The Dollar

I was wrong last week on the dollar, the fundamental picture has changed and should be respected. Last week when the Dollar broke above the descending channel and above the 50 SMA, I was expecting this move to be a fake-out. Reason being, trendlines often get tested, & violated, but eventually resume their course within the current trend.

However in this case we've broken and closed above the channel over the last 5 days. At 76.52 we've closed higher than the previous 76.51 closing swing high. It's possible this could be the point where we establish a an intermediate double top, but at this point anything can happen so I'm not prepared to predict the direction for this week.

The next two charts are YTD Daily charts I like to use to compare the price action side-by-side. For long-term daily charts I like to use a 39, 1 Slow Stochastic to smooth out the price action. What I'm showing you here is that both stochastics are in over bought territory above 80. This doesn't happen very often and it can reflect a shift in market behavior that puts me on edge. For one thing that last time we had a similar setup like this it resulted in a substantial decline in stocks. I can't say this will happen again as I don't have the data to support such an assumption, but I do think it warrants notice. Which ever of these two stochastics head down first should indicate the direction of the S&P 500.

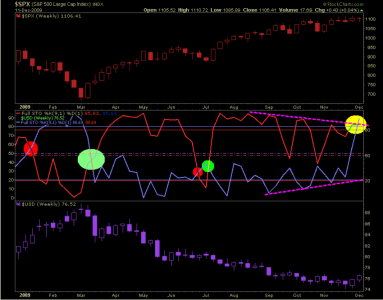

The next chart shows the same thing only now I've used a weekly chart with both 9, 1 stochastics overlaid on one another. I've circled the crossovers so you can see what happens to the price action during that time. What I'm pointing out to you is that most crossovers take place within the 20-80 range and rarely take place above 80 or below 20. With the pink dashed lines if you look at the S&P 500's stochastic you can see it's putting in lower highs while the Dollar's stochastic is putting in higher lows. This is one of many a divergence we see where the S&P 500's price is rising while indicators are declining. Declining indicators can only peacefully co-exist with rising price for so long before one of the two breaks.

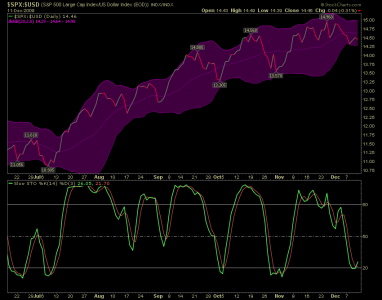

Now let's take a look at a direct $SPX vs. Dollar comparison chart with the default slow stochastic and a Bollinger band added for guidance. We can see where the Dollar's breakout shoved this chart's price under the middle bollinger band. With a recent bounce off the bottom of the bollinger band and a small turn upward in stochastics, I would hope we are ready to work on our next swing-high in stocks. But the truth of the matter is I have no idea how this chart will playout, so for the moment I'll just sit back, watch and learn and hope I'm on the right side of this trade.

Best of luck to you this week, I'm out of IFTs, in the I-Fund and expect to remain there for the remainder of the year unless the charts tell me otherwise.

Cheers... Jason