Yep. We should drop from here. Logic says so. Gold over $1,000. Dollar falling below support. Sentiment is bearish. The Baltic Dry Index is lagging, and there is still a strong demand for Treasuries, as evidenced by yesterday's 3-year note auction.

Stick a fork in it.

But there's a problem. The Seven Sentinels are not buying this doom and gloom picture. And neither are the top 25% in our tracker.

I had hoped for some selling yesterday and/or today. I certainly didn't get it yesterday, but I did buy a 30% stock position. I'm ready to commit the rest too.

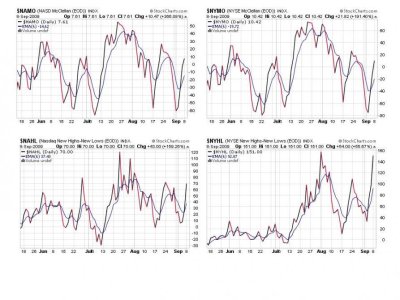

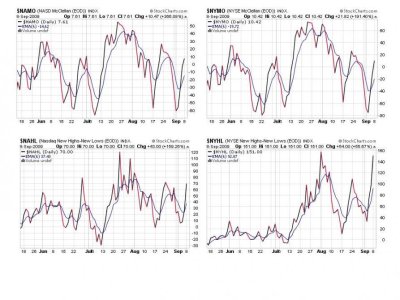

Here's the charts:

There's nothing bearish about these four signals.

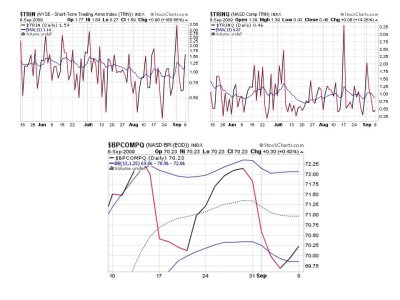

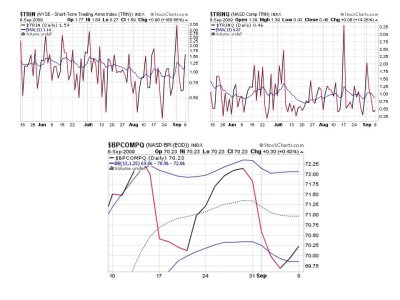

These either. Only one is on a sell. Meaningless really.

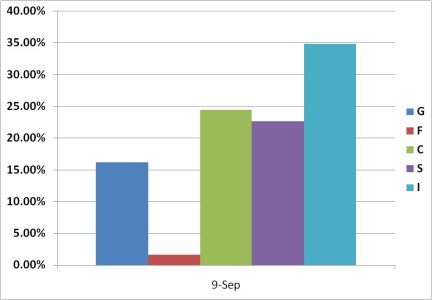

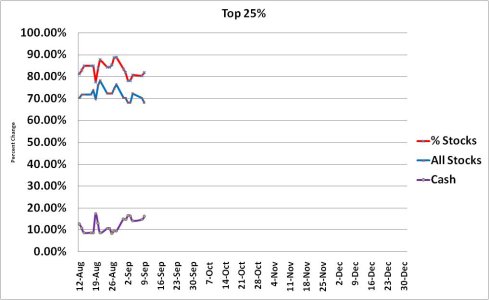

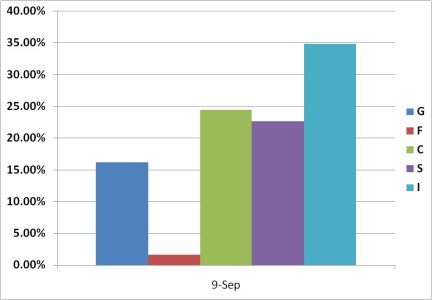

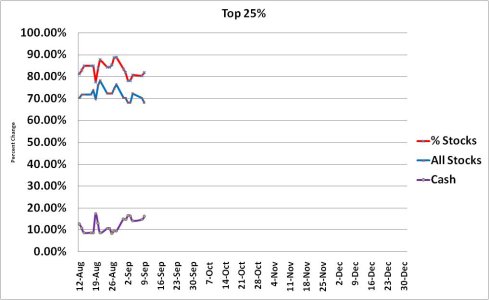

Here's our top 25% data:

Minor increase in cash position, but an increase in stock allocation. Bond holdings dropped.

We can see it here too. Small increase in cash position with a rise in total stock holdings.

While my emotion may say one thing, the above data certainly suggests something else. So the song remains the same. Full speed ahead.

Stick a fork in it.

But there's a problem. The Seven Sentinels are not buying this doom and gloom picture. And neither are the top 25% in our tracker.

I had hoped for some selling yesterday and/or today. I certainly didn't get it yesterday, but I did buy a 30% stock position. I'm ready to commit the rest too.

Here's the charts:

There's nothing bearish about these four signals.

These either. Only one is on a sell. Meaningless really.

Here's our top 25% data:

Minor increase in cash position, but an increase in stock allocation. Bond holdings dropped.

We can see it here too. Small increase in cash position with a rise in total stock holdings.

While my emotion may say one thing, the above data certainly suggests something else. So the song remains the same. Full speed ahead.