01/14/26

Stocks paused and the S&P 500 experienced just its second losing day of the New Year after JP Morgan's earnings sent financial stocks sharply lower. There was also more Trump / Powell drama, plus oil spiked on the turmoil in Iran. The Dow lost just under 400-points, but it gained back 150-points in the final minutes of trading as dip buyers showed up. CPI data was slightly better than expected. Is the Supreme Court ready to give a decision on tariffs?

Reminder: I have some personal plans this week so the commentaries may be a little brief, and I may not respond to emails as quickly as I'd normally like to. I apologize for any inconvenience this may cause.

JP Morgan fell over 4% yesterday after reporting earnings.

That sent the financial sector down sharply along with the Dow. It was a breakdown from one of those "F" flag formations and it is now looking for support at the 50-day average.

I'm not seeing it in the mainstream headlines, but I read in a post on X from someone with 300K followers that the Supreme Court may be ruling on the tariffs today? Don't know for sure, but just in case it is true, there it is.

The S&P 500 (C-fund) slipped as it continues to trade in that narrowing wedge formation, while trying to hold above the breakout area near 6950, which it did for a third straight day yesterday despite the loss. Rising wedges can be bearish and that support is getting tested regularly. However, the overall look of the new highs above the inverted head and shoulders pattern is impressive. Some are calling this a Wyckoff distribution pattern, which is actually concerning, so the breakout needs to hold. If it fails, run.

The CPI inflation report came in better than expected sending yields lower. Between the chart above and this one below where the 10-year Treasury Yield rolled over again keeping the long range between the 50-day and 200-day averages continuing, it feels like something is going to trigger a bigger move in one direction or the other on both charts very soon.

We get the PPI (Wholesale prices) report this morning.

Admin note: We plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) was flat on the day after an early loss found support again at the breakout line. This looks good unless or until this falls back below 2600. Filling that red open gap wouldn't be the worst thing to happen, since we know that is likely going to get filled at some point, but that would make this a failed breakout and sentiment could change, and as I mentioned above, it could be considered a Wyckoff distribution pattern. Holding and rebounding after a gap fill near 252 would be OK, and a probably good opportunity, but it could get tricky.

The ACWX (I-fund index) was down and lagged yesterday after a rally in the dollar. It is sitting at the top of a long rising trading channel and it could fall and fill in some of those gaps to clean up the chart before going any further, but the surprise move would be for it to keep climbing with investors waiting on a pullback.

BND (bonds / F-fund) was up with yields falling on the better than expected inflation data. Nothing has changed as this trades between the 50-day average and the two overhead resistance lines.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks paused and the S&P 500 experienced just its second losing day of the New Year after JP Morgan's earnings sent financial stocks sharply lower. There was also more Trump / Powell drama, plus oil spiked on the turmoil in Iran. The Dow lost just under 400-points, but it gained back 150-points in the final minutes of trading as dip buyers showed up. CPI data was slightly better than expected. Is the Supreme Court ready to give a decision on tariffs?

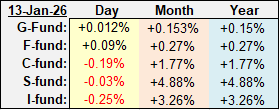

| Daily TSP Funds Return More returns |

Reminder: I have some personal plans this week so the commentaries may be a little brief, and I may not respond to emails as quickly as I'd normally like to. I apologize for any inconvenience this may cause.

JP Morgan fell over 4% yesterday after reporting earnings.

That sent the financial sector down sharply along with the Dow. It was a breakdown from one of those "F" flag formations and it is now looking for support at the 50-day average.

I'm not seeing it in the mainstream headlines, but I read in a post on X from someone with 300K followers that the Supreme Court may be ruling on the tariffs today? Don't know for sure, but just in case it is true, there it is.

The S&P 500 (C-fund) slipped as it continues to trade in that narrowing wedge formation, while trying to hold above the breakout area near 6950, which it did for a third straight day yesterday despite the loss. Rising wedges can be bearish and that support is getting tested regularly. However, the overall look of the new highs above the inverted head and shoulders pattern is impressive. Some are calling this a Wyckoff distribution pattern, which is actually concerning, so the breakout needs to hold. If it fails, run.

The CPI inflation report came in better than expected sending yields lower. Between the chart above and this one below where the 10-year Treasury Yield rolled over again keeping the long range between the 50-day and 200-day averages continuing, it feels like something is going to trigger a bigger move in one direction or the other on both charts very soon.

We get the PPI (Wholesale prices) report this morning.

Admin note: We plan to have annual subscription sale during the week of January 19 - 23. More details to follow but we did move upcoming expiring annual subscription dates out until that day so you can renew that week without a lapse. As always, if you have an annual subscription that does not expire this month, or if you want to convert a monthly subscription to annual, the sale will allow you to tack on another year to your current subscriptions at the sale price. Also, we are considering a price increase after the sale, so this will lock in the lower price. As you can imagine, the costs of doing business has gone up quite a bit in the last 20 years and the TSP Talk Plus and Revshark premium service prices have remained the same since the day they started. A cure for that would be more subscribers so, spread the word and we may leave prices alone. That's a bribe.

DWCPF (S-fund) was flat on the day after an early loss found support again at the breakout line. This looks good unless or until this falls back below 2600. Filling that red open gap wouldn't be the worst thing to happen, since we know that is likely going to get filled at some point, but that would make this a failed breakout and sentiment could change, and as I mentioned above, it could be considered a Wyckoff distribution pattern. Holding and rebounding after a gap fill near 252 would be OK, and a probably good opportunity, but it could get tricky.

The ACWX (I-fund index) was down and lagged yesterday after a rally in the dollar. It is sitting at the top of a long rising trading channel and it could fall and fill in some of those gaps to clean up the chart before going any further, but the surprise move would be for it to keep climbing with investors waiting on a pullback.

BND (bonds / F-fund) was up with yields falling on the better than expected inflation data. Nothing has changed as this trades between the 50-day average and the two overhead resistance lines.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.