From a sentiment perspective, today's action could have been predicted, welcomed even. Just a bullish levels were rising, we get a bad payroll report to temper the bulls. Was today's sell-off enough or is there more weakness ahead?

Monday's have seen many big rallies in the past year, will the next one build on the end of day recovery we saw today?

So as expected the market was waiting to make its big move on the Friday jobs report, which saw payrolls decline by 131,000. This was worse than expected and right now the market hasn't been taking negative surprises very well. And to make matters worse, the June report was revised lower.

And although the unemployment rate held steady at 9.5%, informed folks know that as job seekers abandon their efforts they are omitted from the statistics. The market knows the real score very well.

The good news in all this is that the S&P rallied back off its lows (which saw it dip below its 200-day moving average) to close back above that level.

And bonds aren't done yet either. The yield on the 10-year Treasury Note saw it dip to as low as 2.81%.

And the dollar continues to mount losses. It is now down 10% since its June high and at its lowest level in close to four months. This is why the I fund has found new life.

We've dipped down some on the NAMO and NYMO after today's sell-off, but we needed to work off some bullishness, so this may be what the doctor ordered for those that dare to be long.

Same with NAHL and NYHL.

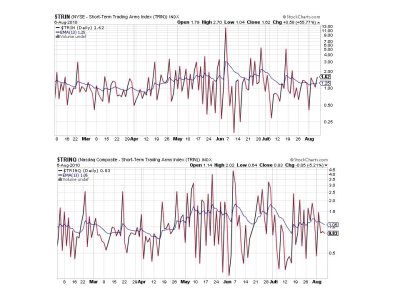

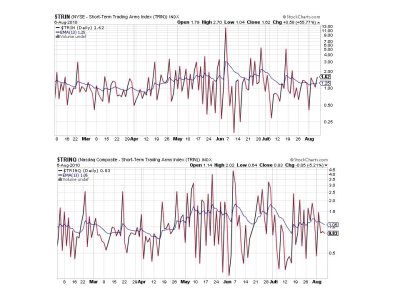

TRIN is flashing a sell, while TRINQ remains on a buy.

I'd prefer that BPCOMPQ remain on a buy, but its been hugging that upper bollinger band for some time now, so I'm not entirely surprised to see it cross over and trigger a sell.

So we have 6 of 7 signals now flashing sells, but the system remains on a buy. I do not believe this up-leg is over, but we may see some effort to force weaker hands to the sidelines. I suspect we'll know whether that's the case or not by the middle of next week.

I'll be compiling the tracker charts this evening for posting over the weekend. I'm expecting the total tracker chart to show a higher allocation to stocks. We shall see.

Monday's have seen many big rallies in the past year, will the next one build on the end of day recovery we saw today?

So as expected the market was waiting to make its big move on the Friday jobs report, which saw payrolls decline by 131,000. This was worse than expected and right now the market hasn't been taking negative surprises very well. And to make matters worse, the June report was revised lower.

And although the unemployment rate held steady at 9.5%, informed folks know that as job seekers abandon their efforts they are omitted from the statistics. The market knows the real score very well.

The good news in all this is that the S&P rallied back off its lows (which saw it dip below its 200-day moving average) to close back above that level.

And bonds aren't done yet either. The yield on the 10-year Treasury Note saw it dip to as low as 2.81%.

And the dollar continues to mount losses. It is now down 10% since its June high and at its lowest level in close to four months. This is why the I fund has found new life.

We've dipped down some on the NAMO and NYMO after today's sell-off, but we needed to work off some bullishness, so this may be what the doctor ordered for those that dare to be long.

Same with NAHL and NYHL.

TRIN is flashing a sell, while TRINQ remains on a buy.

I'd prefer that BPCOMPQ remain on a buy, but its been hugging that upper bollinger band for some time now, so I'm not entirely surprised to see it cross over and trigger a sell.

So we have 6 of 7 signals now flashing sells, but the system remains on a buy. I do not believe this up-leg is over, but we may see some effort to force weaker hands to the sidelines. I suspect we'll know whether that's the case or not by the middle of next week.

I'll be compiling the tracker charts this evening for posting over the weekend. I'm expecting the total tracker chart to show a higher allocation to stocks. We shall see.