I had a great time last night. Yesterday was a day off from work for me, and I took the wife down to Port Canaveral to watch the Space Shuttle Discovery launch. I don't know if any of you are familiar with the locale, but we ended up going to Grill's Tiki Bar http://www.grillsseafood.com/ a few hours before the scheduled launch. I had never been there before, but I was pleasantly surprised with the atmosphere, food, people, and of course the drinks. The band was awesome too. They had quite a repertoire of songs from various bands including Van Halen, Boston, and Pink Floyd to name a few. They even played some Motown hits. It was an unexpected surprise to find such a talented group of musicians who could do justice to just about every song they played.

And the food...I had some Yellow Tail Tuna for dinner that was marinated in their special sauce and it was just outstanding. I heard some other folks talking about their fish dinners and they seemed to agree that it was quite enjoyable.

And to top off the evening we watched Discovery make a spectacular blast off for another mission to the space station.

I only live about 30 miles or so from Kennedy Space Center and had seen several launches in the past, but I had never gone down to the coast to see it from a closer perspective. And being a night launch Discovery really lit up the sky, which added that much more visual impact.

There's not too many Shuttle missions left, so I'm glad I finally took the time to really enjoy one of our country's greatest space programs in action.

Well, next week starts a new month and it would seem that the market is in for a big test in the next two weeks. I'm especially watching to see what happens once the Labor Day weekend passes. The C and S funds seem to be hitting a wall of resistance right now, which would not ordinarily be unexpected given the recent Seven Sentinels sell signal, but this market has proven for some time that it can rally when we least expect it. We have a bearish undercurrent that continues to spike every time the market looks poised to enter a decline. And honestly, that set-up still seems to be with us.

Let's look at some charts.

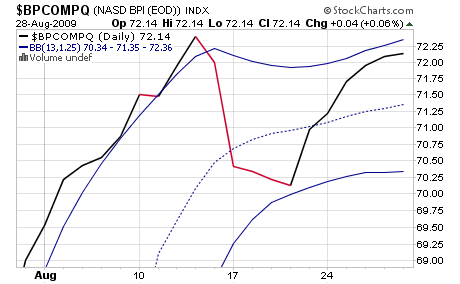

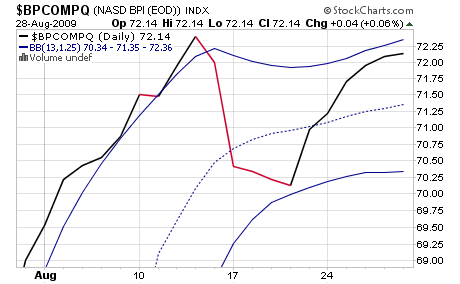

We can see that $BPCOMPQ appears to be topping out a little short of the upper bollinger band and looks ready to drop again. It was the last signal to flash a sell giving us our current seven sentinels sell signal, and has not been able to enter buy mode in the most recent up leg.

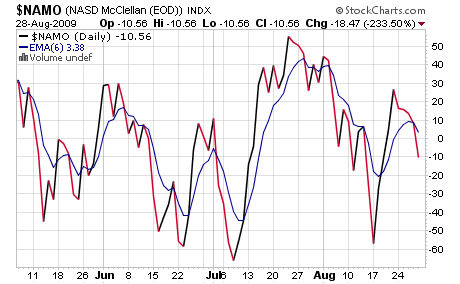

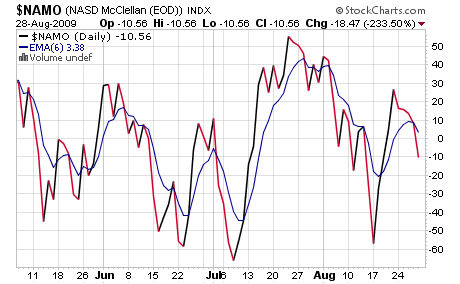

$NAMO continues to fall deeper into sell territory...

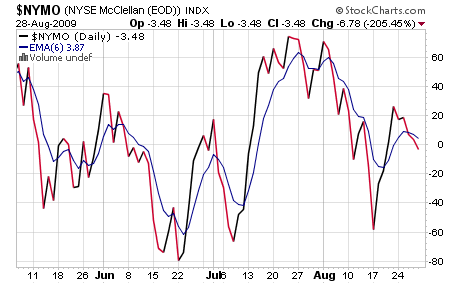

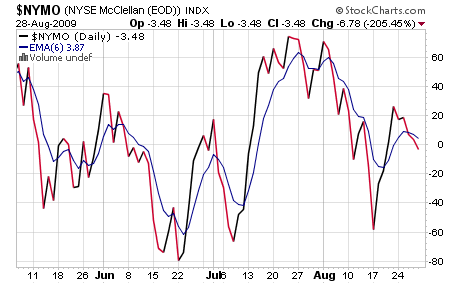

as is $NYMO.

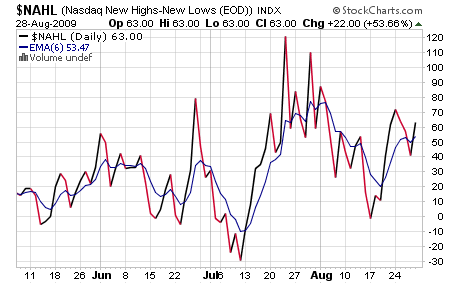

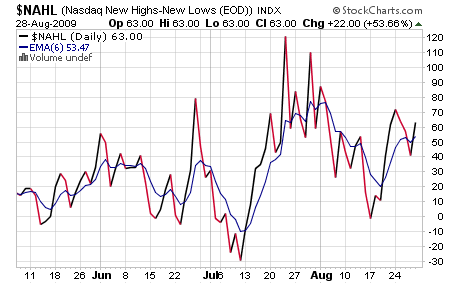

On the other hand, $NAHL managed to move higher and issue a buy signal.

However, $NYHL did not nearly match the Nasdaq strength in this area and remains on a sell.

$TRIN and $TRINQ remain on a buy.

So we have a mixed bag, but the bottom line of course is that the Seven Sentinels remains in a sell condition.

I'll be updating my spreadsheet later today as I follow our top 25% on the tracker. I've been watching for a shift to cash, which to their credit has not happened. And that's why they're in the top 25%. :cheesy:

And the food...I had some Yellow Tail Tuna for dinner that was marinated in their special sauce and it was just outstanding. I heard some other folks talking about their fish dinners and they seemed to agree that it was quite enjoyable.

And to top off the evening we watched Discovery make a spectacular blast off for another mission to the space station.

I only live about 30 miles or so from Kennedy Space Center and had seen several launches in the past, but I had never gone down to the coast to see it from a closer perspective. And being a night launch Discovery really lit up the sky, which added that much more visual impact.

There's not too many Shuttle missions left, so I'm glad I finally took the time to really enjoy one of our country's greatest space programs in action.

Well, next week starts a new month and it would seem that the market is in for a big test in the next two weeks. I'm especially watching to see what happens once the Labor Day weekend passes. The C and S funds seem to be hitting a wall of resistance right now, which would not ordinarily be unexpected given the recent Seven Sentinels sell signal, but this market has proven for some time that it can rally when we least expect it. We have a bearish undercurrent that continues to spike every time the market looks poised to enter a decline. And honestly, that set-up still seems to be with us.

Let's look at some charts.

We can see that $BPCOMPQ appears to be topping out a little short of the upper bollinger band and looks ready to drop again. It was the last signal to flash a sell giving us our current seven sentinels sell signal, and has not been able to enter buy mode in the most recent up leg.

$NAMO continues to fall deeper into sell territory...

as is $NYMO.

On the other hand, $NAHL managed to move higher and issue a buy signal.

However, $NYHL did not nearly match the Nasdaq strength in this area and remains on a sell.

$TRIN and $TRINQ remain on a buy.

So we have a mixed bag, but the bottom line of course is that the Seven Sentinels remains in a sell condition.

I'll be updating my spreadsheet later today as I follow our top 25% on the tracker. I've been watching for a shift to cash, which to their credit has not happened. And that's why they're in the top 25%. :cheesy: