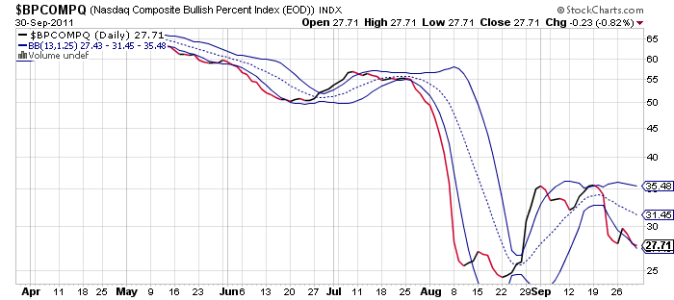

BPCOMPQ dipped a bit lower and remains on a sell.

So all signals are is a sell condition, which keeps the system in an intermediate term sell condition.

Well, we're in familiar territory once again. The market is staring into the abyss. I am a bit more bearish today than I was yesterday, but there has been so many reversals that I can't be overly confident that we'll finally drop below the August lows next week, although that's what I am expecting to see. I held my 100% F position based on that expected outcome. If the market drops hard next week, I would expect to see the F fund extend its rally. And I'll be looking to sell that position and enter the C and S funds should this scenario play out.

I should have the tracker charts posted by Sunday evening, so stop by at that time and check them out.

Yesterday I was leaning bearish for today's trading action, but my confidence in making a hard call like that was tempered as a result of yesterday's end of day rally. It appeared the bulls might be staging another swift reversal to the upside, but instead the market gapped lower and remained deeply in the red the entire day.

We did get some market data early in the day. The August Chicago PMI came in at 60.4, which handily beat estimates of 54.0. The consumer sentiment reading from the University of Michigan improved to 59.4 from the preliminary reading of 57.8. Both those data points were positive.

However, there was some less than optimistic numbers too. Personal income fell 0.1% while spending rose by 0.2%.

All in all, the stock market logged its poorest quarter since the fourth quarter of 2008 when it fell 23%. This quarter saw a loss of 14%.

Here's today's charts:

NAMO and NYMO remain on sells and appear poised to move lower. I've been noting the lower highs and lower lows at the peaks and this certainly is consistent with the overall movement of stock prices.

NAHL and NYHL are also flashing sells. If Monday is anything like Friday, these two signals will almost certainly drop harder.

TRIN spiked back to the upside, flipping to a sell in the process, while TRINQ remained about where it's been for the last couple of days. Both are showing a moderately oversold market, which may indicate some buying pressure soon. But I'm not so sure that means another multi-day rally is near.

BPCOMPQ dipped a bit lower and remains on a sell.

So all signals are is a sell condition, which keeps the system in an intermediate term sell condition.

Well, we're in familiar territory once again. The market is staring into the abyss. I am a bit more bearish today than I was yesterday, but there has been so many reversals that I can't be overly confident that we'll finally drop below the August lows next week, although that's what I am expecting to see. I held my 100% F position based on that expected outcome. If the market drops hard next week, I would expect to see the F fund extend its rally. And I'll be looking to sell that position and enter the C and S funds should this scenario play out.

I should have the tracker charts posted by Sunday evening, so stop by at that time and check them out.