After yet another gap down start that saw the S&P drop below the flash crash level, the market found its feet and staged a rally that saw its peak just before noon. Choppy trade to the downside saw the major averages approach the zero line most of the afternoon before a surge higher in the final half hour of trade. The averages managed to post impressive gains, but only retraced about one third of yesterday's losses.

Of note in today's action was the financial sector finishing with a 3.6% gain today after dropped more than 11% in the previous 6 sessions. This was interesting as this rally occured while the Senate passed the financial reform bill.

It was also Options Expiration, which elevated volume. About 2.3 billion shares exchanged hands on the NYSE, which is almost double the 200-day average.

Let's look at the charts:

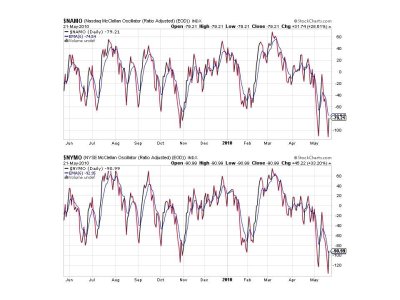

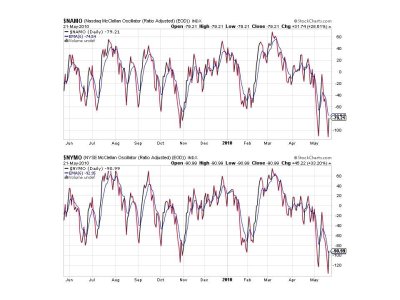

The NAMO and NYMO 6 day EMA is lower than it's been in over a year. Is today's action the start of another run to the upside? NYMO is on a buy using the orginal SS settings, but well away from a buy using the new parameters. But it's too early to worry about a system buy signal yet as much more work needs to be done to improve the signals in general.

NAHL and NYHL are also hitting multi-month lows, but bounced today. Still on sells though.

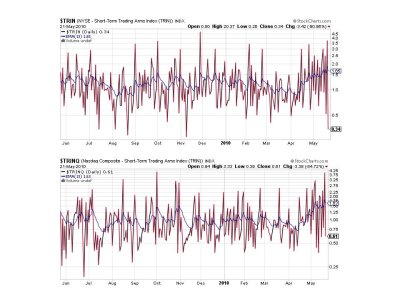

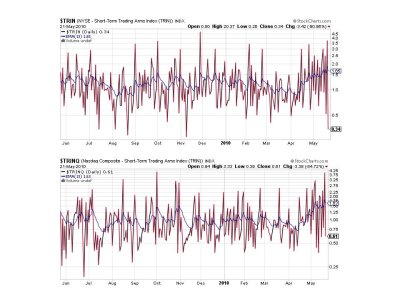

TRIN and TRINQ are both flashing buys.

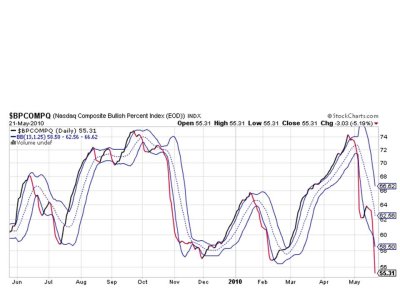

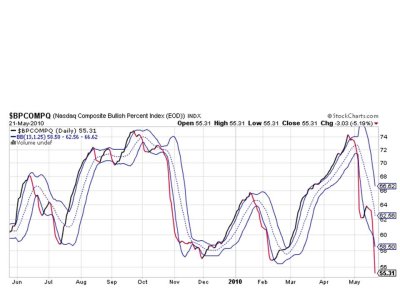

BPCOMPQ dropped lower today and is well away from a buy signal.

So 5 of 7 signals are flashing sells, which keeps the system on a sell. A relief rally may be starting if today's close is any indication. Our sentiment survey is on a strong buy, and there's certainly enough bearishness elsewhere to get some momentum to the upside. But will it be seen as a selling opportunity? One thing to keep in mind is that the upside potential can be significant here, but it may not last. And the volatility will almost certainly make trading TSP a continued challenged.

Big changes in the Top 50. I'm still waiting for Friday's IFTs to be processed before I capture the latest data, but the charts will be posted this weekend. See you then.

Of note in today's action was the financial sector finishing with a 3.6% gain today after dropped more than 11% in the previous 6 sessions. This was interesting as this rally occured while the Senate passed the financial reform bill.

It was also Options Expiration, which elevated volume. About 2.3 billion shares exchanged hands on the NYSE, which is almost double the 200-day average.

Let's look at the charts:

The NAMO and NYMO 6 day EMA is lower than it's been in over a year. Is today's action the start of another run to the upside? NYMO is on a buy using the orginal SS settings, but well away from a buy using the new parameters. But it's too early to worry about a system buy signal yet as much more work needs to be done to improve the signals in general.

NAHL and NYHL are also hitting multi-month lows, but bounced today. Still on sells though.

TRIN and TRINQ are both flashing buys.

BPCOMPQ dropped lower today and is well away from a buy signal.

So 5 of 7 signals are flashing sells, which keeps the system on a sell. A relief rally may be starting if today's close is any indication. Our sentiment survey is on a strong buy, and there's certainly enough bearishness elsewhere to get some momentum to the upside. But will it be seen as a selling opportunity? One thing to keep in mind is that the upside potential can be significant here, but it may not last. And the volatility will almost certainly make trading TSP a continued challenged.

Big changes in the Top 50. I'm still waiting for Friday's IFTs to be processed before I capture the latest data, but the charts will be posted this weekend. See you then.