01/28/26

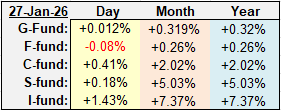

Stocks were mixed again, but mostly higher on Tuesday. The Dow lost 400-point because of a 20% loss in Unitedhealth Group, but otherwise the indices were positive, and the I-fund had another big day as the dollar continued to tumble. Small caps opened lower but found support and closed with a modest gain. Bonds were down as yields moved up.

It's day two of the 2-day FOMC meeting and investors are not expecting any changes to the Fed Funds interest rate. The Polymarkets shows virtually a 0% chance of a change, but looking out to the March meeting, there are some bets for a 0.25% cut, although it has been decreasing.

The big news recently has been the rapid decline in the value of the dollar, and as we know that tends to be good news for prices in general, but particularly the I-Fund. In this case the ACWX Index, which the I fund tracks fairly closely, rallied over 1% yesterday after a 1.64% decline in the dollar ETF, UUP.

I mentioned this the other day, but the longer term chart of UUP shows long term support right in this area, and it could be make or break time for the dollar. This is not a bullish chart but it is still trending higher, as long as support holds.

You can go down a rabbit hold in trying to interpret what this means. The skyrocketing price of gold and silver. The tokenization of assets, stable coins, block chains, etc. I admit I don't get it all, but I know what a bearish chart looks like, and the above chart would need to hold support or the weakness in the dollar could accelerate.

Another chart that may cause problems for the stock market if new highs are made is the Japanese 10-year Treasury Yield. It seems to be headed that way after a brief pullback.

Following up on the Nasdaq, it did move above some recent support, and in the process it filled in an open gap near 26,000. It could retrace that November 1st negative candlestick, but then it will have a double top to deal with as we head into the Fed meeting and Magnificent 7 earnings, which starts tonight.

The small caps of the Russell 2000 pulled back after its recent breakout above the inverted head and shoulders. It is holding, as the bullish formation might suggest, but there is more support down by 257 that may need to get retested as well. It could depend on what the Fed says today about rates

We will get earnings from Magnificent 7 companies this week; Tesla, Meta, and Microsoft today, and Apple tomorrow. We will get the PPI data (Producer Price Index) on Friday. And again, another government shutdown is looming at the end of the week, but the market usually brushes this off.

Additional TSP Fund Charts:

The S&P 500 (C-fund) made a new high yesterday, and I'm not sure if that is a good thing, or a bad thing heading into a Fed meeting. We now have a mini-double top formation, but the Fed and / or Mag 7 earnings could be the catalyst for a breakout, or a double top break down. I don't have much conviction either way here in the short-term.

The DWCPF (S-fund) is holding in all the right places after a two-day dip ended yesterday. 2600 is solid support, but if that can't hold, the losses could accumulate quickly, so be careful here. It looks like a perfect place to buy, unless support breaks, in which case there is a lot of room down to the next support level.

BND (bonds / F-fund) fell yesterday, and that was the first loss in five days. It filled in Monday's open gap, so it could bounce from here, but there is a lot of resistance overhead, with a lot of room down to the bottom of the channel, if it wants to return there. Short-term resistance, but a breakout could change the outlook.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks were mixed again, but mostly higher on Tuesday. The Dow lost 400-point because of a 20% loss in Unitedhealth Group, but otherwise the indices were positive, and the I-fund had another big day as the dollar continued to tumble. Small caps opened lower but found support and closed with a modest gain. Bonds were down as yields moved up.

| Daily TSP Funds Return More returns |

It's day two of the 2-day FOMC meeting and investors are not expecting any changes to the Fed Funds interest rate. The Polymarkets shows virtually a 0% chance of a change, but looking out to the March meeting, there are some bets for a 0.25% cut, although it has been decreasing.

The big news recently has been the rapid decline in the value of the dollar, and as we know that tends to be good news for prices in general, but particularly the I-Fund. In this case the ACWX Index, which the I fund tracks fairly closely, rallied over 1% yesterday after a 1.64% decline in the dollar ETF, UUP.

I mentioned this the other day, but the longer term chart of UUP shows long term support right in this area, and it could be make or break time for the dollar. This is not a bullish chart but it is still trending higher, as long as support holds.

You can go down a rabbit hold in trying to interpret what this means. The skyrocketing price of gold and silver. The tokenization of assets, stable coins, block chains, etc. I admit I don't get it all, but I know what a bearish chart looks like, and the above chart would need to hold support or the weakness in the dollar could accelerate.

Another chart that may cause problems for the stock market if new highs are made is the Japanese 10-year Treasury Yield. It seems to be headed that way after a brief pullback.

Following up on the Nasdaq, it did move above some recent support, and in the process it filled in an open gap near 26,000. It could retrace that November 1st negative candlestick, but then it will have a double top to deal with as we head into the Fed meeting and Magnificent 7 earnings, which starts tonight.

The small caps of the Russell 2000 pulled back after its recent breakout above the inverted head and shoulders. It is holding, as the bullish formation might suggest, but there is more support down by 257 that may need to get retested as well. It could depend on what the Fed says today about rates

We will get earnings from Magnificent 7 companies this week; Tesla, Meta, and Microsoft today, and Apple tomorrow. We will get the PPI data (Producer Price Index) on Friday. And again, another government shutdown is looming at the end of the week, but the market usually brushes this off.

Additional TSP Fund Charts:

The S&P 500 (C-fund) made a new high yesterday, and I'm not sure if that is a good thing, or a bad thing heading into a Fed meeting. We now have a mini-double top formation, but the Fed and / or Mag 7 earnings could be the catalyst for a breakout, or a double top break down. I don't have much conviction either way here in the short-term.

The DWCPF (S-fund) is holding in all the right places after a two-day dip ended yesterday. 2600 is solid support, but if that can't hold, the losses could accumulate quickly, so be careful here. It looks like a perfect place to buy, unless support breaks, in which case there is a lot of room down to the next support level.

BND (bonds / F-fund) fell yesterday, and that was the first loss in five days. It filled in Monday's open gap, so it could bounce from here, but there is a lot of resistance overhead, with a lot of room down to the bottom of the channel, if it wants to return there. Short-term resistance, but a breakout could change the outlook.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: