Bullitt

Market Veteran

- Reaction score

- 75

Looking for confirmation from the NYSE.

https://www.lse.co.uk/news/live-markets-hindenburg-omen-buzzing-the-tower-xcdw6ay835bkseu.html

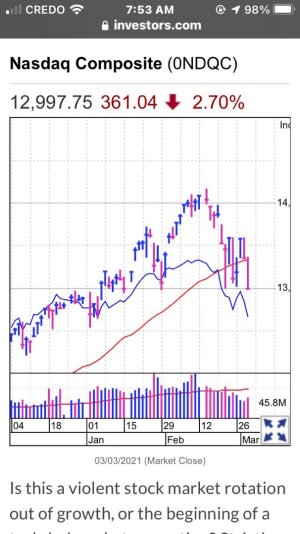

Using Refinitiv data, a more stringent construction of the indicator shows a signal popped up Tuesday on the Nasdaq. The last signal developed 12 trading days ahead of the Nasdaq's Feb. 19, 2020 top and what would then prove to be a 33% swoon in the tech-laden index into its March trough. No signal occurred on the NYSE on Tuesday. Its last occurrence was the Feb. 3, 2020 date.

https://www.lse.co.uk/news/live-markets-hindenburg-omen-buzzing-the-tower-xcdw6ay835bkseu.html