SPN46er

Investor

- Reaction score

- 6

Recently I have been thinking about and working on a good way to graphically represent the TSPTalk community's trading patterns on a day to day basis. I realize that currently our own forum member coolhand provides us with a report at the end of every week on the stock vs. cash allocation of our group. Another tool that one could look at is the Sentiment Survey that Tom conducts and also we have the ability take a look at the daily Recent IFT tracker to see how the majority of people on the tracker are using their IFTs for the day (jumping into stocks vs. pulling back to bonds or cash). All of these are no doubt great tools to get a sense of fear or maybe even complacency that we as members of this website are feeling (kind of like the VIX indicator). One thing that Tom often posts in his daily market analysis is a chart of Smart Money vs. Dumb Money and that is kind of what got me thinking about this idea.

One thing missing from all of the aforementioned tools is trader consistency. These tools use us as a community to provide the indications, however, when you use these indicators you can't be entirely sure who is being counted. For example, when you take a look at coolhand's stock vs. cash charts at the end of every week (great graphical tool by the way) you really don't have any idea if the people in stocks are people you can have confidence in. Just because the top 10 or top 50 are mostly in stocks doesn't necessarily the people making up these groups are consistent in their performance. As we near the end of the year the indicator becomes more useful as the top 10 or top 50 are either people who have consistently been near the top of the tracker over the years or they just got a lucky in their timing. Let's face it we are all on this board to learn new things from one another because everyone brings a new and different perspective, however, as in any community you as a member have certain people you listen to more than others. There are some of us with more free time to analyze the markets and others who are just really good at predicting the market's next move. Since this is a friendly community every is allowed to have an opinion and although we may not agree with all that is said we are for the most part respectful of those opinions. Something I find myself doing when checking the Recent IFT page is also checking names against past performance. So if I see some one jumping on board 100% S fund on day where I am wondering how anyone could be putting all their eggs in one basket (read: buying high) I usually take a look at how they have been performing in the past. This allows me to get a sense of confidence in their move and then I can decide if I want to follow suit in some form or another.

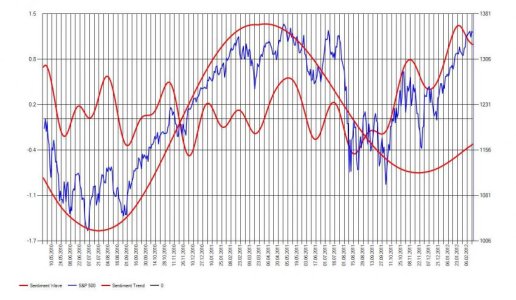

I know this is getting long winded so I will cut to the chase. My idea is using a Excel spreadsheet (I am an engineer so I love Excel) where I will track everyone's performance from previous years on the tracker. I realize that every year we have newcomers so for any one who had a partial return in that particular year does not get credit for that year. There are also a few people who went inactive for a year and then came back after a year of being deleted from the tracker and they will only get credit for years of activity (sitting in S fund in a great year and never logging in most likely means you just got lucky and didn't try to beat the market). I still haven't entirely figured out the methodology I will use yet but at a higher level I would like to use the collected data to produce a consistency factor for each member. I realize the quote about past performance not being indicative of future results (this is true otherwise 1 or 2 people would be top of the tracker every year), however, I have much more confidence in following someone who has been consistently good with their performance even in rough market years vs. someone who was very negative in a bad year and then had a positive results in a good year. The goal of this forum afterall is to try and beat market performance otherwise we would all just be buy and holders. Once I am able to come up with a consistency number for each member I will then use that to produce a smart money vs dumb money graph using day to day allocations on the tracker. Those with consistency levels below an as of yet undetermined level will be lumped in with the dumb money (no this does not mean these people are dumb, I will probably be in this group afterall lol) and those above will be considered smart money. Once I am able to produce a graphical representation I will see if it a useful tool in market prediction (this may be all for nothing!). Its still a work in progress and I am open for suggestion/comments. You can tell me its a great idea or a terrible idea I don't care I will take it constructively. There may be someone who already tried something like this or has something like this and maybe they can chime in. I will post updates from time to time as I progress.

If you made it through that you are probably either bored :notrust:, intrigued :suspicious:, elated :nuts: or just have lots of questions

One thing missing from all of the aforementioned tools is trader consistency. These tools use us as a community to provide the indications, however, when you use these indicators you can't be entirely sure who is being counted. For example, when you take a look at coolhand's stock vs. cash charts at the end of every week (great graphical tool by the way) you really don't have any idea if the people in stocks are people you can have confidence in. Just because the top 10 or top 50 are mostly in stocks doesn't necessarily the people making up these groups are consistent in their performance. As we near the end of the year the indicator becomes more useful as the top 10 or top 50 are either people who have consistently been near the top of the tracker over the years or they just got a lucky in their timing. Let's face it we are all on this board to learn new things from one another because everyone brings a new and different perspective, however, as in any community you as a member have certain people you listen to more than others. There are some of us with more free time to analyze the markets and others who are just really good at predicting the market's next move. Since this is a friendly community every is allowed to have an opinion and although we may not agree with all that is said we are for the most part respectful of those opinions. Something I find myself doing when checking the Recent IFT page is also checking names against past performance. So if I see some one jumping on board 100% S fund on day where I am wondering how anyone could be putting all their eggs in one basket (read: buying high) I usually take a look at how they have been performing in the past. This allows me to get a sense of confidence in their move and then I can decide if I want to follow suit in some form or another.

I know this is getting long winded so I will cut to the chase. My idea is using a Excel spreadsheet (I am an engineer so I love Excel) where I will track everyone's performance from previous years on the tracker. I realize that every year we have newcomers so for any one who had a partial return in that particular year does not get credit for that year. There are also a few people who went inactive for a year and then came back after a year of being deleted from the tracker and they will only get credit for years of activity (sitting in S fund in a great year and never logging in most likely means you just got lucky and didn't try to beat the market). I still haven't entirely figured out the methodology I will use yet but at a higher level I would like to use the collected data to produce a consistency factor for each member. I realize the quote about past performance not being indicative of future results (this is true otherwise 1 or 2 people would be top of the tracker every year), however, I have much more confidence in following someone who has been consistently good with their performance even in rough market years vs. someone who was very negative in a bad year and then had a positive results in a good year. The goal of this forum afterall is to try and beat market performance otherwise we would all just be buy and holders. Once I am able to come up with a consistency number for each member I will then use that to produce a smart money vs dumb money graph using day to day allocations on the tracker. Those with consistency levels below an as of yet undetermined level will be lumped in with the dumb money (no this does not mean these people are dumb, I will probably be in this group afterall lol) and those above will be considered smart money. Once I am able to produce a graphical representation I will see if it a useful tool in market prediction (this may be all for nothing!). Its still a work in progress and I am open for suggestion/comments. You can tell me its a great idea or a terrible idea I don't care I will take it constructively. There may be someone who already tried something like this or has something like this and maybe they can chime in. I will post updates from time to time as I progress.

If you made it through that you are probably either bored :notrust:, intrigued :suspicious:, elated :nuts: or just have lots of questions