Since Monday's advance the broader market has consolidated gains and moved sideways. Mostly on very low volume, although today saw much higher volume totals due to quadruple witching options expiration. Still, the market seems to be spring loaded for a big move, but in what direction?

The preliminary Consumer Sentiment Survey for September fell to 66.6 from August's reading of 68.9. The reading had been expected to be closer the 70.

The Consumer price data for August was 0.3% higher, but core CPI was unchanged. The market didn't seem to care much about CPI today.

The Seven Sentinels have not changed much the past few trading days and it's very difficult to ascertain which way they may go in the short term. The FOMC announcement comes Tuesday, so I suspect Monday's trading activity might be listless until that data release.

Here's the charts:

Still on sells here, but that doesn't mean much with the signals hugging their respective 6 day EMAs.

NAHL and NYHL continue to track sideways, but the signals themselves are bullish.

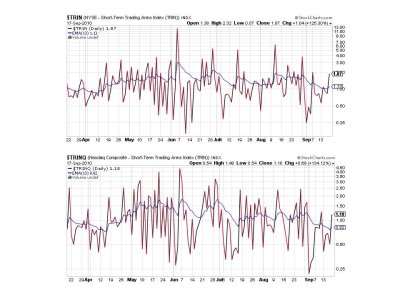

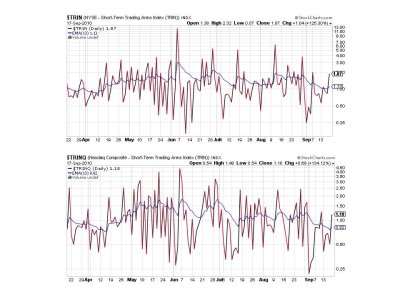

TRIN and TRINQ flipped to sells today. This moderates the overbought condition some and helps support the bullish case in the short term.

BPCOMPQ is still tracking higher.

So we have 3 of 7 signals on sells, but the system remains on a buy. I have no conviction either way with these charts right now, but we seem to be coiling for a big move. The more obvious move is down, but sentiment doesn't particularly support that position even with all the cheerleading on CNBC. I think it's going to be very difficult for the bears to take control here for more than a short period of time.

I haven't got tonight's tracker data yet, but I think we are collectively becoming more defensive. I'll have those charts posted over the weekend. See you then.

The preliminary Consumer Sentiment Survey for September fell to 66.6 from August's reading of 68.9. The reading had been expected to be closer the 70.

The Consumer price data for August was 0.3% higher, but core CPI was unchanged. The market didn't seem to care much about CPI today.

The Seven Sentinels have not changed much the past few trading days and it's very difficult to ascertain which way they may go in the short term. The FOMC announcement comes Tuesday, so I suspect Monday's trading activity might be listless until that data release.

Here's the charts:

Still on sells here, but that doesn't mean much with the signals hugging their respective 6 day EMAs.

NAHL and NYHL continue to track sideways, but the signals themselves are bullish.

TRIN and TRINQ flipped to sells today. This moderates the overbought condition some and helps support the bullish case in the short term.

BPCOMPQ is still tracking higher.

So we have 3 of 7 signals on sells, but the system remains on a buy. I have no conviction either way with these charts right now, but we seem to be coiling for a big move. The more obvious move is down, but sentiment doesn't particularly support that position even with all the cheerleading on CNBC. I think it's going to be very difficult for the bears to take control here for more than a short period of time.

I haven't got tonight's tracker data yet, but I think we are collectively becoming more defensive. I'll have those charts posted over the weekend. See you then.