If you like dancing, you've got to love the choreography the market puts on display on a regular basis.

After opening modestly higher, the market chopped around today until about 2:00 EST. That's when Ben Bernanke issued his semiannual monetary policy report to the Senate Banking Committee. He spoke of continued uncertainty in the economy and of the Fed's preparations to take more policy actions if needed.

Was this really anything new? Not really. It was in-line with what the last Fed minutes communicated, but it was an opportunity for the market to go from a waltz to a hip hop dance routine as it dove into the close.

But in my view it was actually a good thing, as it helped solidfy overall bearish sentiment for the moment.

In other action, the yield of the 10-year Treasury Note dropped below 2.90% to its lowest level since April 2009.

To the charts:

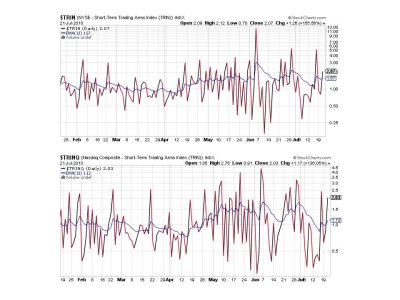

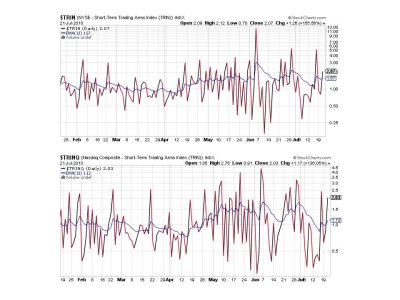

Back to sells here, but I see no problem as we are now chopping around the trigger point on both charts.

NAHL and NYHL actually improved today. :blink:

TRIN and TRINQ both flipped to sells.

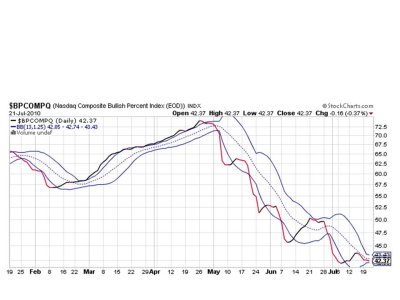

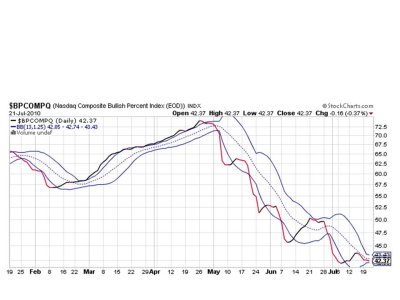

BPCOMPQ continues to move sideways and those bollies just keep tightening.

So we have 3 of 7 signals on a buy, which keeps the system on a buy.

I really have nothing new to add to what I've been saying for at least a few trading days now. I'm still expecting a breakout to the upside based on the SS buy signal and sentiment.

See you tomorrow.

After opening modestly higher, the market chopped around today until about 2:00 EST. That's when Ben Bernanke issued his semiannual monetary policy report to the Senate Banking Committee. He spoke of continued uncertainty in the economy and of the Fed's preparations to take more policy actions if needed.

Was this really anything new? Not really. It was in-line with what the last Fed minutes communicated, but it was an opportunity for the market to go from a waltz to a hip hop dance routine as it dove into the close.

But in my view it was actually a good thing, as it helped solidfy overall bearish sentiment for the moment.

In other action, the yield of the 10-year Treasury Note dropped below 2.90% to its lowest level since April 2009.

To the charts:

Back to sells here, but I see no problem as we are now chopping around the trigger point on both charts.

NAHL and NYHL actually improved today. :blink:

TRIN and TRINQ both flipped to sells.

BPCOMPQ continues to move sideways and those bollies just keep tightening.

So we have 3 of 7 signals on a buy, which keeps the system on a buy.

I really have nothing new to add to what I've been saying for at least a few trading days now. I'm still expecting a breakout to the upside based on the SS buy signal and sentiment.

See you tomorrow.