11/04/25

The new week starts with more mixed messages as we saw the Dow fall over 200-points, small caps lose 0.40%, while the S&P 500 and Nasdaq posted slight to moderate gains. A lot of this is happening while investors reallocate due to the new more hawkish outlook as outlined in last week's FOMC meeting. Yields and the dollar have been up, and that adds to the potential shift in investment strategies.

It could all be a lot about nothing, but the Fed sent shockwaves into the stock and bond markets last week when they changed their tone on interest rates. There is still a pretty good chance that they will cut interest rates at their December meeting, which is still many weeks away, but going from over a 90% chance of a cut to a mid-60% has money managers scrambling to make adjustments.

It hasn't been dramatic, but the move higher in the 10-year Treasury Yield last week got some attention, although we see that there is some resistance in the area. But the thought of higher yields had small caps lagging again, so there is some impact from this new outlook from the Fed.

The dollar has also been rallying since that meeting, although it has been firming up for several weeks. A stronger dollar not only taps the breaks on international stock market prices, but also large cap global stocks in the US markets as a stronger dollar raises prices of US goods overseas, which could decrease sales.

A strong dollar can also weigh on commodity prices and you can see the counter move in bitcoin since the dollar (above) bottomed in July. Bitcoin has been a fair indicator of investors' willingness to speculate, and when you shave off 16% of the value of this ever growing speculative, wealth generating vehicle in a couple of weeks, it can take money out of the stock market. This doesn't look great and that 105K area needs to hold.

Longer term it is still in an uptrend, but it could be back below 100K before it hits the bottom of the red trading channel. Anything below 95K could send shock waves through the financial world.

Meanwhile the S&P 500 (C-fund) has been churning in a tight range since Wednesday's peak - the day of the Fed meeting. It has satisfied one of the open gaps (blue) but there is still an open gap (red) near 6750. The prospects of filling that gap, testing the green 20-day average or the bottom of the trading channel, has investors a little worried about the short-term

So, the short-term feels questionable. The trouble is, if the Fed is going to cut interest rates, the market will probably rally into the end of the year. If it does not cut rates, investors may have to brace for a pivot and perhaps a different type of stock market. And all of this is happening while we don't have our normal gauges from the economic data because of the shut down. That said, the bond market is a pretty good indication and right now, with the 10-year Treasury Yield clinging to resistance, it could go either way.

We are supposed to get the October jobs report on Friday, but with the government still shut down, that may not happen.

The DWCPF Index (S-Fund) again tested the bottom of its trading channel and the 50-day EMA, and both held on a closing basis, although intraday the lows did penetrate the lower end of the channel. It's still intact but it keeps knocking on that door.

ACWX (I-fund) managed a decent gain and led the US funds despite a small gain in the dollar yesterday. Some of that may have had to do with the US stocks being higher when some of the overseas markets were closing.

BND (bonds / F-fund) made a lower low so it has been trending lower since the Fed meeting, and the blue trading channel failed. The bond market is a good indication of what's happening out there, and it does seem to be pricing in the possibility of the Fed not cutting in December. Remember, bond prices and the F-fund go down, when yields go up.

Thanks so much for reading! We'll see you tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The new week starts with more mixed messages as we saw the Dow fall over 200-points, small caps lose 0.40%, while the S&P 500 and Nasdaq posted slight to moderate gains. A lot of this is happening while investors reallocate due to the new more hawkish outlook as outlined in last week's FOMC meeting. Yields and the dollar have been up, and that adds to the potential shift in investment strategies.

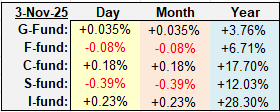

| Daily TSP Funds Return More returns |

It could all be a lot about nothing, but the Fed sent shockwaves into the stock and bond markets last week when they changed their tone on interest rates. There is still a pretty good chance that they will cut interest rates at their December meeting, which is still many weeks away, but going from over a 90% chance of a cut to a mid-60% has money managers scrambling to make adjustments.

It hasn't been dramatic, but the move higher in the 10-year Treasury Yield last week got some attention, although we see that there is some resistance in the area. But the thought of higher yields had small caps lagging again, so there is some impact from this new outlook from the Fed.

The dollar has also been rallying since that meeting, although it has been firming up for several weeks. A stronger dollar not only taps the breaks on international stock market prices, but also large cap global stocks in the US markets as a stronger dollar raises prices of US goods overseas, which could decrease sales.

A strong dollar can also weigh on commodity prices and you can see the counter move in bitcoin since the dollar (above) bottomed in July. Bitcoin has been a fair indicator of investors' willingness to speculate, and when you shave off 16% of the value of this ever growing speculative, wealth generating vehicle in a couple of weeks, it can take money out of the stock market. This doesn't look great and that 105K area needs to hold.

Longer term it is still in an uptrend, but it could be back below 100K before it hits the bottom of the red trading channel. Anything below 95K could send shock waves through the financial world.

Meanwhile the S&P 500 (C-fund) has been churning in a tight range since Wednesday's peak - the day of the Fed meeting. It has satisfied one of the open gaps (blue) but there is still an open gap (red) near 6750. The prospects of filling that gap, testing the green 20-day average or the bottom of the trading channel, has investors a little worried about the short-term

So, the short-term feels questionable. The trouble is, if the Fed is going to cut interest rates, the market will probably rally into the end of the year. If it does not cut rates, investors may have to brace for a pivot and perhaps a different type of stock market. And all of this is happening while we don't have our normal gauges from the economic data because of the shut down. That said, the bond market is a pretty good indication and right now, with the 10-year Treasury Yield clinging to resistance, it could go either way.

We are supposed to get the October jobs report on Friday, but with the government still shut down, that may not happen.

The DWCPF Index (S-Fund) again tested the bottom of its trading channel and the 50-day EMA, and both held on a closing basis, although intraday the lows did penetrate the lower end of the channel. It's still intact but it keeps knocking on that door.

ACWX (I-fund) managed a decent gain and led the US funds despite a small gain in the dollar yesterday. Some of that may have had to do with the US stocks being higher when some of the overseas markets were closing.

BND (bonds / F-fund) made a lower low so it has been trending lower since the Fed meeting, and the blue trading channel failed. The bond market is a good indication of what's happening out there, and it does seem to be pricing in the possibility of the Fed not cutting in December. Remember, bond prices and the F-fund go down, when yields go up.

Thanks so much for reading! We'll see you tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: