It was boring all day, but in the end the advance continued, albeit on low volume.

I suppose the big event for the market will happen this weekend when the G-20 meets to discuss trade and currency policy manipulation. The results of that meeting may or may not drive the markets come Monday depending on what comes out of it.

Let's take a look at the charts:

NAMO and NYMO are pretty much neutral, but that 6 day EMA has been moving lower. While that seems to suggest weakness may be coming, this market can continue to chop higher longer than we might think.

NAHL and NYHL flipped back to sells today, and also show their 6 day EMA moving lower.

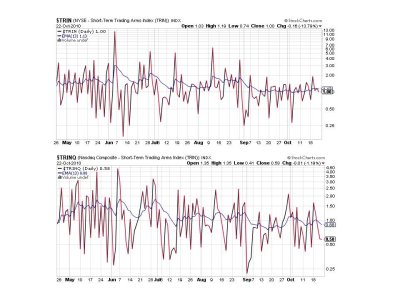

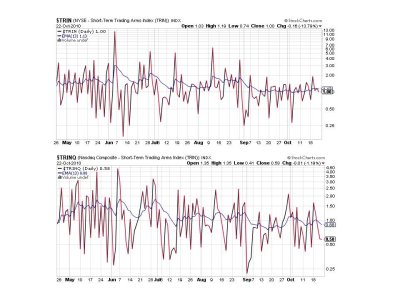

TRIN and TRINQ are both flashing buys.

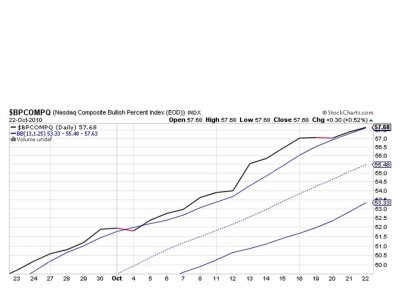

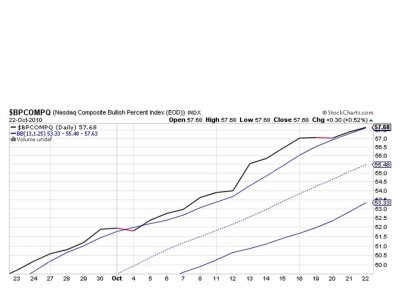

BPCOMPQ continued its rise, but is sitting right on that upper bollinger band. It's still a buy though.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy.

The market has been trading in ragged fashion for at least a week now, but has been able to keep its upward bias. There is a lot of potential market movers ahead such as the election results, the next FOMC meeting, QE2, mortgage fraud inquiries, and currency wars not to mention continued earnings reports and market data.

Sentiment is certainly more bullish now than at any point since the end of August, although not over-the-top by any means. While a correction may appear to be on the horizon, it's not a given we'll see one with all these cross-currents. I did take another 15% out of my stock funds and into cash today, which leaves me with 45% in stocks going into next week. That's about where my comfort level is right now. If we continue to move higher, I'll still be invested, but if the hammer falls, I'll have been hedged against that too.

Check back this weekend when I post the weekly tracker charts. It'll be interesting to see where we stand going into the last week of October.

I suppose the big event for the market will happen this weekend when the G-20 meets to discuss trade and currency policy manipulation. The results of that meeting may or may not drive the markets come Monday depending on what comes out of it.

Let's take a look at the charts:

NAMO and NYMO are pretty much neutral, but that 6 day EMA has been moving lower. While that seems to suggest weakness may be coming, this market can continue to chop higher longer than we might think.

NAHL and NYHL flipped back to sells today, and also show their 6 day EMA moving lower.

TRIN and TRINQ are both flashing buys.

BPCOMPQ continued its rise, but is sitting right on that upper bollinger band. It's still a buy though.

So we have 4 of 7 signals flashing buys, which keeps the system on a buy.

The market has been trading in ragged fashion for at least a week now, but has been able to keep its upward bias. There is a lot of potential market movers ahead such as the election results, the next FOMC meeting, QE2, mortgage fraud inquiries, and currency wars not to mention continued earnings reports and market data.

Sentiment is certainly more bullish now than at any point since the end of August, although not over-the-top by any means. While a correction may appear to be on the horizon, it's not a given we'll see one with all these cross-currents. I did take another 15% out of my stock funds and into cash today, which leaves me with 45% in stocks going into next week. That's about where my comfort level is right now. If we continue to move higher, I'll still be invested, but if the hammer falls, I'll have been hedged against that too.

Check back this weekend when I post the weekly tracker charts. It'll be interesting to see where we stand going into the last week of October.