Not surprisingly, today's action retraced some of yesterday's impressive gains. At the close the DOW and Nasdaq posted modest gains, while the S&P 500 was modestly lower. Small and Mid-Caps took the brunt of the selling pressure in today's action.

Perhaps notable on the day was that treasuries were hit hard, with the yield on the 10 year note hitting a multi-month high of 2.25%. Gold was down better than $50 as well. These are suppose to be safe havens so it's a bit interesting to see this action one day after the Fed announced it was keeping rates at current levels for an extended period of time. I'm not reading too much into this right now, but that kind of action has the potential to be bullish for stocks.

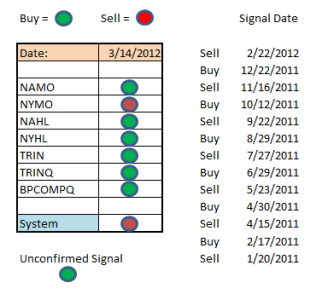

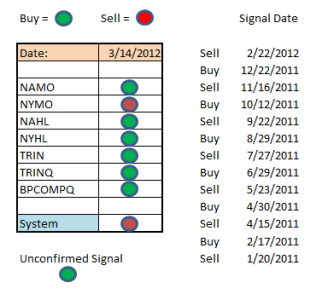

The Seven Sentinels officially remain in an intermediate term sell condition. The system did trigger an unconfirmed buy signal yesterday, but NYMO still needs to tag a 28 day trading high to confirm it.

Make no mistake, this market is doing its level best to deceive the masses. The bearish arguments are compelling. There are no shortage of downside indicators either. Most of you have probably read Tom's commentary, so you should be aware of some of those downside risks. I would think most bulls would be at least a little nervous right now, and the bears have to be feeling somewhat insecure too. In spite of the new highs achieved by the broader market yesterday, caution is still readily seen on the MBs. How will sentiment continue to react? So far it's been supportive of upside action just when the downside looks the most promising.

As uneasy as I am about the downside, I am also still wary of this bull.

Perhaps notable on the day was that treasuries were hit hard, with the yield on the 10 year note hitting a multi-month high of 2.25%. Gold was down better than $50 as well. These are suppose to be safe havens so it's a bit interesting to see this action one day after the Fed announced it was keeping rates at current levels for an extended period of time. I'm not reading too much into this right now, but that kind of action has the potential to be bullish for stocks.

The Seven Sentinels officially remain in an intermediate term sell condition. The system did trigger an unconfirmed buy signal yesterday, but NYMO still needs to tag a 28 day trading high to confirm it.

Make no mistake, this market is doing its level best to deceive the masses. The bearish arguments are compelling. There are no shortage of downside indicators either. Most of you have probably read Tom's commentary, so you should be aware of some of those downside risks. I would think most bulls would be at least a little nervous right now, and the bears have to be feeling somewhat insecure too. In spite of the new highs achieved by the broader market yesterday, caution is still readily seen on the MBs. How will sentiment continue to react? So far it's been supportive of upside action just when the downside looks the most promising.

As uneasy as I am about the downside, I am also still wary of this bull.