Volatility has certainly picked up. For the second day in a row, early gains have been wiped out by the end of the trading day. The DOW and S&P may have managed to close slightly higher, but that's small consolation given the spread between their respective highs and the closing numbers.

On economic data front, the second revision to Q4 GDP was lower than expected and the University of Michigan Sentiment for March was revised to 73.6, up a bit from the expected 73.0.

It still feels like topping action to me. I would be very leary of sentiment right now. Rising bearish levels may be deceptive given the current economic-political climate. What I mean by that is fundamentals don't matter until they matter. The changes sweeping the country right now are going to re-set business and financial paradigms. What that looks like moving forward and at what point it affects stock pricing is difficult to know. But it's something to ponder for now.

Here's today's charts:

Both signals remain on sells here.

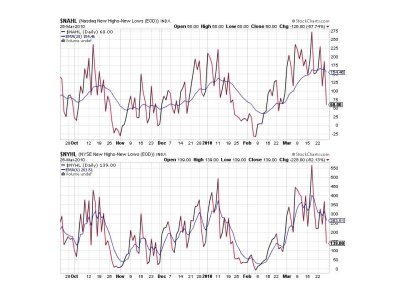

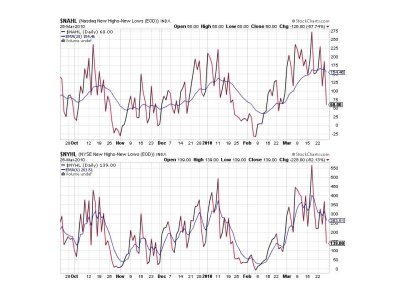

NAHL and NYHL have both flipped back to sells in whipsaw action.

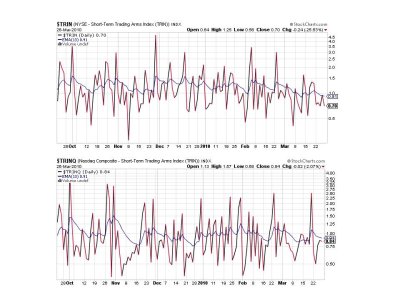

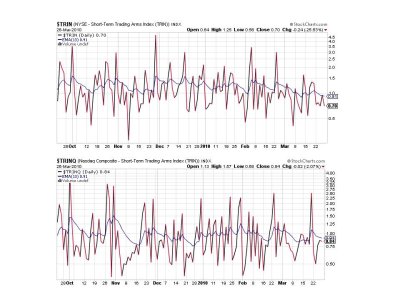

TRIN and TRINQ remain on buys.

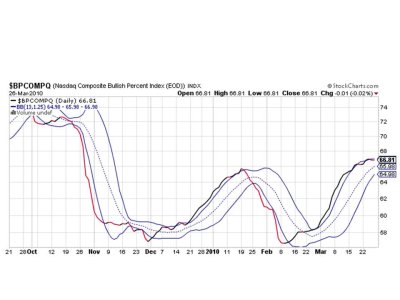

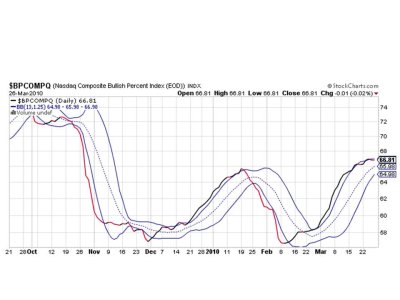

BPCOMPQ remains on a sell. It hasn't started a serious move lower yet, so the current trend has not technically broken down yet. But it's certainly suggesting more weakness may be coming soon.

I'll be posting Top 15 and Top 50 charts this weekend.

So we have 5 of 7 signals flashing sells, keeping the system on a sell, unless you're a die-hard bull clinging to that borderline buy earlier this week. I knew any whipsaw action might muddy the waters and it has. Next week is the end of the quarter and so far it's not shaping up in a positive way for stocks, so the tipping point may be close.

That's it for this evening. See you this weekend.

On economic data front, the second revision to Q4 GDP was lower than expected and the University of Michigan Sentiment for March was revised to 73.6, up a bit from the expected 73.0.

It still feels like topping action to me. I would be very leary of sentiment right now. Rising bearish levels may be deceptive given the current economic-political climate. What I mean by that is fundamentals don't matter until they matter. The changes sweeping the country right now are going to re-set business and financial paradigms. What that looks like moving forward and at what point it affects stock pricing is difficult to know. But it's something to ponder for now.

Here's today's charts:

Both signals remain on sells here.

NAHL and NYHL have both flipped back to sells in whipsaw action.

TRIN and TRINQ remain on buys.

BPCOMPQ remains on a sell. It hasn't started a serious move lower yet, so the current trend has not technically broken down yet. But it's certainly suggesting more weakness may be coming soon.

I'll be posting Top 15 and Top 50 charts this weekend.

So we have 5 of 7 signals flashing sells, keeping the system on a sell, unless you're a die-hard bull clinging to that borderline buy earlier this week. I knew any whipsaw action might muddy the waters and it has. Next week is the end of the quarter and so far it's not shaping up in a positive way for stocks, so the tipping point may be close.

That's it for this evening. See you this weekend.