Sunday Brief, 1 August 2010.

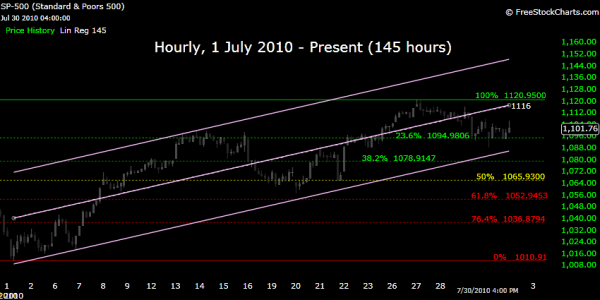

Key Fibonacci & Linear Regression Levels over multiple time-frames.

Key Fibonacci & Linear Regression Levels over multiple time-frames.

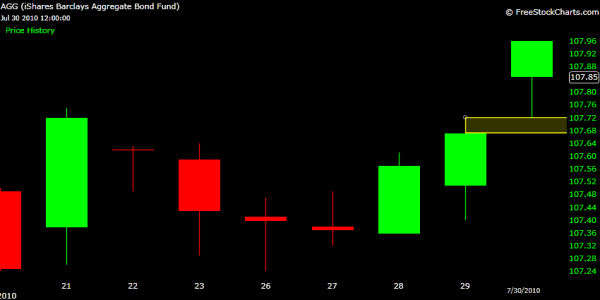

Not much for me to add this week, I've spent more time house-hunting over the net, rather than going over the charts (a rarity.) We've spent most of last week consolidating prices and this was somewhat of a disappointment week of price action for me. Some folks think we'll go up, while an equal amount think we'll go down. At this point I'm ready for prices to "put up or shut up." Bonds are still strong, so if I'm forced to make an exit, the F-Fund is where I'll go.

Monthly

No Fibonacci changes, prices are neutral with a bearish bias. Downside target is 1014, upside target is 1121, with a 34 Month Linear Regression price target of 936.

Weekly

No Fibonacci changes, prices are bullish with a bullish bias. Downside target is 1008, upside target is 1219, with a 74 Week Linear Regression price target of 1195.

Daily

No Fibonacci changes, prices are neutral with a bearish bias. Downside target is 1090, then 1060, upside target is 1115 then 1140, with a 68 Day Linear Regression price target of 1056.

Hourly

On the Hourly chart price moved a higher early into the week so I moved the Fibonacci levels. Prices are bullish with a bullish bias. Downside target is 1094 and we've tested this level multiple times, so I'm wanting to see it hold. Here we have a 145 Hour Linear Regression price target of 1116.

Lastly, on AGG's Daily chart, the yellow box shows us something we don't see very often on this chart. An un-filled gap?

Thanks for reading, take care and trade safe...Jason