In my last few blogs I've been telling you that I thought the likelihood of a pullback was rather high given the recent strength in the market. But last Thursday I had this to say:

"...window dressing may be at play and liquidity is still pouring into this market. That combination could mean we get silly on the upside over the next few days. "

It's getting silly alright. And that's the initial scenario I was anticipating. And I never really doubted it could happen since then, but I also said you never know when the market is going to throw you a curve ball. So a pullback may still come, but it could be an intra-day decline that we never get to take advantage of too. You just never can be sure how the market will play out.

So the S&P is back up near it's 2 year highs, but it's bumping up against resistance around that 1330 level. I'm anticipating it will advance beyond that at some point and set fresh 2 year highs at the very least. But I'm not looking for a straight shot.

Market volume continues to be low in spite of the fact we are very near the end of the quarter. Perhaps we'll see some fireworks by the end of the week when the official nonfarm payrolls report is released this Friday. In spite of my reluctance to predict a parabolic move higher at this point, the fact is the bulls are back in control so a sell-off is becoming less likely. And it's the 1st of the month again, which up until March 1st was almost always green.

And the Seven Sentinels finally confirmed this move higher and have officially triggered a buy signal as of today. Here's the charts:

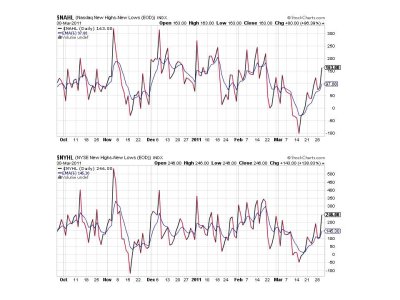

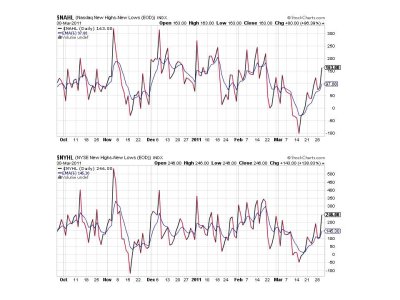

The important thing to note with these two charts is that NYMO blew past its 28 day trading high target. That was the only check in the box I was looking for to officially declare a new buy signal.

NAHL and NYHL remain on buys.

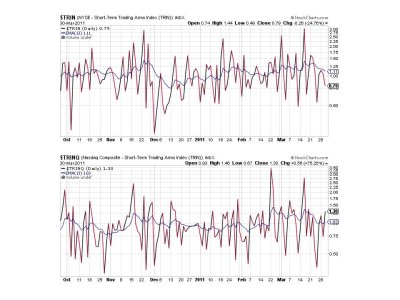

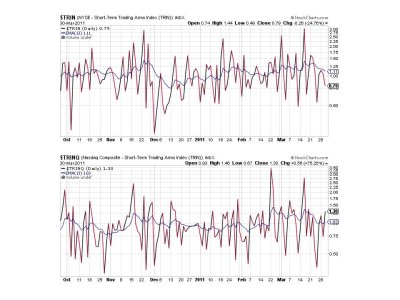

TRIN and TRINQ are on a buy and sell respectively.

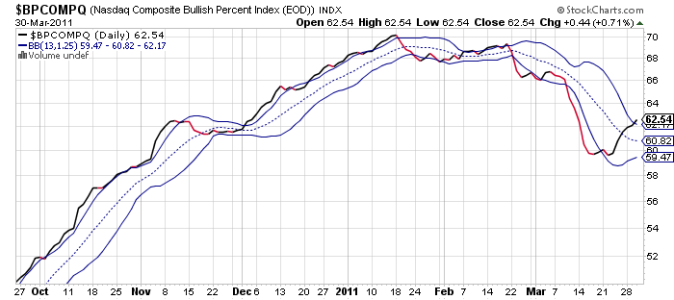

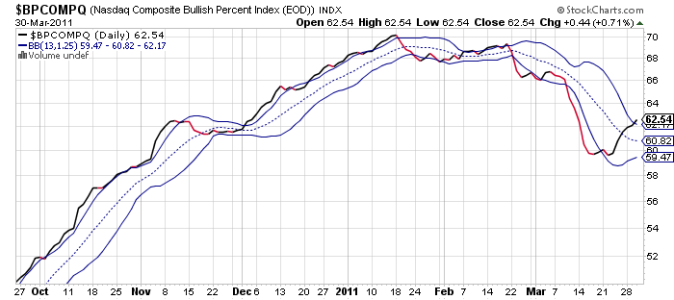

BPCOMPQ ticked higher still and has now penetrated the upper bollinger band. It too remains on a buy.

So while only 6 of 7 signals are on buys, the system had at least 3 and darn near 4 unconfirmed buy signals in the past few trading days. With NYMO now hitting a fresh 28 day trading high the system flips from a sell to a buy condition.

It's tough to deny this market's propensity to run higher after setting a relatively short term low. Longer term investors may want to simply hang on for the ride, but traders looking to buy a dip may still have that opportunity in the short term. But then, many of us waited for weeks in the final months of 2010 to buy a dip, and they rarely came.

"...window dressing may be at play and liquidity is still pouring into this market. That combination could mean we get silly on the upside over the next few days. "

It's getting silly alright. And that's the initial scenario I was anticipating. And I never really doubted it could happen since then, but I also said you never know when the market is going to throw you a curve ball. So a pullback may still come, but it could be an intra-day decline that we never get to take advantage of too. You just never can be sure how the market will play out.

So the S&P is back up near it's 2 year highs, but it's bumping up against resistance around that 1330 level. I'm anticipating it will advance beyond that at some point and set fresh 2 year highs at the very least. But I'm not looking for a straight shot.

Market volume continues to be low in spite of the fact we are very near the end of the quarter. Perhaps we'll see some fireworks by the end of the week when the official nonfarm payrolls report is released this Friday. In spite of my reluctance to predict a parabolic move higher at this point, the fact is the bulls are back in control so a sell-off is becoming less likely. And it's the 1st of the month again, which up until March 1st was almost always green.

And the Seven Sentinels finally confirmed this move higher and have officially triggered a buy signal as of today. Here's the charts:

The important thing to note with these two charts is that NYMO blew past its 28 day trading high target. That was the only check in the box I was looking for to officially declare a new buy signal.

NAHL and NYHL remain on buys.

TRIN and TRINQ are on a buy and sell respectively.

BPCOMPQ ticked higher still and has now penetrated the upper bollinger band. It too remains on a buy.

So while only 6 of 7 signals are on buys, the system had at least 3 and darn near 4 unconfirmed buy signals in the past few trading days. With NYMO now hitting a fresh 28 day trading high the system flips from a sell to a buy condition.

It's tough to deny this market's propensity to run higher after setting a relatively short term low. Longer term investors may want to simply hang on for the ride, but traders looking to buy a dip may still have that opportunity in the short term. But then, many of us waited for weeks in the final months of 2010 to buy a dip, and they rarely came.