02/06/26

The tech wreck continued yesterday with all the major indices participating in the selling on Thursday. Losses of over 1% was widespread, and this time the small caps were taken down with the large caps, and even the I-fund could not dodge the selling. Bonds rallied as yields fell sharply, while the dollar rallied.

After highlighting Amazon in yesterday's commentary saying it's earnings Thursday evening could be telling, the stock sold off over 4% during the day BEFORE those earnings were released. That's odd and suspicious, but what happened after earnings were released last night? They sold off again. Even worse - at least to start. Did someone get the word, because Thursday's loss was higher percentage-wise, compared to many large cap stocks. It was trading near 200 after hours, down almost 10%.

That sell off after hours basically broke the head and shoulders pattern down to the initial target area already, before most investors will have a chance to react. Is this the final nail for this leg higher in stocks, or the capitulation low?

We've been talking about the bearish Wyckoff Distribution pattern for a couple of weeks now, and almost as soon as I stopped talking about, the break down seems to have begun. Remember this chart?

The S&P 500 (C-fund) has been closely mimicking the pattern above. If I had to guess where this chart is in relation to the technical pattern above, I'd say it is just below the "Test" channel. Amazon's action could mean another black candlestick today, but if that pattern is going to play out, the downside may just be getting start. The buy and holders know what to do, but for market timers, whether this means sell now, or wait for a rally to sell, I don't know. Of course this could be a fake out and the rally resumes soon, but that's what makes a market, and it is not easy. Missing the brunt of a decline like the one depicted the pattern above is what market timing is all about. But if you're wrong, you get a double whammy -- take the loss, then miss the rebound.

Yields fell sharply but once again found support at the top of the old bull flag and 200-day average. Whenever bonds rally (and yields fall like the chart below) during a market sell off, it is often considered a move to a safe haven. Gold wasn't a safe haven as it fell more than 3% yesterday.

The dollar rallied and that puts pressure on prices all around.

I, and probably most of you, have been through these pullbacks many times before. They don't always turn out the same, although it always feels the same. If you're in the stock market you are wondering whether you need to get out, and if you out and have cash, you are wondering whether to buy this weakness. While buying pullbacks in a bull market is almost always a good idea, the weekly chart shows that, if we are going to see a test of the 50-week moving average, as we tend to do every year or two, there is a lot more downside potential if this is the time. It's too early to talk about the 200-week average near 5000. 8^\

Bitcoin and other crypto-currencies are in one of their massive pullbacks that we have seen several times since bitcoin made its appearance about 15 years ago. They came back every time before, but these days they are now more broadly owned by the average investor through ETFs, and that's new this time and it may be magnifying the problem.

The January Jobs Report scheduled to be released this Friday, has been rescheduled for Wednesday February 11th.

Additional TSP Fund Charts:

The DWCPF (S-fund) is again flirting with key support and the question is, what will Amazon do to the small caps today? It could be a case of small caps getting a bid while big tech fails, or it could be more selling in sympathy. It's time for it to make up its mind. Next stop could be the 200-day average if it doesn't hold the nearby support.

ACWX (I fund) outperformed the US funds, even with the dollar rallying strongly. That's impressive, I suppose, but it did break its trading channel. However, the 20-day EMA is still holding, as is often the case in a strong bull market.

BND (bonds / F-fund) went from the bottom to the top of its trading channel yesterday, as bonds became the safe haven. It's a new high but selling the top of the range has been working here for months.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The tech wreck continued yesterday with all the major indices participating in the selling on Thursday. Losses of over 1% was widespread, and this time the small caps were taken down with the large caps, and even the I-fund could not dodge the selling. Bonds rallied as yields fell sharply, while the dollar rallied.

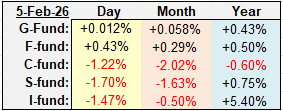

| Daily TSP Funds Return More returns |

After highlighting Amazon in yesterday's commentary saying it's earnings Thursday evening could be telling, the stock sold off over 4% during the day BEFORE those earnings were released. That's odd and suspicious, but what happened after earnings were released last night? They sold off again. Even worse - at least to start. Did someone get the word, because Thursday's loss was higher percentage-wise, compared to many large cap stocks. It was trading near 200 after hours, down almost 10%.

That sell off after hours basically broke the head and shoulders pattern down to the initial target area already, before most investors will have a chance to react. Is this the final nail for this leg higher in stocks, or the capitulation low?

We've been talking about the bearish Wyckoff Distribution pattern for a couple of weeks now, and almost as soon as I stopped talking about, the break down seems to have begun. Remember this chart?

The S&P 500 (C-fund) has been closely mimicking the pattern above. If I had to guess where this chart is in relation to the technical pattern above, I'd say it is just below the "Test" channel. Amazon's action could mean another black candlestick today, but if that pattern is going to play out, the downside may just be getting start. The buy and holders know what to do, but for market timers, whether this means sell now, or wait for a rally to sell, I don't know. Of course this could be a fake out and the rally resumes soon, but that's what makes a market, and it is not easy. Missing the brunt of a decline like the one depicted the pattern above is what market timing is all about. But if you're wrong, you get a double whammy -- take the loss, then miss the rebound.

Yields fell sharply but once again found support at the top of the old bull flag and 200-day average. Whenever bonds rally (and yields fall like the chart below) during a market sell off, it is often considered a move to a safe haven. Gold wasn't a safe haven as it fell more than 3% yesterday.

The dollar rallied and that puts pressure on prices all around.

I, and probably most of you, have been through these pullbacks many times before. They don't always turn out the same, although it always feels the same. If you're in the stock market you are wondering whether you need to get out, and if you out and have cash, you are wondering whether to buy this weakness. While buying pullbacks in a bull market is almost always a good idea, the weekly chart shows that, if we are going to see a test of the 50-week moving average, as we tend to do every year or two, there is a lot more downside potential if this is the time. It's too early to talk about the 200-week average near 5000. 8^\

Bitcoin and other crypto-currencies are in one of their massive pullbacks that we have seen several times since bitcoin made its appearance about 15 years ago. They came back every time before, but these days they are now more broadly owned by the average investor through ETFs, and that's new this time and it may be magnifying the problem.

The January Jobs Report scheduled to be released this Friday, has been rescheduled for Wednesday February 11th.

Additional TSP Fund Charts:

The DWCPF (S-fund) is again flirting with key support and the question is, what will Amazon do to the small caps today? It could be a case of small caps getting a bid while big tech fails, or it could be more selling in sympathy. It's time for it to make up its mind. Next stop could be the 200-day average if it doesn't hold the nearby support.

ACWX (I fund) outperformed the US funds, even with the dollar rallying strongly. That's impressive, I suppose, but it did break its trading channel. However, the 20-day EMA is still holding, as is often the case in a strong bull market.

BND (bonds / F-fund) went from the bottom to the top of its trading channel yesterday, as bonds became the safe haven. It's a new high but selling the top of the range has been working here for months.

Thanks so much for reading! Have a great weekend!

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.